Economic Survey FY23: Experts take govt's 'budget optimism' with a pinch of salt

"I don’t think government has room in budget to provide social protection in the form of subsidies to the people," says an economist

June 08, 2023

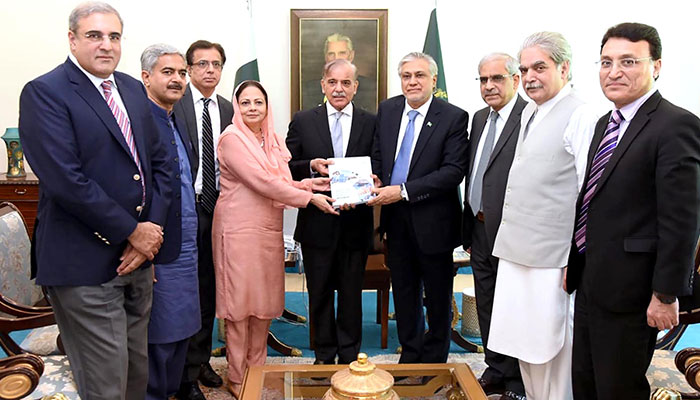

Finance Minister Ishaq Dar Thursday unveiled the Pakistan Economic Survey 2022-23, a document that sums up an economy's performance during a fiscal year, showing that the politically mired country, totally failed to meet its macroeconomic targets.

While Planning Minister Ahsan Iqbal blamed the year of force majeure, grim data gives the cash-strapped government little room to introduce populist measures in tomorrow’s budget ahead of an election due to be held in October.

The government is also under enormous pressure from the International Monetary Fund (IMF) to tighten the purse strings to unlock another last tranche of a vital bailout package.

When Geo.tv reached out to economic experts, they expressed similar concerns and said that the “problems are deep”.

Structural issues

Dr Khaqan Najeeb, former adviser to the Ministry of Finance, said a year characterised by floods, a derailed IMF programme, and weak economic management forced the country to witness a stagflationary environment in the fiscal year 2022-23.

"The dollar liquidity crunch remained to be the dominant factor clogging economic growth to near zero with declining private sector credit, waning federal direct investment, and slowing Federal Board of Revenue (FBR) collection from initial targets," he added.

"Likely to see another fiscal deficit beyond 7% of GDP with the FBR tax-to-GDP ratio down to near a decade-low of 8.6%."

He said the investment-to-GDP ratio was estimated to drop to a mere 13.6% in FY23 with both declines in public and private investment.

"Slowing of the economy will increase unemployment and poverty necessitating a change of economic management by ensuring both an IMF programme as well as some work on structural issues," he added.

'Problems are deep'

Maheen Rehman, an economic expert said: "They (the government) were being very optimistic but I think the kind of challenges Pakistan is facing is very difficult to overcome soon and there are no short-term fixes".

"There’s a problem of $13 billion debt repayment till December and even if we somehow are able to revive the IMF programme we still need to repay a heavy amount in 2024."

She said whatever measures they were going to take [to generate revenue] either through taxation or others none of these were going to increase economic growth and Pakistan's capacity to repay was debatable.

"I think the problems are very deep and it is a matter of two-three years [to achieve some sort of stability]."

"If we fail to renegotiate the IMF programme before June 30 then we will have to go entirely for a new facility and the conditions for this fresh programme will be very harsh and the government will find it difficult to meet."

It’s a matter of confidence when it comes to the IMF-Pakistan relationship, she said. "The lender has dealt with two very different governments since 2018 and too many finance ministers here. I think credibility is also an issue here," Rehman added.

She said the debt-to-GDP ratio of Pakistan was not a big issue and there were countries that had a 100-120% ratio, adding, Pakistan’s two main problems were tax collection and export competitiveness.

"We only have 2.5-3 million tax filers and that’s why we rely more on indirect taxes. Until and unless untaxed sectors are not brought into the net, the revenue generation issue will remain and another is our export competitiveness," Rehman said.

She said despite the subsidies, our export sectors were still not competitive because they needed investments.

"I think even if we manage to revive the IMF loan facility, we won’t be able to achieve stability unless we address underlying issues," said she.

Focus on Five Es

Sana Tawfiq, an economist at Arif Habib Limited, said the Economic Survey of Pakistan released today shed light on the country's economic performance in the out-going fiscal year amid challenges like geopolitical situations, political situations, natural disasters and high inflationary pressures.

Despite these challenges, Pakistan was able to post a GDP growth of 0.29% in FY23 against last year’s GDP of 6.1%, she said.

Tawfiq was of the view that the all-time high inflationary rate of 29.2% during July-May FY23 put a damper on the economic front.

This high inflation was mainly due to depreciation in the exchange rate, supply disruptions caused by flood damages, increased global food prices, and broader energy tariff hikes.

To curb the inflation rate, the SBP tightened monetary policy by hiking the policy rate to 21%. On the external front, the authorities were able to narrow the current account deficit to $3.3 billion, down 76% year-on-year in FY23.

"Going forward, the government will be focusing on the Five Es framework covering exports, equity, empowerment, environment, and energy," she said.

Inflation to persist

Dr Vaqar Ahmed, Joint Executive Director of Sustainable Development Policy Institute, said first, it was a low-growth year and unfortunately due to low economic growth, the job losses were a lot.

He said these job losses were probably so much that they were not seen in the last two decades. So, this was an unprecedented year in terms of low growth and job losses.

"Second, after seeing the numbers, I feel the impact of floods has affected the agricultural growth and agriculture-related manufacturing sector — such as the cotton-based textile sector. This is very apparent," Ahmed added.

He said thirdly, macroeconomic fundamentals that included a balance of payment and the government’s budget required stability [and would have been] achieved if the International Monetary Fund programme had been restored in the last two quarters of this year.

Because it did not happen, "we are seeing that foreign exchange reserves remained low and the rupee did not stabilise and a major factor is that we could not bring our IMF programme back on track," he said.

"These are three main takeaways and the future outlook that I see is that inflation would not come down so easily and that is going to be a concern for the government because if prices do not come down the people that have gone below the poverty line will continue to face hardships."

"This is an unfortunate thing and I don’t think the government has room in the budget to provide social protection in the form of subsidies to the people," Ahmed said.