Are we moving away from the dollar?

Pakistan making efforts to promote trade by paying in their own currencies

September 01, 2023

The dollar got the status of a reserve currency after the aftermath of World War II by the 1944 Bretton Woods Conference. World War II brought fortunes for some countries, especially the US as it ascended to the world throne as a superpower and its currency got the status of a reserve currency.

The international financial system orchestrated soon after the formation of the powerful UN, a system that runs through the IMF and the World Bank, revolves around the dollar as an international currency. This is how ‘dollarization’ became a popular term in our economic lexicon. Currently the dollar flight is facing headwinds, as alternative currencies like digital currency, the euro or the yuan are advancing to stop the world’s total reliance on the dollar.

The Chinese yuan is considered the biggest threat to the US dollar. Countries like Russia, India and Pakistan are making efforts to promote trade by paying in their own currencies. These currency-swap agreements provide a mechanism to pay for goods and services to their trading partners in their respective national currencies. Barter trade is also taking place in sanctions-hit countries like Iran to bypass the process of payment in dollars.

Pakistan, facing a dollar shortage, recently entered into a cost-effective oil deal with Russia to import crude oil by paying in a third currency like the Chinese yuan. The BRICS countries have already agreed to promote trade by using their national currencies or the Chinese yuan for international payments.

Significantly, China has become the lender of last resort after the IMF and the World Bank, and is extending loans to developing countries like Myanmar, Sri Lanka, Pakistan or African countries in yuan instead of dollar. Russia is also replicating the Chinese model, especially after the boycott of Russian products by America and the EU countries in the backdrop of the Ukraine war.

The importance of China’s role in conflict resolution in the long drawn case of Iran and Saudi Arabia cannot be understated. That will pave the way to a successful launch of the BRI (Belt and Road Initiative) project in the Middle East, connecting it through CPEC/Gwadar. China’s triumph or success means the promotion of trade in the yuan and not dollars in the future.

Global trade is taking new twists and turns, with China and India already starting currency-swap agreements with other countries to pay in their own currencies. BRICS too has member states promoting trade in their own national currencies. Bilateral, multilateral and preferential trade agreements are also promoting trade in their regional currencies. For example, the euro has become synonymous with the dollar in terms of its use and utility in the euro zone, as a lot of trade there is taking place in the euro instead of the dollar; that is significant. After the yuan, the Indian rupee is also entering the market through currency-swap agreements by India with other countries.

In another significant development, the BRICS (Brazil, Russia, India, China and South Africa) countries – possessing almost 41 per cent share of international population and market – have agreed to expand their bloc by allowing other developing countries to become members. There are about 40 countries showing an interest in joining the bloc; 22 out of these 40 countries have formally applied for membership.

BRICS has allowed six countries to become full members by January 1 next year. These countries include Saudi Arabia, UAE, Iran, Egypt, Ethiopia and Argentina. Chinese President Xi Jinping, who has long pushed for the expansion of the BRICS group, said: “The world is undergoing major shifts, division and regrouping….it has entered a new period of turbulence and transformation.” The BRICS countries are committed to promoting trade in their national currencies or by adopting major strong currencies like the Chinese yuan, Indian rupee or Russian ruble for payments to their trading partners in the group.

Crypto currency or digital currency is another reality check on the dollar as an international currency. Although, there are myriad complex security issues for its acceptability as an international currency, that is the way forward. No one can stop the ideas of the modern technological web of time. Currency in itself has a long history – starting with hard metal coins of gold or silver to paperback to now crypto or digital currency. The time has come to promote trade and business by using the digital mode of payment. This can be done by maintaining crypto accounts, just like we are accustomed to maintaining bank accounts in banks by way of depositing or withdrawing our paperback currency.

There is every possibility and probability that America’s influence as a superpower may prolong the dollar’s hegemony as an international currency for some time. But that cannot stop the currents and undercurrents of new centres of economic power, as this century is considered the ‘Asian Century’ so far as economic prowess is concerned.

The international monetary system still revolves around the dollar, but there are moves to shift away from the dollar to other dominating widely acceptable currencies like the yuan. Almost half of the world population is in Asian countries and half of the population means half of the world market; so that is the reality of the Asian Century. The international monetary system will ultimately bend towards that huge international market to promote trade and businesses.

The new geopolitical and geo-economic realities are a compelling factor to go all out for de-dollarization. The Ukraine war has opened up one chapter. Another is Taiwan and the South-China sea conflict dominating the international theatre. The Covid-19 pandemic opened up a separate chapter to rely on an internet-based online system of working to open up a digital door for international trade.

China is already spearheading the overarching concept of the Asian Monetary Fund replacing the International Monetary Fund. The Chinese-dominated Asian Infrastructure Investment Bank (AIIB) is already providing an opportunity to developing countries. The AIIB is, in fact, a replacement platform to attract developing countries mainly from Asia to move away from the dominating World Bank for development purposes.

It is enough to say that the dollar king may still have some time to rule over the world, but there are now problems that could put an end to its rule. The dollar flight is facing headwinds slowing down its pace and speed. The dollar’s hegemony may erode with time, as new centres of economic powers are emerging on the world scene.

The international monetary system dominated by the dollar may lose its ground, especially if international conflicts like the Ukraine war, Taiwan and the South-China Sea, and the Middle East are not successfully resolved. The new cold war with China is already creating ripples in international relations, and may create a lot of supply chain issues affecting international trade in case such a huge future development takes place. Another Covid-19 like situation may create further ground for the dollar’s replacement with crypto or international digital currency.

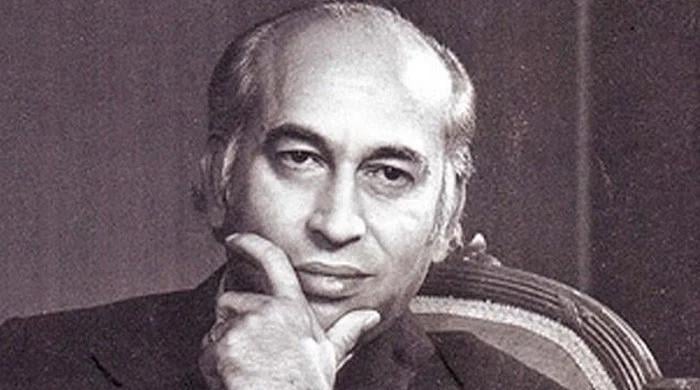

The writer is a former additional secretary and can be reached at: [email protected]

Originally published in The News