2023: A year of two economies for Pakistan

As the scent of elections sweetens the air in 2024, will political parties harness this fragile momentum or fall back into the comfortable embrace of short-term fixes?

Pakistan was tied to a rollercoaster ride in the year 2023, grappling with the sudden highs and lows of grave economic uncertainty, coupled with soaring inflation and depreciating currency, tearing apart people's lives.

The country had already been reeling from the aftermath of the 2022 floods that washed away swathes of agricultural land, affecting millions of lives. But amid all that chaos, the nation also saw a ray of hope.

This isn't your conventional story of doom and gloom. It's about a nation struggling against a perfect storm of challenges, some homegrown, some imported. It's about a people teetering on the edge of economic precarity, yet finding ways to defy gravity.

It's about a government trying to acquire loans from other countries while dealing with angry citizens and uncertain politics.

In this special issue, we'll talk about Pakistan in 2023: farmers facing floods and expensive fertilisers, entrepreneurs making opportunities, and leaders handling money carefully. We'll look at how the International Monetary Fund (IMF) helped, the possibility of money losing value, and some hope in better exports and good cotton harvests. It's a story about Pakistan in 2023—hard times, brave actions, and uncertainty about the future. Is the country heading towards a big problem or about to turn things around? Let's find out.

“The outgoing year was disastrous for incomes and economic activity, as excessive sovereign debt and a perpetual fiscal deficit constrained the government's ability to catalyse growth,” independent macroeconomist Ammar Habib Khan said while speaking to Geo.tv.

In the outgoing 2023, Pakistan encountered economic challenges and political unrest that cast a shadow on its GDP growth. The nation was grappled with various obstacles including rising inflation, fiscal deficits, weak currency, political instability and a decline in capital flows (to name a few) that impeded its economic progress.

• The size of Pakistan’s economy (Gross Value Added at current price) is estimated to be Rs84.07trn in FY23 compared to Rs66.64trn recorded in FY22.

• During the first half of fiscal year 2023-24, the country’s deficit decreased by 85% to $2.6 billion compared with a deficit of $17.5 billion during the same period last year. This is the lowest yearly current account deficit after FY13 ($2.5 billion).

• Total imports during FY23 clocked-in at $60 billion, down 29% year-on-year; while total exports during FY23 clocked-in at $35 billion, down 11% year-on-year.

• During FY23, remittances went down by 14% year-on-year to $27 billion as compared to $31.3 billion in FY22.

• During FY23, net FDI down by 25% year-on-year to $1,456 million compared to $1,936 million in FY22.

• During FY23, Large-Scale Manufacturing Industries (LSMI) output stood at 114.8 (FY22: 128). This marks a 10.3% decline in LSMI output during FY23.

• Average inflation for FY23 clocked in at 29.2% compared to 12.2% in FY22.

• Meanwhile, the GDP for FY23 has been revised. The initial estimate, which indicated a growth of 0.29%, has been revised downward to -0.17%.

“Decades of inefficient, inequitable and impulsive decision making, primarily benefiting political and economic elite, has resulted in one economic crisis after another and 2023 was another hard year. The first six months engulfed Pakistan in a financial crisis — keeping all stakeholders on the edge — wondering if Pakistani policymakers will be able to negotiate and lock in the IMF funds,” Development Economist Maha Rehman said.

PSX’s journey from 40,000 to 62,000 points

Terming 2023 “best” for the stock market, Alpha Beta Core CEO Khurram Schehzad mentioned that within three months, PSX returned the best in over a decade, while it managed to re-secure the title of being one of the best-performing markets globally.

The equities gained 55% in 2023 with 22,031 points up, closing the year at 62,451 points. The market value was up by $9 billion, closing at $32 billion.

2023 was divided into two distinct halves, each telling a unique story.

The first half of 2023 saw Pakistan's stock market facing challenges. Economic difficulties and political uncertainty were key contributors to the subdued market conditions.

The delay in resuming the IMF programme significantly affected economic and market dynamics.

