Original KE investors reject majority ownership claim by Sage

KE Direcror Shan Abbas Ashary says the claim is entirely incorrect and baseless

August 27, 2023

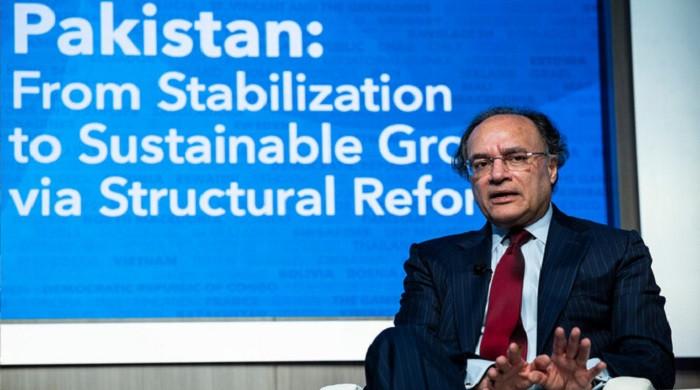

LONDON: Chief Investment Officer (CIO) of Al-Jomaih and Director at Karachi Electric (KE) Shan Abbas Ashary firmly contradicted the assertion of Infrastructure and Growth Capital Fund (IGCF Fund) ownership in IGCF SPV 21 Ltd that it has become K-Electric's majority shareholder.

In an interview, Ashary said the claim was entirely incorrect and baseless.

He said that both Al-Jomaih Power and Denham Investments collectively hold a total 46.2% share in KES Power and highlighted the uncertainty revolving around the ownership of IGCF Fund and its further ownership in IGCF SPV 21 Ltd. This uncertainty arises due to concealed and non-transparent transactions conducted by Sage in the Cayman Islands, he claimed.

Ashary said the recently emerged group asserting majority ownership of IGCF should first understand the implications and necessary permissions required by the Government of Pakistan (GoP) regarding any significant change of ownership of KE, which is a national security matter.

As an example, he pointed to the situation of China's state-owned Shanghai Electric Power Company (SEP) acquiring KE whereby checks and balances were put in place in the documents to be executed so that no one else could enter the ownership chain through a back door. This makes common sense as GoP would not like KE to end up in the hands of hostile parties, he said.

He emphasised that the current matter in Pakistan courts does not concern KE's ownership and it’s solely a jurisdictional issue. Although Shaheryar Arshad Chishty claims ownership, he hasn't provided any proof, neither to the courts nor to other stakeholders of KE, said Ashary.

On his part, Shaheryar Arshad Chishty says he has met all the legal requirements and everything has been done in the spirit of the law.

His unverified assertion of a substantial IGCF share lacks evidence, especially with 80 plus original investors who subscribed to the IGCF Fund, said Ashary. According to Shaheryar Arshad Chishty’s own declaration he owns around 20% of the IGCF Fund and this would only translate to approximately 5% of KE, undermining his major ownership claim, he added.

IGCF SPV 21, in a new statement, said: “It has a legal right to appoint its allocated number of nominees on the KE Board under the KESP shareholders agreement, which was mutually agreed between IGCF SPV 21 and the KESP minority shareholders. This right was established in Cayman Courts in 2009 and has been reaffirmed again in July 2023 through the Court Order.”

However, the CIO pointed out that the ruling of the Cayman court has a restricted jurisdiction as per the previous agreements signed during the Abraaj era however, the hearing isn't conclusive and further court dates have been set in the Cayman Islands. The ownership of KE carries national security implications, requiring clearance at various levels, Ashary added.

He also questioned the source of funds for shares acquired through Asia Pak and said a disclosure is needed. Shaheryar Arshad Chishty says he has followed legal guidelines in arranging and raising the funding.

The Cayman Island Court hasn't issued any directives regarding the management of KE or the composition of its board of directors.

“K-Electric holds notable importance as a Pakistani asset, with strategic value. It also enjoys a significant investor base from Pakistan. Furthermore, the Government of Pakistan holds a 25% ownership stake in K-Electric,” he said.

According to Ashary, the potential owners will require security clearance from the Privatisation Commission of Pakistan.

