Dirty money and politics of drug trade

Successive govts in Pakistan have provided tax amnesty schemes to facilitate plunderers of national wealth in name of “good economic measures”

June 26, 2023

Monday, June 26, 2023, marks International Day against drug abuse and illicit trafficking as decided by the United Nations General Assembly in 1987 to raise the level of awareness in the international community about the dangers of drug abuse, to prevent its spread and to encourage all efforts to combat the menace at international level. Each year the United Nations Office on Drugs and Crime (UNODC) selects a theme for the day, and this year, the theme is “People first: stop stigma and discrimination, strengthen prevention.”

“In September 2021, the then Prime Minister Imran Khan tasked all federal and provincial agencies to present a comprehensive drug awareness and treatment policy by the end of 2021. However, this remained unfinished at the end of Khan’s tenure in April 2022, and no subsequent action has been taken.

"The Ministry of Narcotics Control is currently pursuing the creation of a National Coordination Center to improve drug enforcement operational coordination among law enforcement agencies as well as a unified approach to substance use disorder treatment among provincial and federal stakeholders [...]. The Government of Pakistan does not, as a matter of government policy, encourage or facilitate illicit drug production or distribution, nor is there evidence of its involvement in laundering the proceeds of the sale of illicit drugs, but corruption remains a key concern. The National Accountability Bureau (NAB) is Pakistan’s main agency responsible for eliminating corruption. The NAB claims to have recovered more than $4.8 billion since it was established in 1999, but the consequences for convicted perpetrators are rarely severe. Corruption undermines the government’s ability to address illicit drugs, as bribed public servants may facilitate the movement of contraband or otherwise interfere with arrests and prosecutions. Media sources regularly report that police officers are involved in drug trafficking or the selling of seized drugs," —International Narcotics Control Strategy Report (INCSR, Vol. I, March 2023)

Successive governments in Pakistan have provided tax amnesty schemes to facilitate money launderers, tax evaders, the corrupt and plunderers of national wealth in the name of “good economic measures” (sic) and/or mobilising tax revenues — unfortunately, these were tacitly approved or not interfered with even by the country’s highest court observing “we cannot intervene in policy matters” and “we will not intervene in the tax amnesty scheme and if the scheme fails, the government will be responsible for it.”

These observations were highlighted by one of the biggest online realtors in the country, as immovable property in Pakistan is an established sanctuary for shady money.

Resultantly, tax evaders, drug barons, and persons engaged in other organised crimes availed “legal means” to whiten assets worth billions under the State patronage.

Till recently, anybody could bring money in Pakistan or remit outside through normal banking channels without being probed by officers of the Federal Board of Revenue (FBR) and Federal Investigation Agency (FIA) about its 'source' — courtesy of the Protection of Economic Reforms Act, 1992 [“PERA 1992”].

This law was amended by Finance Act 2018 to withdraw blanket immunity from the probe.

In other parts of the world, through asset-seizure legislation, governments confiscate unlawful assets/dirty money and punish offenders — Pakistan has yet to pass any such law.

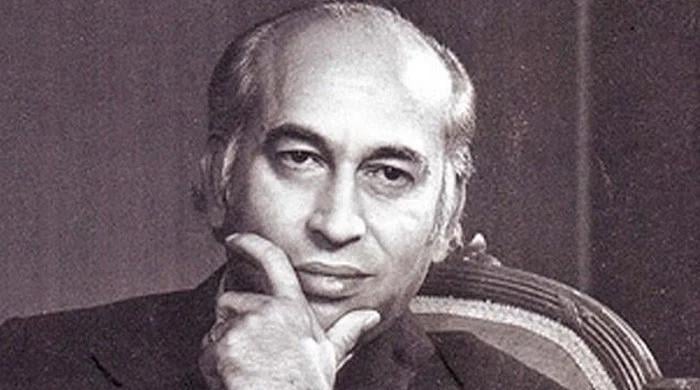

The law of once complete and blanket immunity, PERA 1992, was the brainchild of Muhammad Ishaq Dar. He is presently the four-time federal finance minister and economic wizard of Pakistan Muslim League Nawaz (PML-N) and samdhi (in-law) of three-time elected premier Nawaz Sharif, who was disqualified for a lifetime and ousted from politics by the Supreme Court of Pakistan in a case which is considered highly controversial.

He was punished in an Iqama matter, whereas the case recommended by the Joint Investigation Team (JIT) was for non-furnishing of a money trail by the accused for buying the expensive Avenfield apartments (Mayfair properties) in London through offshore companies.

