Pakistan's power sector puzzle

It is time to take some smart business-oriented decisions to deal with existential threat posed by power sector to economy

May 20, 2024

With the new round of negotiations with the IMF, the power sector and its continued ailment is once again under discussion. The mounting circular debt and its crippling impact on the entire energy value chain directly, and the negative impact on the larger economy are not in debate.

The causes of this seemingly intractable problem are multifarious. Inefficient governance, decaying infrastructure, inability to collect receivables from both public and private consumers, theft of electricity, under budgeting of power subsidy etc are well known factors and have been discussed for years.

However, despite all this the total cumulative circular debt stood at Rs450 billion in 2013 and the annual additions to this number were not worryingly large. From this state, what happened that the increase of circular debt within four years jumped to about Rs450 billion in a single year and in a matter of just a few years the cumulative circular debt increased by more than Rs2,000 billion?

Until we understand what caused this massive explosion of circular debt, we will not be able to identify the root cause of our current problems and may take decisions that make matters worse. The root cause of this massive burden of crushing electricity bills for the people and businesses of Pakistan is the flawed, to the extent of being divorced from reality, expansion of power generation capacity.

The PML-N government came to power inheriting a power shortage crises and decided rightly to prioritise the building of new capacity. However, they made two critical mistakes in this regard, and missed an opportunity to rectify past policy mistakes, and it is the cost of these which the 250 million people of Pakistan are collectively paying.

The missed opportunity was not moving away from the disastrous take-or-pay model to a competitive market structure. With the shortage in the market, investors would have been willing to come in and those who moved fast would have made excellent returns in the first couple of years while the shortage lasted and then prices would have normalised.

This structural problem was compounded by two huge mistakes. First, the guaranteed rate of return was increased and that too in dollar terms. This made the new capacity prohibitively expensive specially as the country faced chronic current account deficits and the rupee came under pressure and started to devalue rapidly.

The second mistake was going overboard and allowing far too much capacity to be built. Remember this massive unneeded capacity was built under an incentive structure in which the citizens and businesses of Pakistan have to pay for this in the shape of capacity charges whether this electricity is used or not. In the seven years between 2016 and 2023, the installed capacity in the country increased from 25,374 MW to 45,885 MW or an 81% increase in a short period of time.

As a result, the annual capacity payments, which were only Rs280 billion in 2015-16 according to Nepra’s State of Industry report published a couple of months back, will exceed Rs2,100 billion this year. Capacity had gone up by 81% but actual generation only increased by 23% in the same period due to insufficient demand. Consequently, capacity utilisation rates crashed and per unit fixed capacity payments sky rocketed nearly six-fold to more than Rs15 per unit.

This massive increase in per unit fixed capacity charges is the main cause behind the doubling of electricity base rate charges from Rs11.72 to more than Rs23 in just the last five years. Newspapers are reporting that an increase of another Rs7 per unit is under discussion with the IMF as part of the new package for implementation effective July this year. This is considered to be needed because despite the sharp increase of electricity prices the circular debt is still continuing to grow. This is a bureaucratic way of looking at the problem and trying to fix it by increasing prices even more despite massive underutilised capacity.

This is not how a business approaches the pricing of the product it sells. The major reason for the continued buildup of circular debt is the massive under-utilisation of the capacity brought online. The sharp price increases have decimated demand growth both in the industry and of households who find the pricing unaffordable. Businesses have been made uncompetitive by the extremely expensive electricity and we will make matters worse by increasing prices sharply again. If the electricity system of Pakistan was being run by private business in a deregulated environment, without doubt they would be looking to increase demand by pricing the electricity at a more affordable level, especially for industry.

This was done in the year 2021-22 by the PTI government. Industry was given discounted prices for consumption above the base level for the previous year. The result was a strong increase in demand and that resulted in much stronger overall economic growth. As long as the marginal consumption is priced above marginal variable costs, the cash flows are positive.

Businesses receiving this incentive prosper and the burden on the taxpayer to foot the capacity charges burden reduces. How much room does that give for price discounts? The expected price structure for next year is expected to be more than 60% fixed charges and less than 40% variable cost. This means there can be a very steep reduction in price and it will still be more than the variable costs and provide positive cash flows.

This is just the direct impact on the cash flows of the electricity sector. If you add to this the impact on FBR revenues of the additional economic activity generated, the overall positive impact on the economy would be even greater. It is time to take some smart business-oriented decisions to deal with the existential threat posed by the power sector to the economy, instead of making matters worse by taking a bureaucratic approach and reinforcing failure.

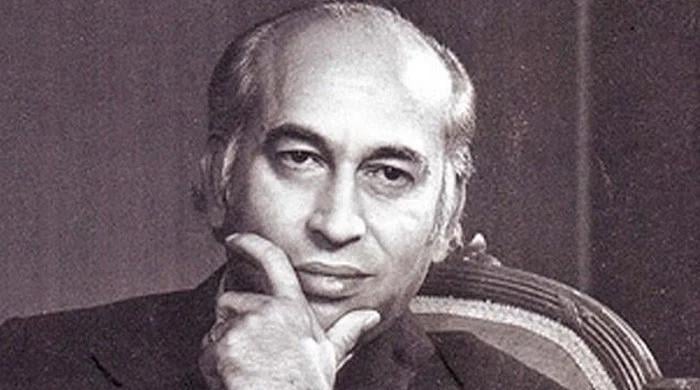

The writer is a retired corporate CEO and former federal minister.

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.