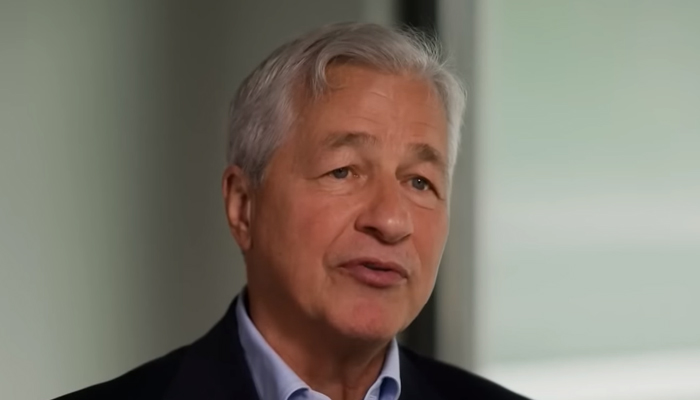

CEO JP Morgan Chase Jamie Dimon sees recession amid banking collapse

"I'm a red-blooded, full-throated, free-market, free-enterprise capitalist," says JP Morgan Chase official

April 08, 2023

JPMorgan Chase CEO Jamie Dimon said that the recent banking collapse of Silicon Valley Bank (SVB) and Signature Bank has fueled fears of financial recession in the US saying, the recent turmoil around the financial system is "another weight on the scale" towards recession.

Speaking during an interview with CNN during the opening of Chase's Atlanta community branch, Jamie Dimon maintained that "We are seeing people reduce lending a little bit, cut back a little bit and pull back a little bit.”

While the banking chaos won't "necessarily force a recession, it is recessionary", he added.

Last month SVB was taken over by California regulators after it collapsed as a result of federal interest rates hike that devalued its treasury bonds, losing 1.8$ billion. This enabled SVB depositors to pull out their money rendering it the biggest banking collapse since the 2008 financial crisis.

CEO of JPMorgan Chase said there are storm clouds ahead for the economy.

"The federal reserve's current tightening regimen, plus higher, sticky inflation and Russia’s war on Ukraine are the largest risks he sees for the economy. But there’s hope about the strength of human capital in the United States", he said.

"I'm a red-blooded, full-throated, free-market, free-enterprise capitalist," CEO said while talking about supporting local entrepreneurship.

"I think we should applaud free enterprise and we should sing from the hills the benefits while we fix the negatives, as opposed to denigrating the whole thing."

The Atlanta branch is Chase's 16th built-in connection with local communities which host free events, financial health workshops and skills training for locals.

Banking services for communities

Dimon said that these branches are not charities in any form. They’re good for business. We need to get money into local communities.”

He added: "Part of that is as simple as opening a savings account. A lot of us had moms and dads who took us to open our first accounts. And then you see your money go from like $84.75 to $85.17. It was like magic, that interest."

"We don't want people to be afraid to walk into a branch here. Come as you are, bring your kids and learn," he remarked during his interview with CNN.

Under the initiative, the bank hired a number of "community managers" with the purpose of "encouraging those who don't feel comfortable in a bank setting to come in and learn about their finances."

CEO maintained: “This role is essential and is often filled by regional, mid-sized community banks, which is partially why the recent failures of SVB and Signature and the possibility of contagion were so harrowing.”

Chain reaction in banking sector

CEO Dimon is not sure if the US economy passed the hard times of the current banking crisis just yet saying “I’m hoping it will resolve, you know, rather shortly.”

He also said that it is not known whether more banks will fail in this ongoing year but said that this crisis is not similar to that of 2008.

We don’t have too many institutions with leverage and huge problems in our mortgage markets. “This is nothing like that. And the American public shouldn’t think that”, he highlighted.

Dimon believed that failure is okay but the chain reaction is not good.

While warning, Dimon said "Regional banks — and American consumers — should be prepared for higher [interest] rates for longer. I don't know if it’s going to happen, but be prepared for that tide."

He also said that there's a good chance that rates remain higher for longer — and banks invested in Treasuries need to be prepared for that possibility.

Debt ceiling breach

According to analyses cited by CNN, lawmakers are growing more uneasy about raising the debt ceiling, the self-imposed $31.38 trillion borrowing limit they hit in January. Without new legislation, a default by the US government could come over the summer or in early September.

However, a deadlock persists over the issue between House Democrats and Republicans.

Dimon, who has also experience working with the government and Congress on economic difficulties, noted that there would be no default under his watch.

Congress will come to a resolution on the debt ceiling within the next few months, but there could be more economic pain to come before an agreement is made, he remarked.

"You'll feel the pain before it happens," he noted while talking about breaching of US debt ceiling.

CEO stated: "As a potential default comes closer you'll see it in the markets and that will scare people. When I go to Washington, most people there know how serious this is, and they want to get it to a resolution."