SBP-held reserves tick up by $18m

Central bank did not mention any specific reason behind an increase in SBP-held reserves

March 16, 2023

- Central bank did not mention any specific reason.

- Net forex reserves held by commercial banks stand at $5.5bn.

- Total liquid foreign reserves clock in at $9.8 billion.

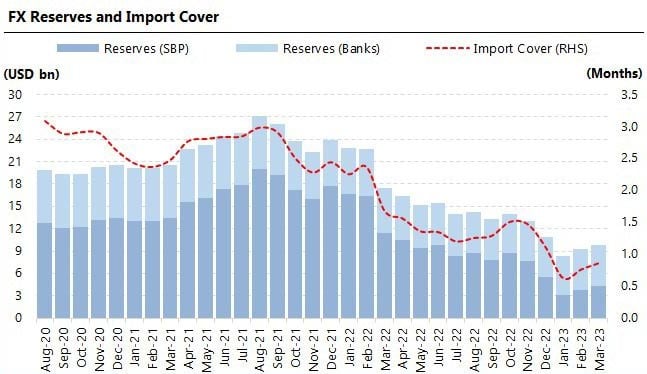

Pakistan’s foreign exchange reserves held by the State Bank of Pakistan (SBP) rose to $4,319 million in the week ending on March 10, the central bank said on Thursday.

The central bank, in its weekly bulletin, said that its foreign exchange reserves have increased by $18 million to $4,319.1 million as of the week ended March 10, which will provide an import cover of around a month.

The net forex reserves held by commercial banks stand at $5,527.7 million, $1,208.6 billion more than the SBP, bringing the total liquid foreign reserves of the country to $9,846.8 million, the statement mentioned.

The central bank did not mention any specific reason behind an increase in SBP-held reserves.

Pakistan faces the renewed risk of recession amid a deepening political and economic crisis and a delay in the revival of the International Monetary Fund’s (IMF) bailout programme.

Bloomberg survey showed that the probability of the economy slipping into recession stands at 70%, according to the median forecast of 27 economists.

In the last few months, the cash-strapped nation has failed to meet several deadlines to secure funds to stave off a default, which has raised concerns that Pakistan might have to pause debt repayments.

In order to woo the IMF, Prime Minister Shehbaz Sharif-led government have raised taxes, cut energy subsidies, and hiked interest rates to a 25-year high to tamp down prices, but some issues are yet to be resolved.

Pakistan needs funds to revive its $350 billion economy, ease widespread shortages and rebuild its foreign currency reserves.

The nation’s dollar stockpile has fallen to less than a month’s worth of imports, restricting its ability to fund overseas purchases, stranding thousands of containers of supplies at ports, forcing plant shutdowns and putting tens of thousands of jobs at risk.