Not consulted on petrol subsidy for low-income groups: IMF

IMF staff are seeking greater details on scheme, and will carefully discuss with Pakistani authorities, says Esther Perez

March 21, 2023

- IMF seeks details on operation, cost, targeting, protections against fraud and abuse, and offsetting measures.

- Govt, a day earlier, had announced subsidy help inflation-hit masses.

- IMF says Islamabad has made “substantial progress” on policy commitments.

The International Monetary Fund (IMF) said that the Pakistani government did not consult the global lender on its petrol subsidy for low-income groups, reported Bloomberg on Tuesday.

Esther Perez, the IMF’s resident representative for Pakistan, told the publication that the lender was not consulted on the government’s plan to raise fuel prices for wealthier motorists to finance a subsidy for lower-income people.

“Fund staff are seeking greater details on the scheme in terms of its operation, cost, targeting, protections against fraud and abuse, and offsetting measures, and will carefully discuss these elements with the authorities,” said Perez.

'This is not subsidy'

A day earlier, Minister of State for Petroleum Musadik Malik announced that the federal government in order to cushion the effect of high petrol prices on inflation-hit masses decided to subsidise petrol up to Rs100 for motorcyclists and owners of vehicles up to 800cc.

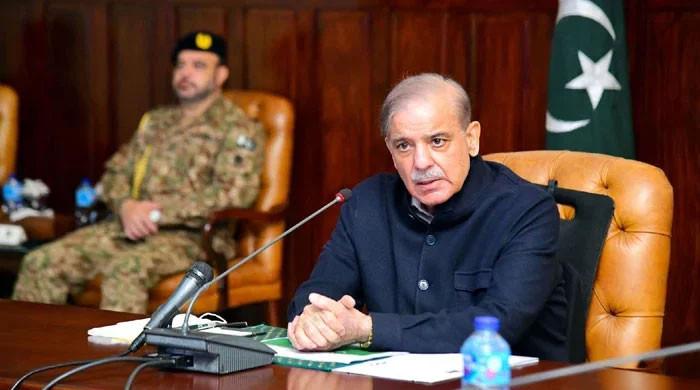

“Prime Minister Shehbaz Sharif has directed to provide subsidy on petrol to low-income people up to Rs100 per litre,” Malik told journalists in Lahore.

Earlier, it was decided to provide a subsidy of Rs50 per litre.

The minister said under a comprehensive strategy, subsidised petrol will be available to motorcyclists and owners of vehicles up to 800cc.

Malik further said owners of vehicles above 800cc would be charged full price.

He said the decision to provide fuel at subsidised rates will be implemented within six weeks, adding that the government will make petrol cheaper for the poor.

“The owners of big vehicles will pay more for petrol. The rich will pay Rs100 more for petrol while the poor will pay Rs100 less. 210 million people are poor in a population of 220 million, we stand with poor Pakistan.”

He said that the decision on the gas tariff has been implemented from January 1. “We have separate tariffs for the poor and the rich.”

Pakistan has made ‘substantial progress’: IMF

On the staff level agreement, the IMF said that Islamabad has made “substantial progress” in meeting the policy commitments required to unlock billions of dollars in loans.

“A staff-level agreement will follow once the few remaining points are closed,” said Perez told Bloomberg.

“Ensuring there is sufficient financing to support the authorities in the implementation of their policy agenda is the paramount priority.”

Last week, Finance Minister Ishaq Dar had said that the global lender wanted to see countries finalise commitments they have promised to help Pakistan shore up its funds before signing off on the bailout package. Pakistan needs to repay about $3 billion of debt by June, while $4 billion is expected to be rolled over.

Pakistan has taken tough measures including increasing taxes and energy prices, and allowing its currency to weaken to restart a $6.5 billion IMF loan package. The funds will offer some relief to a nation still reeling from last year’s devastating floods and help pull the economy out of a crisis ahead of elections this year.