PSX takes massive U-turn to end higher as investors binge on bargains

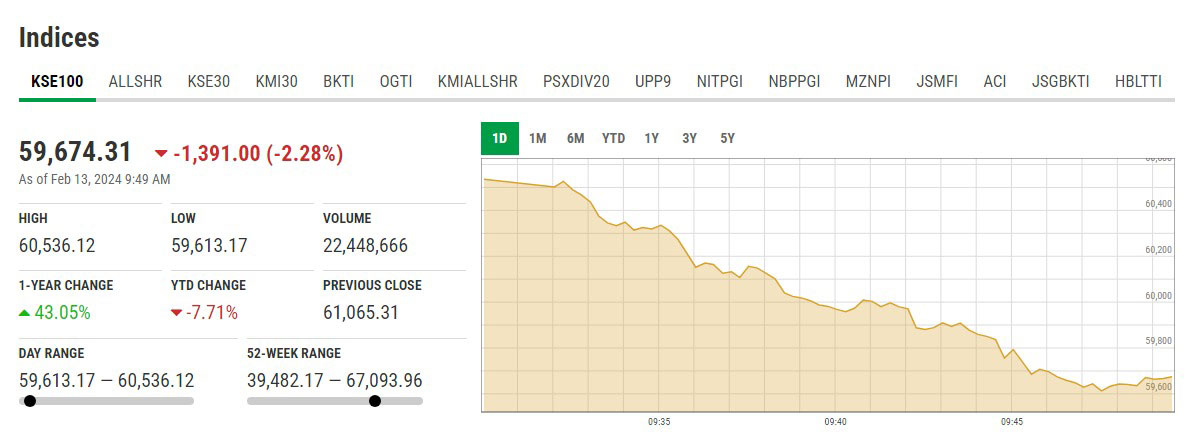

In the initial 15 minutes post the opening bell, PSX's flagship KSE-100 index plummeted below the crucial 60,000 level

February 13, 2024

The Pakistan Stock Exchange (PSX) took a dramatic U-turn on Tuesday following a vicious two-day sell-off that shoved the benchmark index below 60,000, as frustrated investors, taking the post-vote political mayhem in a stride, binged on the bargains in the second half, dealers said.

In the initial 15 minutes post the opening bell, PSX's flagship KSE-100 index plummeted below the crucial 60,000 level, reflecting subdued investor confidence amid ongoing political uncertainty.

At its lowest point, the benchmark KSE-100 Shares Index hit 59,613.31, experiencing a decline of 1,391 points or 2.28% in intraday trading compared to the previous day's close of 61,065 points.

The session started shaky, with OGDC and PPL plunging on IMF tariff concerns, dragging the index down over 2%. Uncertainty surrounding government formation added to the selling pressure.

As soon as the script flipped, investors jumped on the battered stocks at discounted prices. The index clawed its way back, surging over 1,600 points from its intraday low and closing marginally higher.

The index surged by as much as 1,614 points or 2.7% from its intraday low, concluding at 61,226.93, marking a gain of 161.61 points or 0.26% from the prior session's close.

Analysts pin the fluctuations on the uncertainty over the formation of a new government, adding, that the KSE-100's recent rebound after political uncertainty highlights the inherent agility of market players.

This adaptability proves crucial as the political and economic landscape in Pakistan remains in flux, while investors are closely monitoring the developments and are ready to adjust their strategies to make the most of the opportunities and minimise risks in this ever-evolving environment.

The market exhibited significant volatility, ranging from an intraday low of 1,452.14 points to an intraday high of 589.34.

The KSE-100 index traded 253.487 million shares today, following two bearish sessions with a cumulative loss of 3,079 points. However, a mildly positive MSCI review sparked a rebound, with 55 index constituents closing up and 33 down.

While Arif Habib Limited anticipates a neutral impact from the MSCI review, the inclusion of three PSX scrips in the Frontier Market and 19 in the Small Cap Indexes is a welcome development.

Commercial banks gained (+171.72 points), fertiliser (+113.27 points), cement (+40.12 points), power generation & distribution (+35.74 points), and engineering (+19.14 points) lifted the index.

Despite the overall gain, oil & gas exploration companies dragged down the index by 199.48 points. Other negative contributors included oil & gas marketing companies (-53.66 points), automobile parts & accessories (-17.27 points), refineries (-13.73 points), and pharmaceuticals (-9.31 points).