IMF seeks more financial guarantees after confirmation from UAE, Saudi Arabia

Pakistan is at a critical juncture today, and decisive actions are required to stabilise the economy, Jihad Azour says

April 15, 2023

- IMF’s mission chief says Fund backs efforts of Pakistani authorities.

- Pakistan is at a critical juncture today, Jihad Azour says.

- He says IMF has been “very supportive” of Pakistan over the years.

WASHINGTON: Despite receiving confirmation from Saudi Arabia and the United Arab Emirates (UAE), the International Monetary Fund (IMF) is still seeking further assurances to ensure Pakistan has fulfilled the condition of arranging the $6 billion financing to reach a staff-level agreement.

Nathan Porter, the IMF’s Mission Chief to Pakistan, welcomed the announcement of financial assistance from the South Asian nation's "key" friendly countries, saying that the Washington-based Fund backs the efforts of the Pakistani authorities.

A Pakistani delegation comprising top officials of the finance ministry and the central bank is currently in Washington to attend the Spring meetings of the IMF. They are also holding talks with the Fund officials regarding the revival of the loan programme.

Finance Minister Ishaq Dar was also scheduled to travel to Washington but domestic issues forced him to cancel the visit.

"During the meetings between the Pakistani delegation and IMF staff and management, there was agreement on the need to maintain strong policies and secure sufficient financing to support the authorities’ implementation efforts," Porter said.

He added that the Fund looks forward to obtaining the necessary financing assurances as soon as possible to pave the way for the successful completion of the ninth review.

The IMF has asked Pakistan to arrange $6 billion in external financing — a sum that the struggling $350 billion economy needed from now till June to avoid default.

It should be noted that the $6 billion financing gap had been worked out on the assumption that the current account deficit would remain around $7 billion in the current fiscal year.

Earlier, reports suggested that Dar urged the IMF to further cut the external financing requirement to $5 billion due to improvement in the current account deficit; however, the IMF declined Pakistan’s request.

So far, Saudi Arabia has pledged $2 billion while UAE has committed $1 billion funds to Pakistan which reduces the now required amount to $3 billion.

Pakistan's foreign exchange reserves have fallen to cover barely a month of imports after the IMF funding stalled in November, hit by snags over fiscal policy adjustments after officials of the lender visited Islamabad in February for talks.

They formed part of a ninth review exercise on a bailout package of $6.5 billion agreed upon in 2019 whose resumption is critical for Pakistan to avoid risking default on external payment obligations.

The IMF programme will disburse another tranche of over $1 billion to Pakistan before it concludes in June.

Funds from the lender will also unlock other bilateral and multilateral financings for the cash-strapped country.

Programme loans from other multilateral agencies await completion of the IMF review, central bank governor Jameel Ahmad told investors in Washington at the spring meetings of the lender and the World Bank.

Pakistan is at a critical juncture: IMF official

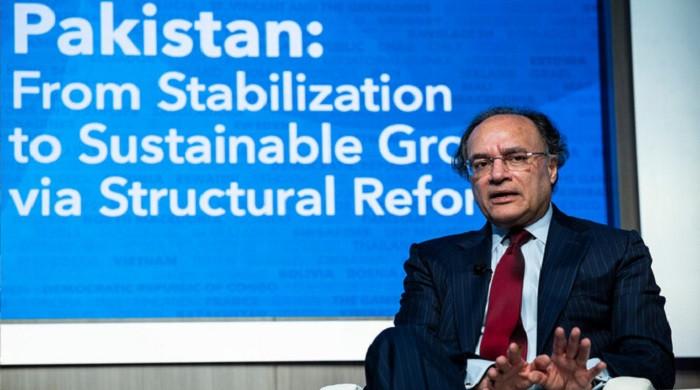

Separately, IMF’s Director of the Middle East and Central Asia Department Jihad Azour — during a press conference — briefed the media about the current status of the $6.5 billion programme with Pakistan.

“Pakistan is at a critical juncture today, and decisive actions are required to stabilise the economy,” Azhour said, adding that the policies that were adopted go in the right direction, and it is important too, in the current juncture, to, on the one hand, to maintain monetary stability by addressing the issue of high inflation that has exceeded 34%, and also maintaining the flexible exchange rate in order to protect the Pakistani economy from external shocks.

He revealed that the discussions between the authorities and the IMF are ongoing, claiming that the Fund has been “very supportive” of Pakistan over the years with several programmes.

“It’s very important for the Pakistani economy to address the imbalances and to maintain macroeconomic stability, and this is the stopping point: addressing inflation that is in double digits for the last three years, it’s a priority with or without the review.

“Reducing the constraints to trade and to export by having the right exchange rate policies is also important for the Pakistani economy and the Pakistani people, with or without an IMF programme,” he emphasised.

IMF's priority to help Pakistan weather economic tensions

Shedding light on the challenges that have emerged in the wake of catastrophic floods that hit the country of 220 million last year in June, Azour said the priority for us is how to help Pakistan and the Pakistani economy to weather a period of tension economically, with the uncertainties and also a political agenda that is very active.

“This is our priority number one, and this is in the context of programme that we have already agreed with the authorities on, and we have ensured that it’s based on a certain number of actions, based on a certain number of priorities.

“We have worked extensively with the authorities to make sure that those priorities are met. That will allow macroeconomic stability, will also provide the economy with the capacity to export, especially that Pakistan is a country with the huge type of talents and the capacity to grow faster,” he maintained.

He said that financing is required, and the financing needs are about what is currently in the programme, and this is where “we are also hand-in-hand with the authorities and the bilateral supporters of Pakistan, working to ensure that the financing needs for the programme and beyond are assured”.

Responding to a question regarding how would the two sides proceed the next year, the IMF official said: “When it comes to the future, I think this is a decision that the sovereign — it’s a sovereign decision. The authorities of Pakistan will decide what are the reforms, what type of programmes they want, and what type of relationship they decide to have with the Fund, and the Fund stands ready, as it did in the past for several decades, to provide assistance to Pakistan.”