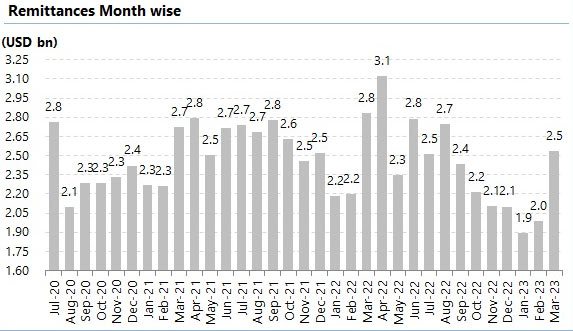

Remittances hit 7-month high at $2.5bn in March

Inflow of workers’ remittances was 27% higher compared to the prior month of February

April 10, 2023

- Workers’ remittances 27% higher compared to February.

- Analysts attribute monthly increase to Ramadan factor.

- Remittances inflows were mainly sourced from Saudi Arabia.

Remittances sent home by overseas Pakistanis touched a seven-month high at $2.5 billion in March apparently due to Ramadan and Eid ul Fitr.

The inflow of workers’ remittances was 27% higher compared to the prior month of February; however, it was 11% lower compared to March 2022, the State Bank of Pakistan (SBP) data showed on Monday.

Moreover, inflows remained comparatively high as non-resident Pakistanis used legal channels to send funds to their family members due to the shrinking gap between rates in the interbank and open market.

Samiullah Tariq, head of research at Pakistan-Kuwait Investment Company, termed the increase a “good omen”, elaborating that the difference between the kerb and interbank rates was minimal.

“Remittances number is highest for past seven months; however, this year Ramadan has started earlier which is why remittance inflow increased earlier than last year,” he explained.

Historical trends suggested that overseas Pakistanis sent record-high remittances ahead of Eid festivals every year.

Arif Habib Limited Head of Research Tahir Abbas told Geo.tv that the monthly increase in the remittances is due to the Ramadan factor which usually fetches higher flows due to family commitments, welfare, charity etc.

"The flows in the upcoming months are expected to remain elevated due to another Eid [Eid ul Adha] falling by the end of this fiscal year," he maintained.

The Ministry of Finance has projected that the remittances will “further improve due to positive seasonal and Ramadan factor”.

Meanwhile, the central bank — in its monthly remittance bulletin — stated that with the cumulative inflow of $20.5 billion during the first nine months of the fiscal year 2022-23, the remittances decreased by 10.8% as compared to the same period last year.

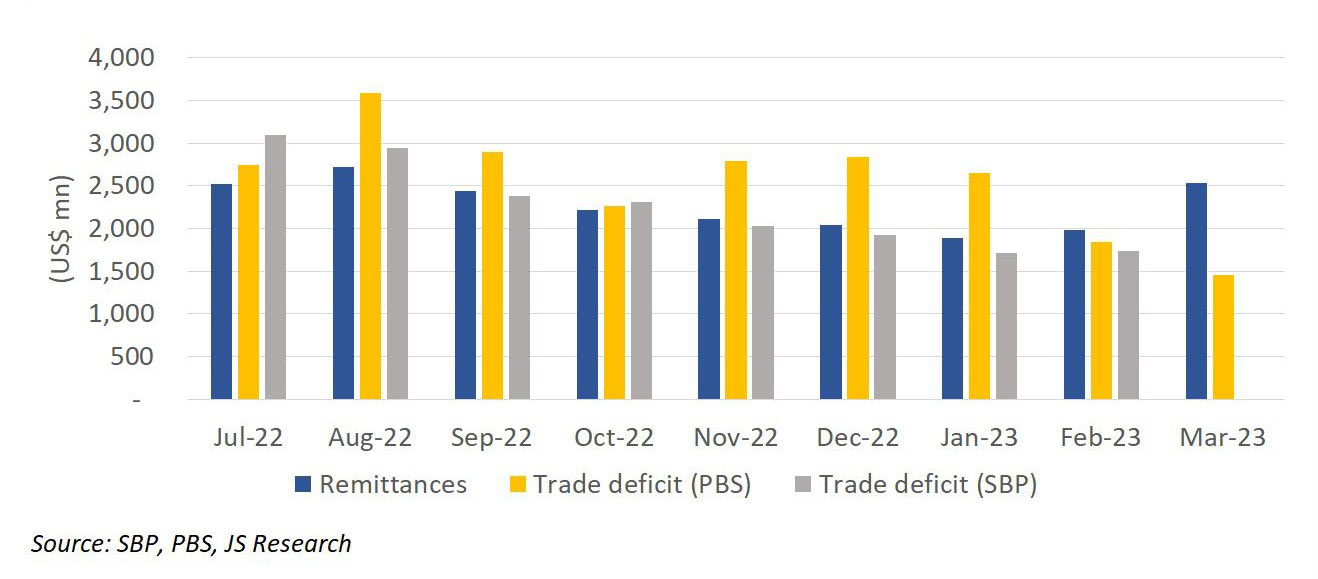

It should also be noted that with remittances widely surpassing the Pakistan Bureau of Statistics (PBS) trade deficit data this month, the possibility of a current account surplus has increased to a great extent.

It should be noted that the SBP trade deficit data point is usually even lower than the PBS trade deficit.

In its monthly outlook report, the Ministry of Finance also mentioned that the current account deficit is likely to remain on the lower side keeping in view the economic factors contributing to the numbers.

Pakistan is in danger of defaulting on its debt, with an International Monetary Fund (IMF) bailout programme stalled since November, while a bruising political battle is raging between the government and former prime minister Imran Khan.

The cash-strapped nation is in dire need of funds with its foreign exchange reserves hovering around $4.2 billion which provides barely one month of import cover.

Country-wise data

Pakistanis residing in Saudi Arabia remitted the largest amount of $563.9 million in March. However, it was 24.04% lower than the $454.6 million received in February.

Expatriates in the UAE sent home 25.52% more amount as receipts increased from $406.7 million to $324 million.

Remittances from overseas Pakistanis in the UK increased 33.12% to $422 million. They sent $317 million in February.

Moreover, remittances from other Gulf Cooperation Council (GCC) countries decreased by 10.33% to $297.6 million and a 21.72% increase was recorded in inflows from European countries, which clocked in at $298.6 million in the month under review compared to February.