PSX gains 692 points to close at 72,051 mark on economic optimism

Benchmark KSE-100 shares index hit another record with analysts attributing surge to rally in cement, textile sectors

April 24, 2024

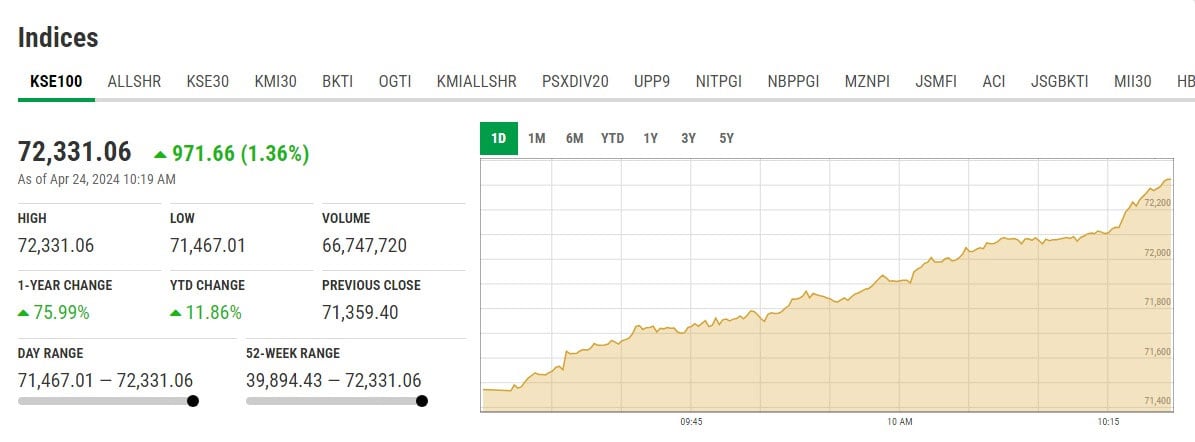

- KSE-100 gains more than 900 points during intraday trade.

- Analyst says rise due to improvement in the economic metrics.

- Stocks fell by 74.06 points to close at 71,359.41 points yesterday.

KARACHI: Pakistan stocks surged past 72,000 points mark on Wednesday mainly powered by improved foreign exchange reserves and hopes of monetary softening by the central bank with inflation likely to cool off down the line.

During the intraday trading, the Pakistan Stock Exchange's (PSX) benchmark KSE-100 index shot up to 72,335.89 points — 976.49 points or 1.37% higher than previous close of 71,359.41 points.

However, the benchmark index closed at 72,051.89 after gaining 692.49 points or 0.97%.

Speaking to Geo.tv, EFG Hermes Pakistan CEO, Raza Jafferi, attributed the rally to the improvement in the economic metrics, especially in foreign exchange reserves and inflation trajectory, which are giving rise to monetary easing expectations.

"This can be a major trigger for equities, and is leading to interest in highly leveraged sectors such as cement and textile which are driving the newest leg of the rally," said Jafferi.

Topline Securities CEO Muhammad Sohail said that the KSE-100 index has set another record. He said that consumer inflation is expected to decrease after record current account surplus.

"Investors believe that the interest rate will decrease in the coming months," added Sohail.

"Stable macros, expectations of a rate cut and hopes of a new IMF (International Monetary Fund) program are driving the market," said Samiullah Tariq, the head of research at Pak-Kuwait Investment Company.

Stocks a day earlier ended slightly lower in mixed trade as early gains driven by a rally in the cement sector were erased by profit-taking in the later session, traders said.

The KSE 100-share index fell by 74.06 points or 0.10% to close at 71,359.41 points.

“Stocks closed under pressure amid higher trades on weak global crude oil prices, reports over refineries shutdown and expectations over prudent SBP policy announcement next week ahead of new IMF loan talks next month," said analyst Ahsan Mehanti at Arif Habib.

"Shanghai Electric Power’s withdrawal on KE acquisition offer, uncertainty over Pakistan-US relations on Pakistan-Iran trade pacts and weak rupee played a catalytic role in the negative close."