IMF set to hold crucial board meeting on Pakistan bailout deal today

Analyst hopeful of approval from IMF board; $3 billion loan to help Pakistan unlock more multilateral funds

July 12, 2023

- Analyst hopeful of approval from IMF executive board.

- Loan to be disbursed in 3-4 days after approval: analyst.

- Loan to help Pakistan unlock more multilateral funds.

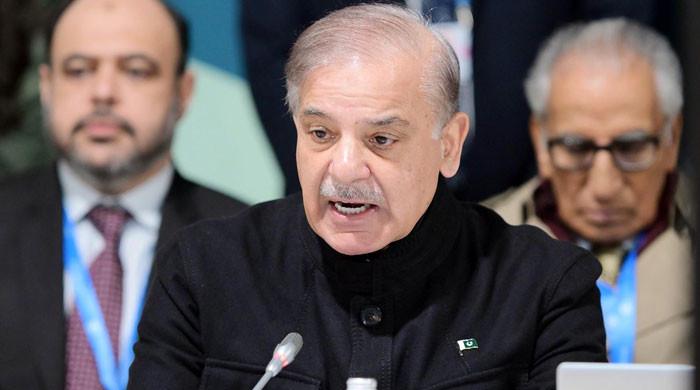

The International Monetary Fund (IMF) is all set to hold the Executive Board's key vote on Pakistan's $3 billion bailout programme today, a person familiar with the matter told Bloomberg.

Islamabad signed a short-term IMF deal on June 30 under a standby arrangement, under which the nation is set to receive $3 billion over nine months, subject to approval by the IMF's board.

Speaking to Geo.tv, Arif Habib Limited (AHL) Head of Research Tahir Abbas said: "I am hopeful that [IMF's board] will discuss and approve the loan."

"Once the board approval is granted, Pakistan will receive $1.1 billion within three to four days," Abbas added.

Pakistan's external financing environment has improved since then as Fitch Ratings Inc. upgraded the cash-strapped country by one notch to CCC long-term foreign currency issuer rating this week.

Saudi Arabia has also deposited $2 billion into the account of the State Bank of Pakistan (SBP), Finance Minister Ishaq Dar confirmed Tuesday, a major development to ease the country's fiscal turmoil.

With sky-high inflation and foreign exchange reserves barely enough for a month of controlled imports, analysts said Pakistan's economic crisis could have spiralled into a debt default in the absence of the IMF bailout.

Fitch's statement mentioned the upgrade reflected the country's improved external liquidity and funding conditions following the SLA with the IMF, but warned that the fiscal deficit remained wide.

With the IMF deal in place, Pakistan can now unlock other external financing.

In the plan sent to the lender, sources in the Finance Division said that Pakistan arranged $3.5 billion in bilateral funds from China, $2 billion from Saudi Arabia, and $1 from the United Arab Emirates.

On the multilateral side, Pakistan aims to secure $500 million from Asian Development Bank, $500 million from World Bank, and $3 billion from the IMF.

Fitch said local authorities expect $25 billion in gross new external financing in FY24, against $15 billion in public debt maturities, including $1 billion in bonds and $3.6 billion to multilateral creditors.

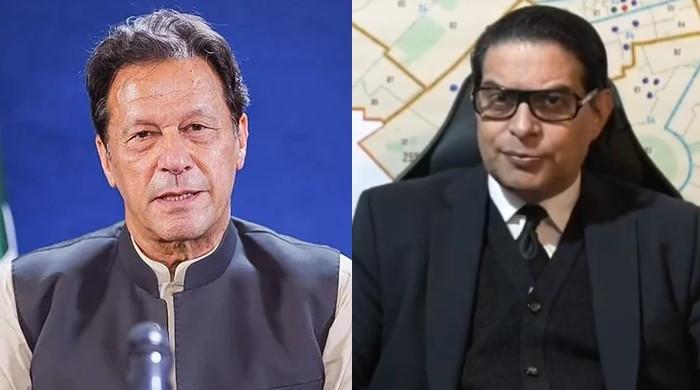

The South Asian nation has also seen severe political uncertainty since former prime minister Imran Khan was ousted through a no-confidence motion in April last year.

In a bid to ensure that the programme's measures are implemented in the lead-up to the elections due in October, the lender's team met all mainstream political parties to seek support and consensus for the SBA.

Khan's Pakistan Tehreek-e-Insaf said he gave his support for the deal.