SBP may cut policy rate by 1% breaking yearlong status quo

Majority of analysts predict central bank is highly likely to revise its hawkish monetary policy stance because of cooling inflation

June 05, 2024

- State Bank's Monetary Policy Committee to meet on June 10.

- Finance minister expects rate to fall owing to slowing inflation.

- SBP now has space to cut rate without risking IMF deal: analyst.

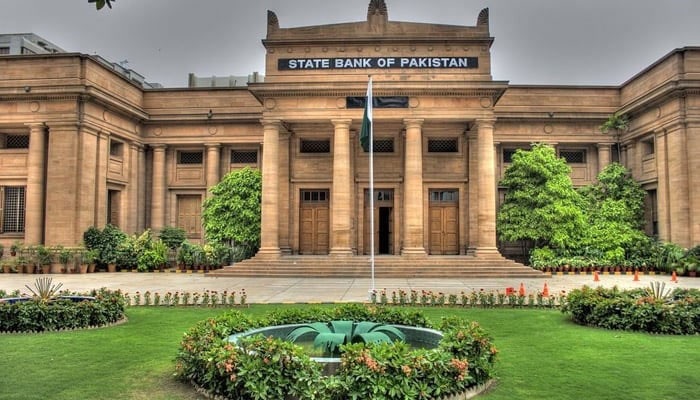

ISLAMABAD: The State Bank of Pakistan (SBP) is expected to lower its main interest rate by 1% (or 100 basis points) next week, a survey conducted by Reuters showed on Wednesday.

This decision, if taken, will signify the first signs of a dovish shift in the ongoing hawkish monetary policy stance that kept the rate at a record high of 22% for seven consecutive meetings of the Monetary Policy Committee (MPC) — since July 2023.

The SBP is scheduled to meet on Monday, only a week after the release of the country's lowest inflation rate in 30 months, which was 11.8% in May.

The state bank will meet to decide the interest rate before the announcement of the annual budget for the fiscal year 2024-25.

This inflation rate was lower than most market and official expectations. The country has been beset by inflation above 20% since May 2022.

According to the Reuters survey of 16 analysts, the majority predict that the SBP will reduce the interest rate by 1%. Specifically, ten analysts forecast a 1% cut, one analyst expects a 1.5% cut, and four analysts predict a 2% cut. One analyst believes the bank will keep the rate unchanged.

Finance Minister Muhammad Aurangzeb, speaking at a business conference in China on Wednesday, said he expected rates to come down in the face of falling inflation.

Commercial activity has been slow in the country for the last two years as it implemented tough reforms under an IMF deal in a bid to stabilise its economy.

The GDP growth was expected to be at 2% in the current financial year, which ends in June, and was negative in the previous year. The government says it will target 3.5% this year as it expects an uptick in economic activity.

The government will formally approach the International Monetary Fund (IMF) for a new longer-term bailout this summer after completing a short-term programme earlier this year that helped it avoid a default.

The IMF had previously stressed the importance of keeping a tight monetary policy to control inflation, which remained above 20% since May 2022 and hit a record high last year at 38%.

Inflation has since slowed, and came in at below 20% in April and 11.8% in May.

"Given the sustained decline in inflation and the fact that SBP showed prudence by not prematurely cutting rates, it now has the space to cut without risking things with the IMF," said Uzair Younus, an economic analyst.

However, Fawad Basir, Head of Research at KTrade, said tax reforms being considered in the budget may have a far-reaching impact on the economy and not just inflation.

"Once the impact of such decisions is evident in the high-frequency data sets, followed by successful negotiation with the IMF, then the SBP will be in a good position to start the dovish stance possibly coinciding with US Fed strategy," he said.