Budget FY25 goes into effect from July 1 after president's ratification

Policymakers have set challenging tax revenue target of Rs13 trillion in a bid to unlock IMF deal

June 30, 2024

- Federal budget will go into effect from July 1.

- President Zardari approves bill under Article 75.

- PM says making budget with IMF was tough task.

ISLAMABAD: President Asif Ali Zardari on Sunday greenlighted the tax-heavy Finance Bill 2024, which will go into effect from July 1, which marks the beginning of the next fiscal year.

According to a statement issued by the President House, the head of state approved the Finance Bill under Article 75 on the advice of Prime Minister Shehbaz Sharif.

The development comes two days after the budget cruised through the National Assembly after some amendments.

The federal government presented the tax-loaded Rs18.877 trillion budget for the fiscal year 2024-25 (FY25) two weeks ago, drawing sharp criticism from opposition parties, which termed it "economic terrorism" against the people.

The finance bill was endorsed by the ruling alliance, including the Pakistan Peoples Party (PPP). The motion was passed with majority vote which led to the passage of Finance Bill 2024 after clause-by-clause reading and adopting amendments after due process of voting.

All the amendments, presented by the opposition members, were rejected.

According to Article 75(1) of the Constitution, the president shall give his assent to the approved bill of parliament within 10 days of its receipt.

“In the case of a Bill other than a Money Bill, return the Bill to the Majlis-e-Shoora (Parliament) with a message requesting that the Bill or any specified provision thereof, be reconsidered and that any amendment specified in the message be considered,” it says.

Amendments

There were a few amendments in the budget including from advance tax on the sale or transfer of immovable property under Section 236C for retired and serving federal and provincial employees, retired and serving armed forces personnel, and individuals injured in war.

Through another amendment, the income tax rate has been reduced for the Association of Persons (AoPs) from 45% to 40% on the annual income exceeding Rs5.6 million. However, individuals or AoPs earning more than Rs10 million annually will now be subject to a 10% surcharge on their income tax.

The federal excise duty rate on cement has been increased to Rs4 per kg, which will alone yield Rs80 billion. This will increase per bag cement price by at least Rs100.

5% Federal Excise Duty (FED) has been imposed on the lubricant oil which will fetch additional Rs15 billion.

The FED on international travel tickets has also been increased. The tax rate for the economy class has been increased to Rs12,500, while for the business class, the new tax per ticket is Rs350,000 for Americas, Rs105,000 for Middle East and Europe and Rs210,000 for Australia, New Zealand and Pacific.

Meanwhile, 3% FED has been slapped on allotment or transfer of property by filers and 5% by non-filers. And 18% sales tax has been imposed on vegetables and fruits imported from Afghanistan, pencils, drawing materials, diagnostic kits, and tractors.

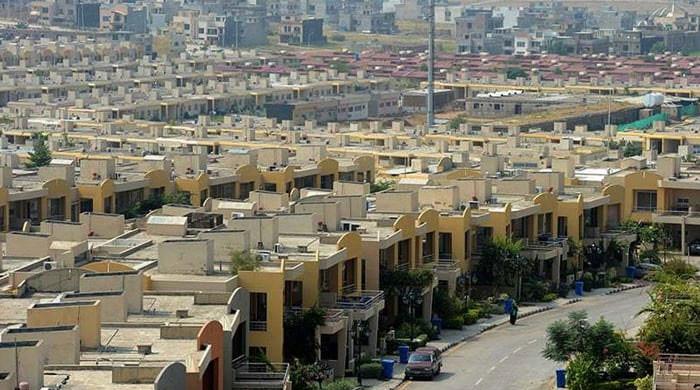

Meanwhile, a capital value tax has been introduced on the farmhouses and residential houses in Islamabad as part of the Finance Bill 2024.

Under the new amendments, farmhouses ranging from 2,000 to 4,000 square yards will have to pay a tax of Rs500,000, while those exceeding 4,000 square yards will incur a tax of Rs1 million.

For residential houses, a tax of Rs1 million will be levied on properties ranging from 1,000 to 2,000 square yards, while residential houses exceeding 2,000 square yards will be taxed Rs1.5 million.

Tough revenue target

Policymakers have set a challenging tax revenue target of Rs13 trillion for the year starting July 1, up about 40% from the current year, in the national budget presented on July 12 that looked to strengthen the case for a new rescue deal with the International Monetary Fund (IMF).

Pakistan is in talks with the IMF for a loan of $6 billion to $8 billion.

The rise in the tax target is made up of a 48% increase in direct taxes and a 35% hike in indirect taxes over revised estimates of the current year. Non-tax revenue, including petroleum levies, is seen increasing by a whopping 64%.

The tax would increase to 18% on textile and leather products as well as mobile phones besides a hike in the tax on capital gains from real estate.

Workers will also get hit with more direct tax on income.

Making budget with IMF tough task: PM

A day earlier, PM Shehbaz told The News that making a budget in consultation with the global lender was a real tough task.

He said on one hand, there was pressure from the IMF and on the other hand, he was to take care of the public expectations, problems and difficulties.

The premier said he saved the public from many more taxes through continuous discussions with his team and direct talks with the IMF team.

Shehbaz said he continued supporting his team and gave them instructions at every important financial issue for saving the people from the impact of tough decisions.