Moreover, the policy rate witnessed a significant 600 basis points increase, reaching a historic high of 22%, making equities less attractive.

However, in the second half — following the Standby Arrangement with the IMF in June — investor confidence rebounded, leading to a resurgence of flows into the market.

Following the IMF support, the SBP received significant inflows/rollovers from friendly countries, boosting the country’s forex reserves to $8.2 billion by July end which bolstered investor interest.

Moreover, the establishment of the Special Investment Facilitation Council (SIFC) to attract foreign direct investment played a significant role in maintaining strong momentum.

Additionally, administrative measures by the authorities aimed at curbing illegal foreign currency and preventing further depreciation of the Pakistani rupee contributed to enhanced investor confidence.

The benchmark KSE-100 index reached unprecedented heights by hitting an all-time high of 66,427 points, which marked a gain of 26,006 (64.3%) since December 2022. After achieving this feat, the market witnessed some profit-taking. Despite this, the KSE-100 index emerged as the fifth best-performing stock market in 2023.

Albeit, the market closed at 62,052 points, gaining 21,632 points (up by 54%) year-on-year.

Another bad year for the Pakistani rupee

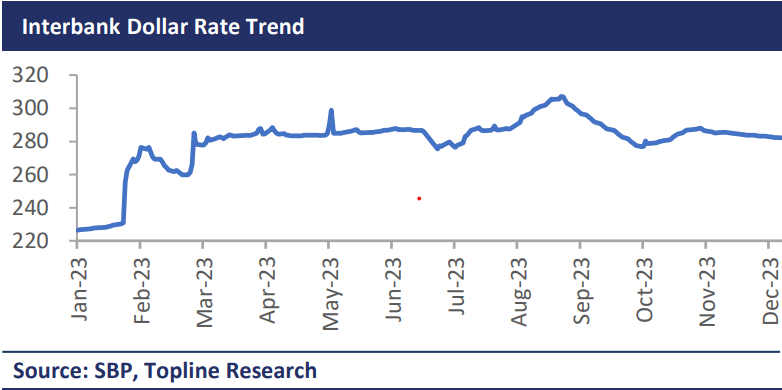

The Pakistani rupee has been under pressure for the last seven years. In 2023 the local unit fell 20% against the greenback in spite of some recovery in the last few months. It should be noted that this 20% fall in 2023 is higher than the last five-year average fall of 13% a year and a 10-year average of 8%.

The downward trajectory was driven by the external financing gap, challenging global financial markets. Moreover, local political instability badly affected foreign exchange reserves which mounted pressure on the rupee.

In the first half of 2023 —before the IMF's Stand-by Arrangement (SBA)— the local unit fell by 21% from Rs226 to Rs286 against the US dollar whereas in the second half, it gained 1% from Rs286 to Rs282 post IMF's SBA.

Meanwhile, in the open market, the rupee fell 17% from Rs236 to Rs284 in 2023. In the first half, it declined by 19% from Rs236 to Rs290, while in the latter half, the local currency gained 2% from Rs290 to Rs284 against the greenback.

Tough start, bright finish: Miftah Ismail on 2023’s economic rollercoaster

Pakistan's economy weathered a storm in 2023, according to former finance minister Miftah Ismail, with starkly contrasting halves: "bad from January to June, and better from July to December."

Miftah — while speaking to Geo.tv — painted a vivid picture of the initial hardship. "Until February, the government held the dollar artificially at Rs230 rupees”, distorting the market and hurting remittances and exports. This, he says, triggered a period of "tough times" as Pakistan grappled with "a huge interbank and open market difference between dollar prices."

Furthermore, the delay in securing an IMF loan programme added to the anxiety. "Pakistan constantly tried and failed to secure the IMF programme, increasing the risk of default," Miftah explained, leading to a decline in Pakistani bonds, market volatility, and heightened business uncertainty.