"A petition has been filed by us in the Sindh High Court. With an 18-year history of running K-Electric, our commitment remains unwavering and we will continue to do our best. No funds have been withdrawn from K-Electric; instead, all resources have been invested in the entity, leading to significant improvements. Our subsequent course of action is abundantly clear," he said.

Giving background, he said Al-Jomaih Group of Saudi Arabia and National Industries Group (NIG) of Kuwait, collectively called the Original Shareholders, obtained a KE stake in 2005. In 2008, Abraaj joined IGCF SPV 21.

After the 2018 scandal of Abraaj’s collapse, liquidators managed IGCF SPV 21 stake in KESP. In 2022, Sage Ventures — a newly incorporated entity with no track record — owned by Shaheryar Arshad Chishty and his spouse claimed a majority stake through backdoor transactions in the Cayman Islands.

This was and will continue to be overwhelmingly opposed by Original Shareholders i.e., the Saudi and Kuwaiti conglomerates.

Ashary said that IGCF Fund's stake in IGCF SPV 21 is purely a non-voting stake, which means that no management rights are associated with the shareholding, rather only beneficial interest.

In October 2022, Sage Venture Group Ltd — a special-purpose company registered in the British Virgin Islands under AsiaPak Investments Ltd — assumed the role of "general partner" for IGCF.

This transition occurred through a closed-door court process whereby Abraaj Investment Management Limited sold the assets — a company that was undergoing official liquidation proceedings. A general partner raises capital from investors and oversees a private equity fund on behalf of limited partners. Now both the recent general partner and its parent company are ultimately under the ownership of Shaheryar Arshad Chishty.

Original stakeholders contend that the assertion of majority ownership in KE lacks foundation. Acquiring the General Partner (GP) of IGCF only entails management rights, devoid of economic stake in KE. The IGCF Fund's share in IGCF SPV 21 consists solely of non-voting shares.

KESP possesses 66.4% ownership in KE. IGCF SPV 21 holds a 53.6% stake in KESP, while the Saudi and Kuwaiti shareholders hold 46.4%. However, IGCF Fund owns only 70% of IGCF SPV21, with the remaining 30% under entities controlled by Mashreq Bank, a bank based in the UAE. In essence, IGCF Fund is not the principal owner of either KESP or KE.

In a statement on the weekend, IGCF said "the KESP minority shareholders continue their illegal battles while comfortably sitting abroad” in an indirect reference to the Saudi and Kuwaiti owners.

“IGCF SPV 21 must immediately be fully seated on the KE Board to lead KE’s massive turnaround with a concerted focus on providing affordable and reliable electricity to Karachi," it said.

In 2008, the Pakistan government granted a unique exemption for Abraaj's participation, allowing them to enter the investment venture. Abraaj utilised a Cayman Islands-based special-purpose vehicle named IGCF SPV 21. This entity attracted over 80 investors including Abraaj within the IGCF Fund framework, as confirmed by records. No such approval was sought by Sage, which tried to enter the equation through concealed transactions in offshore jurisdictions, said Ashray.

Following Abraaj's liquidation in 2018 due to a significant scandal, the task of managing the company's stake — which included Limited Partners (LP) within the IGCF Fund — was taken up by liquidators. Subsequently, the original shareholders and liquidators worked together to complete the sale of KE to Shanghai Electric.

Complicating matters are different share classes, encompassing voting and non-voting shares, held in the Cayman Islands. A probe into SPV 21's share register discloses Abraaj Investment Management Ltd (AIML) as the exclusive holder of voting stock, presently undergoing liquidation. This triggers additional queries on actual ownership, hinting at impending rigorous legal disputes.

Original stakeholders, owning 30.7% of KE, and Mashreq Bank from the UAE, a key stakeholder with 10.5% see-through ownership, together hold a substantial 41.2% ownership in KE. They share common goals, aiming to improve KE and attract foreign direct investment (FDI) in Pakistan. Since 2005, these shareholders haven't taken dividends, reinvesting the funds to strengthen KE's capabilities and drive expansion.

“There are four main players in KESP; three have legal cases going on against one particular player. One does not need an MBA or a law degree to figure out that that particular player must have committed some level of wrongdoing for all three other stakeholders to simultaneously take legal action against one player," Ashary concluded.