E&P sector forewarns financial collapse owing to cash flow plight

Predicament brought on by Sui firms' payment defaults totaling Rs1,317 billion

July 20, 2023

- State-owned firms threaten to halt operations in case of non-payment.

- Significant shortages could not be overcome by import of LNG.

- PPEPCA informs about situation to Finance Minister Ishaq Dar.

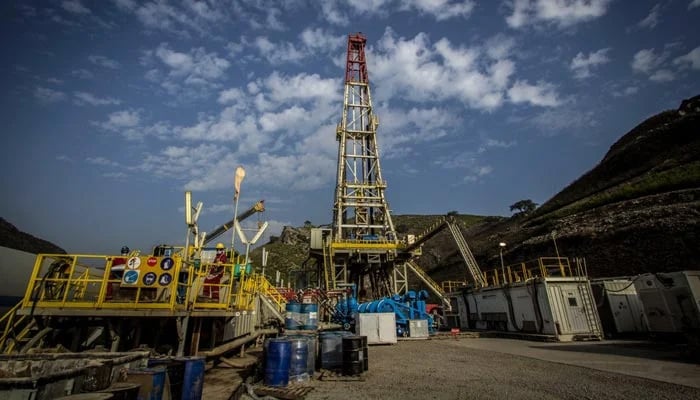

ISLAMABAD: Local exploration and production (E&P) companies have sounded alarm, forewarning of a financial collapse owing to severe cash flow situation, The News reported.

The predicament was brought on by Sui firms' payment defaults totaling Rs1,317 billion.

If the payments are not made, state-owned businesses — including Government Holding (Private) Limited (GHPL), Pakistan Petroleum Limited (PPL), and Oil and Gas Development Company Limited (OGDCL) — have threatened to halt production operations and reduce the delivery of gas.

They claimed that due to a lack of foreign currency and the lukewarm response of international LNG suppliers, significant shortages could not be overcome by the importation of very expensive LNG.

This has been disclosed by Pakistan Petroleum Exploration and Production Companies Association (PPEPCA) in a letter written to Finance Minister Ishaq Dar on July 17.

The minister has been informed about the financial plight of E&P companies that have squeezed the exploration and production activities manifold.

The PPEPCA, earlier, wrote a letter on May 5 to Petroleum Division's secretary, highlighting the deteriorating cash flow situation because of massive default by Sui companies — Sui Northern and Sui Southern.

In the letter to the finance minister, it said receivables of OGDCL, PPL and GHPL have further ballooned to Rs1.317 trillion ($4.65 billion).

It triggered the cash flow situation owing to which half of the planned drilling was deferred in 2022-23.

Furthermore, in the bidding round held in June 2023, out of 18 blocks, competitive bids were received for only one, which reflects the financial crisis of the upstream oil and gas sector.

Pakistan’s upstream oil and gas sector is the backbone of the economy, producing 3.227 bcfd of gas, which comprises over 30% of the primary energy consumption of the country.

And due to the massive default of Sui gas companies in payment of gas invoices of upstream companies, the sector is suffering a severe cash flow crisis.

More than twelve months of US dollar invoices of foreign companies are outstanding, whereas Pak Rupee invoices of over 28 months are due for payments. Many invoices of PPL, GHPL and OGDCL have been outstanding for more than five years.

The Sui companies are not able to make payments to gas producers due to a massive revenue shortfall, which has occurred as consumer gas prices were not revised to cover the revenue requirements.

The Sui Northern is facing a cumulative shortfall of over Rs560 billion, and Sui Southern Rs415 billion.

In the letter, the state-owned E&P companies also disclosed the payment made by them is not even sufficient to cover payment of 18pc Sales Tax and 12.5 percent royalty and advance income tax.

As a result, nothing is available to fund the operating, development and exploration expenditure.

And under such circumstances, companies are forced to borrow funds at an exorbitant rate of 25-30 percent to run production operations. They have shelved most of the planned exploration and development drilling activities.

And if the payments are not made urgently, PPEPCA member companies may be forced to suspend production operations.

PPEPCA urged the finance minister to ensure budgetary grants or tariff differential subsidy (TDS) of at least Rs500 billion to Sui companies to adjust accumulated revenue shortfall partially.

It would facilitate upstream companies in meeting the operating expenditure and carrying out planned exploration and development activities for sustaining and enhancing gas production.

It also asked for an increase in the consumer gas price to meet the revenue requirement of gas companies, which has been increasing due to currency depreciation and other factors.

It further asked the finance minister to advise the State Bank for the allocation of foreign exchange for making payments to foreign E&P companies in an equitable manner.