However, a turning point arrived in June. "Shahbaz Sharif, then prime minister, managed to secure the IMF programme," the foreign finance minister — who was sacked from the office to make way for the party stalwart Ishaq Dar — noted, marking a critical shift towards stability. The subsequent caretaker government's bold move to raise electricity and gas tariffs, while unpopular, "improved the state's financial situation," said Miftah, demonstrating a commitment to fiscal discipline.

This shift in direction yielded noticeable results. "The markets believed that the programme's revival shot down the default risk," Miftah observed, leading to a rebound in the stock market, a stabilised currency, and a remarkable recovery in Pakistani bonds.

Looking back, the former finance minister acknowledged the initial struggles but emphasised the positive turn. "The first six months were really bad," he concedes, "but the last six months have been much better."

Can election year, 2024, push past the boom-bust cycle?

Khan was of the view that the rational way forward would be to retool and restructure the economy, and finally undergo painful reforms. “In the absence of any serious reforms, things may only get worse, unless we can get an influx of foreign currency as a function of geo-economic rents, which seems unlikely,” he added.

With elections around the corner, calls are growing for a drastic shift in economic approaches, moving beyond short-term rhetoric and instead prioritising long-term growth and development.

Endorsing the view, Rehman said that in order to go beyond the economic rhetoric, it was important to zoom out and take a long-term view.

“What is it that we need to do now that ten years down the road our projections will look fundamentally different? With the elections coming in, people and political parties must place their trust in competitive policymakers and advisers.

“To do so, the parties must be open to personnel change and must look beyond the usual familial leaders. Once a new government is sworn in, we must start to scientifically alter embedded incentives to stir the economy towards a path of growth and development.

“Take a systems approach instead of planning and pushing for disjoint policies that further entrench and benefit the status quo. Change will be slow and incremental if the right progressive policies are gradually implemented. There is a lot of advice out there on what the right policies are, what sectors should be targeted and how but it is now also time that, given our constraints, policymakers and advisers turn to the theory of second best. Following Stefan Dercon’s advice, given the elite capture and financial limitations, what is it that we can do today to begin altering our underlying economic fabric?”

Arif Habib Limited Head of Research Tahir Abbas shared some key economic and political headwinds which are expected to subside in 2024.

• General elections in February 2024 will be held per the schedule and are expected to clarify the political landscape.

• GDP growth is expected at 3.3% during FY24.

• The current account deficit is expected to be manageable.

• We estimate FY24 and FY25 inflation to clock in at 24% and 12.8%.

• Start of monetary easing cycle from March 2024, reaching 15% till December 2024.

• Administrative steps and improved external flows to stabilise the Pakistani rupee.

Meanwhile, Miftah emphasised the need to learn lessons from the first half of 2023.

“The continuation of the IMF programme is very important for Pakistan, and whichever government comes [in power next], it is important for it to continue the IMF programme because if Pakistan’s ties with the Fund aren’t good, then the risk of default will increase and things will get worse.

“But if we maintain our good ties with the lender and secure a deal, the risk of default will be minimised and Pakistan will slowly progress,” the former finance minister said.

He further highlighted that the biggest issue right now, for the next six months to a year, is containing inflation, and in order to reduce inflation, the government would have to contain the deficit. “If the government is able to manage these two issues, things will fall in place and improvement will be seen in the economic conditions. However, long due reforms will have to be done, and if these aren’t done, the situation will be bad.”

Pakistan's 2023 economic tale was one of two halves. Turbulence remained the order of the first six months, with inflationary fires raging, the rupee hitting new life-lows, and the IMF loan programme hanging in balance. Yet, from the ashes rose a tentative recovery. Be that as it may, stringent policy measures and international support bore fruit. Now, Pakistan stands at a crossroads. As the scent of elections sweetens the air in 2024, will political parties harness this fragile momentum or fall back into the comfortable embrace of short-term fixes?

The answer lies in their willingness to embrace long-term reforms, break away from entrenched interests, and build an economy that works not just for the few, but for the millions yearning for a brighter future. The next chapter of Pakistan's economic story is yet to be written. Now the onus of writing it right lies equally with leaders and people.