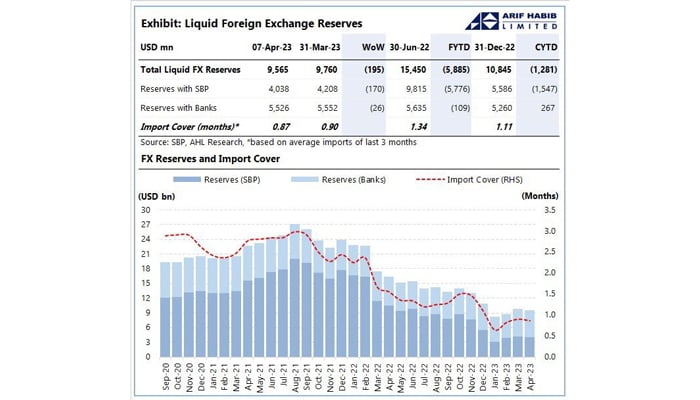

SBP foreign reserves decline by $170 million due to debt repayments

Central bank's reserves stand at $4 billion, which is not enough to cover even a month's imports

April 13, 2023

- Reserves held by commercial banks stand at $5.5 billion.

- Pakistan’s total reserves stand at $9.56 billion.

- IMF deal will bolster reserves, open new financing avenues.

Foreign exchange reserves held by the State Bank of Pakistan (SBP) fell by $170 million in the week ending on April 7 owing to external debt repayments, data released by the central bank showed on Thursday.

The SBP said in a statement that its reserves stand at $4.03 billion, which is not enough to cover even a month’s imports.

Central bank data showed forex reserves held by commercial banks stand at $5.5 billion while the country’s total reserves are $9.6 billion.

Pakistan's $350 billion economy continues to dwindle amid financial woes and the delay in an agreement with the International Monetary Fund (IMF) that would release much-needed funding crucial to avoid the risk of default.

The government has been in talks with the Washington-based lender since end-January to resume the $1.1 billion loan tranche that has been on hold since November, part of a $6.5 billion Extended Fund Facility (EFF) agreed upon in 2019.

The country is getting closer to securing the loan as Saudi Arabia has already committed $2 billion in funds, while sources said the United Arab Emirates (UAE) is likely to assure the global lender that it will provide $1 billion to Pakistan by this week.

A day earlier, IMF Director Middle East and Central Asia Department Jihad Azour expressed confidence that an agreement would be reached soon.

The deal will also unlock other bilateral and multilateral financing avenues for Pakistan to shore up its foreign exchange reserves.

As the situation remains gloomy, IMF has cut Pakistan's growth forecast to 0.5% from the 2% estimate earlier as the nation faces a dollar shortage, leading to supply chain disruptions and companies stopping production.

The World Bank and Asian Development Bank have lowered Pakistan’s growth rate projections to 0.4% and 0.6%, respectively.