Capitalising on coal

Pakistan needs long-tailed capital to execute infrastructure and other industrial projects that can contribute to economic growth

March 31, 2024

The government has been the biggest borrower from banks over the last decade, making up more than 70% of banking assets. This has effectively crowded out private sector credit, stalling overall economic growth in the process.

Banks are now effectively deposit mobilisation shops to finance the government’s fiscal extravagance. Since banks can generate historically high profits just by lending to the government, there is little incentive to actually lend to the private sector, do long-tailed project finance, and contribute to economic growth.

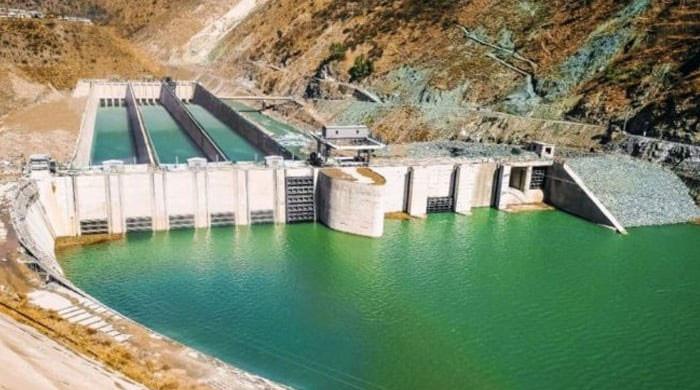

Pakistan being in the very early stages of development needs long-tailed capital to execute infrastructure and other industrial projects that can contribute to economic growth. Banks being largely focused on short-term have barely been doing any such financing, with loans having a maturity of greater than three years being less than one-fifth of total financing.

The inability to mobilise local capital has led to a situation such that major infrastructure projects are executed through external debt, which strains the foreign currency reserves and increases exposure to the depreciation of the rupee. The inability to execute projects also means heavy reliance on imported energy sources, which further drains foreign currency reserves.

The incumbent finance minister recently announced that lending would be directed towards priority sectors. A sector that should be among the top priorities is indigenous coal. Over the last year, Sindh has been able to extract coal from the Thar Coalfields. Currently, more than 15 million tonnes of coal are extracted from the Thar Coalfields, powering 2,400 megawatts of power plants. As initial excavation has been done, there exists potential to considerably scale up the mines to eliminate the need for imported coal.

Through local coal power plants, Thar Coalfields can generate the cheapest electricity, with a fuel cost in the range of Rs4.4 per unit (kWh). Meanwhile, power plants operating on imported coal generate electricity at an average of Rs15 per unit (kWh). Effectively, the fuel cost of electricity generated from Thar Coal is almost one-third of electricity generated from imported coal power plants. The same is from the latest available merit order of the National Transmission & Despatch Company.

There are currently around 4,600+ MW of power generated from imported coal, while significant coal is also imported by the cement industry. Through the conversion of power plants designed to operate on imported local coal, it will not just be possible to significantly reduce the cost of power generation, but also save the outflow of precious foreign exchange reserves. It is estimated that to completely substitute imported coal, local coal mines need to scale up to produce more than 50 million tons of coal. Through such a maneuver, it will be possible to save more than $3 billion of foreign currency outflows, while also significantly reducing the cost of electricity — spurring industrial growth in the process.

Such a turnaround reduces electricity cost, reduces imports, and catalyses economic growth in the process. But the same cannot be done without access to capital. Due to an ever-increasing circular debt situation, banks already shy away from taking exposure to power and energy segments.

Financing for indigenous resources needs to be prioritised, as the economic multiplier of the same would be the highest among other sectors. Unlocking long-term capital for coal can enable coal mines to scale up, and substitute imported coals. This can enable generation of power at considerably lower rates, resulting in a decline in weighted cost of electricity. The availability of lower-cost electricity can then be redirected towards export-oriented segments to catalyse exports.

There can never be any sustainable industrial growth, and neither can there be any industrial policy without reforming the power sector and ensuring the availability of affordable electricity. Another key ingredient is availability of long-term capital. It is only after the presence of these building blocks, an industrial base can be established. Before we prioritise specific industries, it is time to prioritise capital accumulation, and power.

The government has multiple tools at its disposal to nudge the same. The same can be done through mandating lending targets for coal-oriented financing, whether conversion of power plants or scaling up of mining operations. Another tool is to have in place a lower tax rate for revenue generated through such financing. The same tool can also be utilised for other export-oriented priority sectors as well. Before any of this can be done, the government will also have to plug its fiscal deficits as well and reduce its borrowings from banks to create the fiscal space for reallocation towards private sector lending. None of this can be done if fiscal deficits continue to increase incessantly.

There exists an argument that utilising coal would lead to a more expansive carbon footprint. Important to note here that Pakistan has one of the lowest carbon emission rates on a per capita basis. Any incremental emissions are already being countered by a fairly carbon-neutral energy mix, which heavily relies on nuclear, and hydel power for baseload. Pakistan is in fairly early stages of development. To achieve any semblance of sustainable growth above its population growth rate, it needs access to affordable and indigenous energy. There can never be a prosperous country without access to affordable energy.

If policymakers are serious about sustainable growth, it is time to double down on capital accumulation and allocate the same indigenous energy and export-oriented industrial growth. We can either create policies for increasing incomes across the board, or we can continue to increase the income of a rent-seeking elite, succumbing the rest of the country to misery, while moving from one bailout to another. The choice should be fairly clear at this point.

The writer is an independent macroeconomist.

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.

Originally published in The News