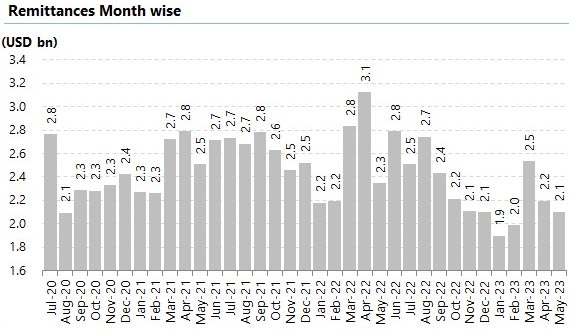

Remittances decline 12.8% to $24.8bn in July-May

Analysts attribute the decrease to higher inflation and economic slowdown in host countries

June 14, 2023

- Analysts attribute 00decrease to higher inflation.

- Inflows in May were mainly sourced from Saudi Arabia.

- Declining trend in inflows is not encouraging.

Remittances sent home by overseas workers declined by 12.8% year-on-year to $24.8 billion in 11 months of the current fiscal year, the State Bank of Pakistan (SBP) data showed.

The data received by the central bank showed that the remittances decreased 10.4% year-on-year to $2.1 billion in May. These inflows saw a 4.4% month-on-month decline.

Last month (April), Pakistani expatriates sent $2.2 billion home.

It should be noted that inflows during the month under review were mainly sourced from Saudi Arabia ($524 million), United Arab Emirates ($335.8 million), the United Kingdom ($306.5 million), and the United States of America ($257.2 million).

Analysts attribute the decrease in remittances between July and May to higher inflation and economic slowdown in host countries, foreign currency cash transfer through overseas Pakistanis, and interlude exchange rate adjustment.

In addition, more overseas Pakistani workers use illegal means to send money home as the difference between interbank and open markets exchange rates widened. As a result, for a few months, the dollar rate was better in the grey market, where the workers’ remittances were shifted.

The declining trend in remittance inflows is not encouraging for the country, which is dealing with a foreign exchange shortage and a delay in the bailout loans from the International Monetary Fund (IMF).

SBP governor, finance minister at loggerheads

After the announcement of the monetary policy decision on Monday, Jameel Ahmad, governor of the SBP, briefed analysts and stated that Pakistan was not considering the bilateral debt restructuring that the finance minister mentioned before.

This indicates that the policy direction remains anchored towards attaining the IMF programme before the June 30 deadline. However, Finance Minister Ishaq Dar said the work on external debt restructuring is going on in the background.

The SBP’s governor said most of the debt is bilateral and multilateral as they have paid large amounts of commercial debt and will pay Eurobonds when due.

The governor said that out of the total external repayment amount of $3.6 billion due this month, $0.4 billion has already been paid. The remaining balance of $2.3 billion will be rolled over, while $0.9 billion needs to be financed.

The total debt requirements for the fiscal year 2023-24 will amount to approximately $23 billion, according to the SBP, which will be evenly distributed across four quarters. In the next monetary policy statement, the SBP will come up with how to fund this depending upon IMF and other factors.

Remittances are falling, which is not good for the country’s balance of payments. Moreover, the country’s exports fell by 12% in July-May to $23.2 billion mostly due to weak global demand and lacklustre performance in the domestic economy amid demand-curtailing measures.

Imports were down 28.4% on the back of import policy tightening and other administrative measures.

The current account continues to respond to the demand-compression policies and regulatory mix, with the deficit during July-April dropping to $3.3 billion, less than one-fourth of last year’s deficit, according to the SBP’s monetary policy statement.

The policy-induced contraction in imports more than offset the drop in exports and remittances, it said. The finance ministry has set a target of $6 billion for the current account deficit for the next fiscal year, which is higher than the expected number of $3.5 billion for FY23.

This target can only be achieved if foreign financing is arranged. Analysts said the current account is easing, but the balance of payments is still a concern.

“In line with GDP growth deceleration, imports also remained constrained, easing off pressures on the current account,” said Alfalah Securities in a note.

“Furthermore, international commodity prices have eased significantly, providing further relief to the external balances. However, minimal foreign exchange reserves cover and the short-term nature of Pakistan’s external debt remains the key risk,” it added.