Industries ministry seeks reversal of hike in taxes on hybrid, electric vehicles

Ministry says sales tax hiked from 8.5% to 25% in contradiction of govt’s policies

June 21, 2024

- Sales tax hiked from 8.5% to 25% in budget, says ministry.

- AIDEP formulated to promote environment friendly technologies.

- Ministry says higher sales tax "jeopardises" investments.

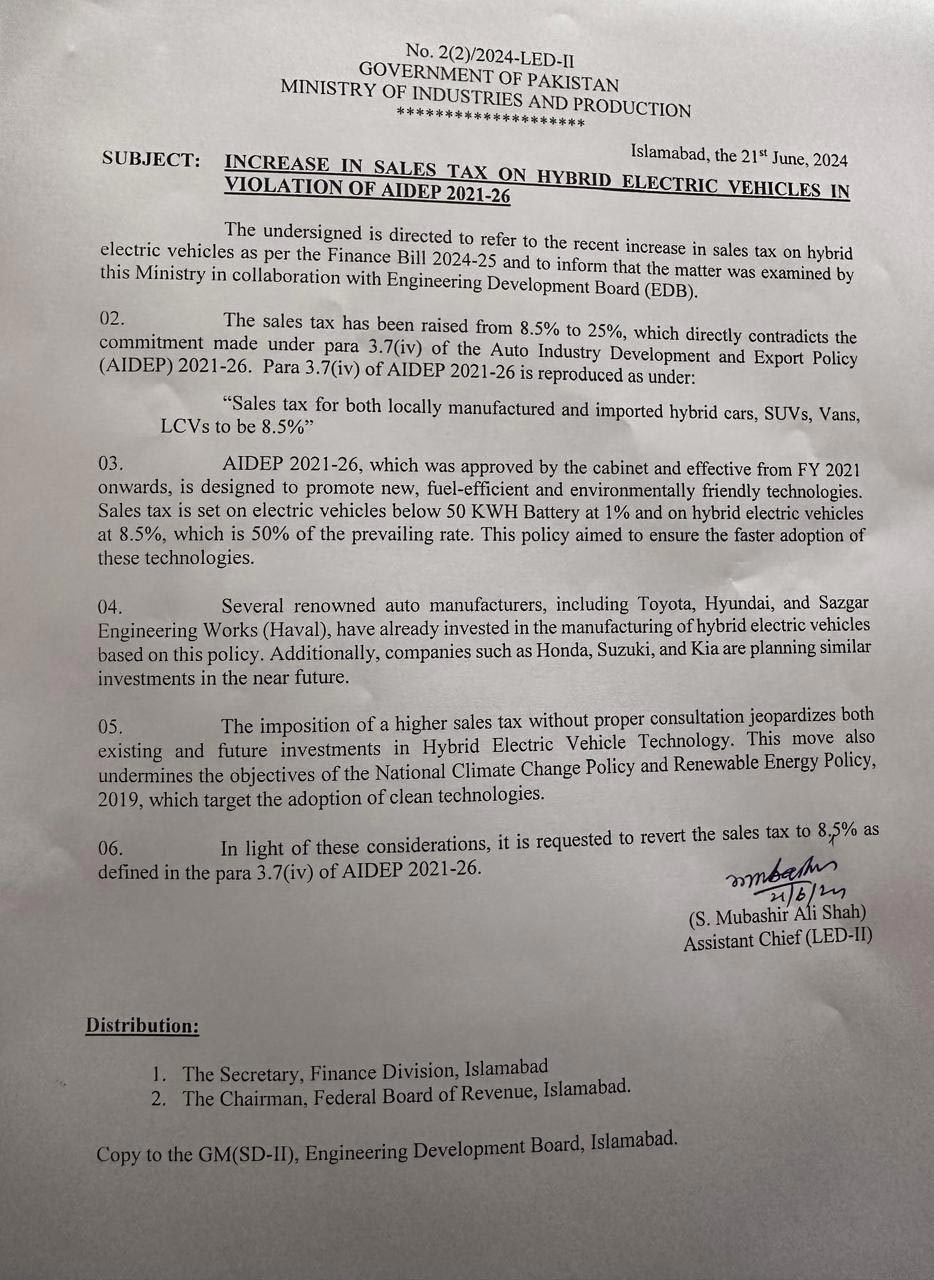

ISLAMABAD: The Ministry of Industries and Production has raised objections over the proposed hike in taxes on hybrid electric vehicles in the budget 2024-25, terming it a violation of export and auto industry development policies.

In a letter written to the Finance Division and the Federal Board of Revenue (FBR), the ministry said the sales tax has been hiked from 8.5% to 25%, which directly contradicts the commitment made under the Auto Industry Development and Export Policy (AIDEP) 2021-26.

It said AIDEP was formulated to promote new, fuel efficient and environment friendly technologies.

“Sales tax is set on electric vehicles below 50KWH Battery at 1% and on hybrid electric vehicles at 8.5%, which is 50% of the prevailing rate,” the letter said adding that the policy aimed to ensure the faster adoption of these technologies.

The industries ministry said several renowned auto manufacturers have already invested in the manufacturing of hybrid electric vehicles based on this policy, while some companies are planning similar investment in the near future.

“The imposition of a higher sales tax without proper consultation jeopardises both existing and future investments in Hybrid Electric Vehicle Technology. This move also undermines the objectives of the National Climate Change Policy and Renewable Energy Policy, 2019 which target the adoption of clean technologies.”

In light of these considerations, the ministry requested to revert the sales tax to 8.5% in line with the export policy.

A day earlier, the senators grilled FBR Chairman Asim Ahmad over the hike in taxes imposed on hybrid and electric cars, among other items.

The Senate Standing Committee on Finance, in a meeting chaired by Pakistan Peoples Party (PPP) Senator Salim Mandviwala, in Islamabad raised an objection on the increased tax rate on electric and hybrid vehicles.

The government has, as per analysts, devised the budget in line with the recommendations of the International Monetary Fund (IMF), as Islamabad hopes to sign a new and bigger programme with the global lender.

The federal government had to increase taxes and reduce the fiscal deficit as part of negotiations with the IMF, with which it is discussing a loan of $6 billion to $8 billion, as it seeks to avert a debt default for an economy growing at the slowest pace in the region.