FBR extends tax return filing deadline to October 31, 2023

FBR decided to extend date for filing of tax returns in response to appeals from trade bodies and various tax bar associations

October 01, 2023

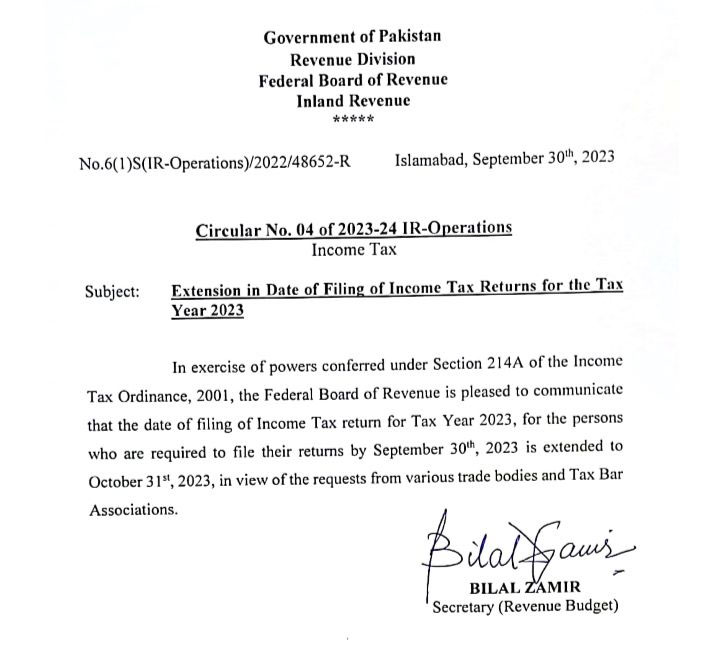

The Federal Board of Revenue (FBR) announced on Saturday that the deadline for filing income tax returns for Tax Year 2023 has been extended for another month to October 31, 2023.

The decision comes in response to appeals from trade bodies and various tax bar associations. However, the federal tax-collecting body has stressed that no further extensions would be provided, according to an FBR notification issued late Saturday.

In a statement posted on the social media platform X, formerly known as Twitter, the FBR said, "In light of the requests from trade bodies and various tax bar associations, we have decided to extend the deadline for filing income tax returns for Tax Year 2023 to October 31, 2023."

"Nevertheless, it's important to note that no additional extensions will be granted," it added.

FBR officials reported that over 1.7 million individuals have already filed their tax returns. The officials also anticipated that the number would exceed two million by September 30.

Two days ago, the FBR announced that it would not extend the deadline for tax return submissions, which was initially set for September 30.

The tax slabs for year 2022-23 approved by the former government are:

- For income below Rs600,000 per year (Rs50,000 per month) — no tax will be deducted

- Those earning Rs600,000 to Rs1.2 million per year (Rs50,000 to Rs100,000 per month) will pay a tax of 2.5% of the amount exceeding Rs600,000

- On the income within a range of Rs1.2 million to Rs2.4 million (Rs100,000 to Rs200,000 per month) will pay Rs15,000 plus 12.5% of the amount exceeding Rs1.2 million

- Individuals earning Rs2.4 million to Rs3.6 million a year (Rs200,000 to Rs300,000 per month) will be charged at Rs165,000 plus 20% of the amount exceeding Rs2.4 million

- Those earning Rs3.6 million to Rs6 million a year (Rs300,000 to Rs500,000 per month) will be charged at Rs405,000 plus 25% of the amount exceeding Rs3.6 million

- People with an annual income of Rs6m to Rs12 million (Rs500,000 to 1,000,000 per month) will be charged at Rs1.005 million plus 32.5% of the amount exceeding Rs6 million

- In the last slab, individuals earning more than Rs12 million (more than 1,000,000 per month) a year will be charged at Rs2.955 million plus 35% of the amount exceeding Rs12 million

The then-finance minister, Miftah Ismail — while announcing the federal budget for the fiscal year 2022-23 — revealed the FBR's target for the financial year is 9% — Rs7,004 billion.