Rupee expected to remain stable after falling to record low

After eight straight sessions of record lows, the rupee managed to hold steady on Friday

September 03, 2023

- Rupee closed at 305.47/dollar Friday; 1.15% decline in five sessions.

- Currency fell by 4.2% in kerb market, where it is traded freely.

- Rupee likely to struggle next week, slide seems to have moderated.

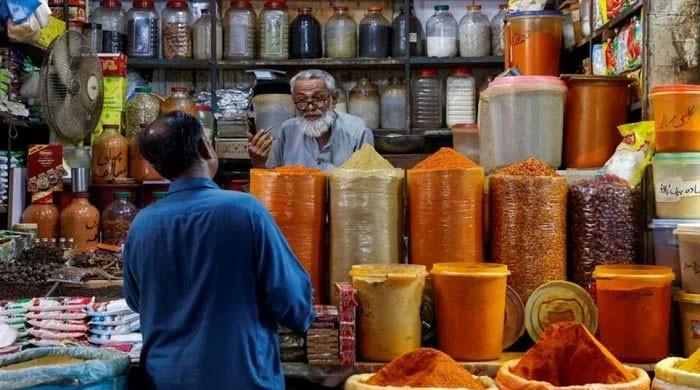

KARACHI: As the rupee's sharp depreciation moderated after hitting record lows last week, the Pakistani currency is expected to trade in a tight range against the dollar in the upcoming week, The News reported Sunday, citing traders and analysts.

On Friday, the rupee closed at 305.47 per dollar, after losing 1.15% in the last five sessions, while last Monday, the local currency's interbank market closing price was 302 per dollar, losing more ground on Thrusday as it dropped to 305.54.

However, after eight straight sessions of record lows, it managed to hold steady on Friday.

The currency also fell by 4.2% in the kerb market, where it is traded freely, during the week. It dropped from 315 per dollar on Monday to 328 on Friday, according to the Exchange Companies Association of Pakistan.

Although it's expected that the rupee will struggle in the coming week, the slide in the currency seems to have moderated.

“The rupee will be under pressure, but I think any weakness will be gradual. I don’t expect an aggressive slide like the eight to ten sessions ago,” said a foreign exchange dealer at a major bank.

The dealer added that the demand for dollars was high due to capital withdrawals, political unrest and economic uncertainty.

Another trader said the rupee’s slide was also driven by a diversion of remittances to hawala, an informal money transfer system, which fuels the demand for dollars among smugglers and informal/under-invoiced traders.

“The sudden drop in the value of the rupee is attributed to a combination of relaxation of import restrictions, weakening exports, and the diversion of remittances to hawala,” he said.

In order to meet the conditions of a $3 billion bailout package from the International Monetary Fund, import limits were eased, which put pressure on the rupee. Additionally, the currency is under pressure from political unrest and economic uncertainty.

“Heads of financial institutions have been called, while traders on Friday were dissuaded from trading the dollar at or above 306 level, and we will soon see forex companies being called by SBP,” said Tresmark, a platform for the treasury market, in a client note on Saturday.

“Due to this, we see the rupee being range-bound in the coming week and may also see some minor consolidation... but with the financial market in such disarray, people are wondering if it even really matters now,” it added.

“If nothing is done within the next few days, financial markets will continue to see a meltdown. The cost of inaction matters,” it said.

The Monetary Policy Committee will meet on the scheduled date of September 14 to decide on the policy rate, according to the State Bank of Pakistan, which denied reports that it might conduct an off-cycle review.

As inflation is likely to stay higher than anticipated, analysts predict that interest rates will likely increase by at least 100 basis points. The consumer price index will remain high in the short term due to falling rupee and rising energy prices.

The SBP kept the policy rate unchanged at 22% at its last meeting held on July 31. The SBP has raised the policy rate by 1,500 basis points since September 2021.

“In spite of the clarification by SBP, analysts are of the view that a radical shift in monetary policy is coming. It would help to persuade the hoarders of forex, commodities, and other assets to unwind, giving some relief to spiraling prices,” Tresmark said.