Supreme Court disposes of JI plea seeking privatisation of K-Electric

Apex court observes petition filed by Jamaat-e-Islami against K-Electric privatisation was ineffective

June 06, 2023

- 'It is not our concern, you have to see law', CJP tells JI counsel.

- Justice Minallah says plea non-maintainable under Article 184.

- Only the court remains when parliament fails, says counsel Rizvi.

KARACHI: The Supreme Court observed on Tuesday that the petition filed by Jamaat-e-Islami (JI) against K-Electric's privatisation was ineffective, disposing of the plea on the basis of its withdrawal.

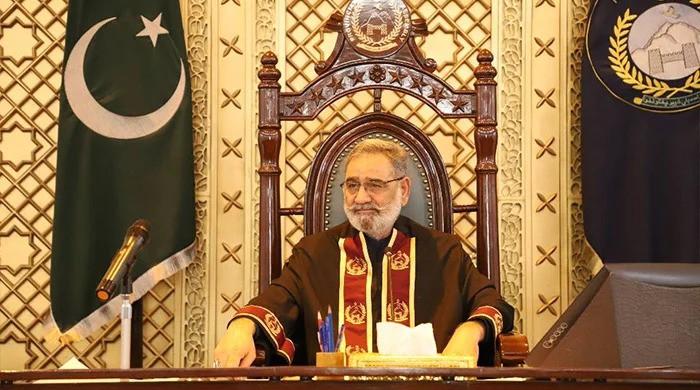

The plea was heard by a three-member bench of the top court headed by Chief Justice of Pakistan (CJP) Umar Ata Bandial and comprising Justice Athar Minallah and Justice Ayesha A Malik.

During the previous hearing, the CJP said that the Supreme Court would not interfere in economic affairs as it has no expertise in the domain, telling the petitioner's counsel that he could approach the relevant high court for the matter.

In today's hearing, CJP Bandial asked JI's counsel Rashid Rizvi if he wanted to continue the hearing of the petition.

At this, Rizvi replied: "Yes, this petition is still relevant. Over 20 million citizens of the city are being affected."

“It is not our concern, you have to see the law,” CJP remarked.

Justice Minallah added that “the plea has been non-maintainable under Article 184".

“Only the court remains when parliament fails,” said Rizvi

At this, the CJP remarked that parliament is an honourable institution and should be strengthened.

“How could we cancel the privatisation, you should take the matter before Nepra [National Electric Power Regulatory Authority],” Justice Malik said.

KE, which is the sole private power utility company in Karachi, was formerly known as Karachi Electric Supply Corporation (KESC).

It was privatised in 2005 for a sum of Rs16 billion to a Saudi-Kuwaiti group. In those days, the US dollar was valued at Rs59.75 in the inter-bank market.

Going by those rates, the company was privatised for $270 million.

The general perception was that privatisation will improve the financial condition of the company. In 2009, the company was sold to private equity firm Abraj Group with management control for Rs361 million.