In the Income Tax Ordinance 2001, promulgated on September 13, 2001, a special provision [section 111(4)] was inserted, facilitating tax evaders and criminals for laundering their ill-gotten money through banking channels, surrendering the foreign currency to the State Bank and getting Pakistani rupees as encashment. This was done by a military dictator, General Pervez Musharraf (late), through a Presidential Ordinance.

Thus both civilian and military regimes have extended immunities from probes into sources of shady funds. The Finance Act 2018 placed a limit of Rs10 million for exemption from the probe, which was later reduced to Rs5 million through the Finance Act 2021 with effect from July 1, 2021. Now, the Finance Bill 2023 has proposed to enhance it to an amount equal to $100,000 with effect from July 1, 2023.

During the first government of Nawaz Sharif, many schemes like Bearer National Fund Bonds, Foreign Exchange Bearer Bonds, Special Bearer Bonds, US Dollar Bonds and Certificates were introduced to decriminalise dirty money [Economic Disaster under PML-N, address by the then Leader of Opposition, Mohtarma Benazir Bhutto, to Peshawar High Court Bar Association on December 3, 1998 — Benazir Bhutto: Selected Speeches from 1989 to 2007].

Since the era of General Muhammad Zia-ul-Haq [1977-1988], the black economy has been flourishing at an amazing rate. According to various studies, the parallel economy has been growing at an alarming rate of 20% per annum since 1980.

A 2010 study by the State Bank of Pakistan, ‘The Size of Informal Economy in Pakistan’, estimates the size of the informal economy at around 30% of GDP.

It means that since 2010 annually, some Rs1,500-2,000 billion are generated by the parallel economy (informal, though not illegal). Black money, generated through organised criminal activities e.g., bribery, kidnapping for ransom, rent-seeking, smuggling in goods, and narcotics trade etc., is about Rs3,000 billion per annum that does not appear in the study of SBP but documented in Pakistan: Enigma of Taxation. Another study — Pakistan: Drug-trap to Debt-trap — estimated the total figure of the informal economy at $200 billion in 2003.

Pakistan is one of the countries worst hit by tax evasion, corruption, terrorism, and money laundering. There is sufficient evidence that militant groups working against the security and stability of the State generate huge funds through criminal activities and also get huge “donations” from “sympathisers” in and outside Pakistan.

Yet, hardly any prosecution is reported under the provisions of Anti-Money Laundering Act of 2010. The banks do not diligently report suspicious transactions required under section 7 of Anti-Money Laundering Act, 2010 or section 67 of Control of Narcotics Substance Act of 1997. This shows the slackness of institutions and regulators/agencies responsible for implementing these laws.

The illicit trafficking in drugs is not possible without the connivance of police that has political connections and backing. The case of Lyari in Karachi is a classic study. It is sad to note that nobody has exposed the scandal of ephedrine in proper context — its business and political connections.

The so-called experts writing on ephedrine in media do not even know how ephedrine is abused (many erroneously call it ‘poor man’s cocaine’ whereas it is a main ingredient of ‘ecstasy’ and is consumed by the rich who can spend thousands just for a single shot).

Accumulation of vast assets by drug barons in Pakistan has enabled them to continue large-scale operations even after crackdown and arrest of some of their leaders (although they have also managed to defy proper investigation getting themselves released). On a serious note, over the past four decades, drug barons in Pakistan have established themselves as patrons of politicians and government functionaries.

The ‘Norwegian Connection’ story exemplifies as to how narcopower flourished in the country and how drug barons managed to influence the highest authority in the State — read details in Pakistan: From Hash to Heroin. The “financial assistance” provided to some politicians by drug barons in the 1995, 1988, 1990 and all subsequent general elections are nothing but a continuation of the ‘drug legacy’ of the mid 1970s.

The drug scene at its roots in Pakistan, like other countries, is nothing more than a business story. This is a stark reality of the emergence of ‘dirty money power’ in the country.

A 2018 study reveals that the share of Pakistani drug cartels in the total world drug trade was not less than $2 billion a year. It has now reached the level of $5 billion.

A trade that started in the late 1970s has achieved this unbelievable proportion in five decades and so its political connections are understandable—those in power in Pakistan want to make quick bucks, irrespective of legality or illegality of their source.

The politics of drug trade has rendered millions of people, as a most helpless lot. This is a war against the people and humanity. Our present day civilization faces a great threat of annihilation if the rising tide of drug culture is not stemmed. Awareness alone can bring light to overcome the darkness caused by drug traders, merchants of death and destruction.

The writer is an Advocate Supreme Court and specialises in studying global narco-arms economy and its linkages with terrorism. He is author of numerous articles on these issues, besides author of books, Pakistan: From Hash to Heroin and its sequel, Pakistan: Drug-trap to Debt-trap

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.