Pakistan, IMF clinch staff-level agreement on $7bn bailout deal

Latest bailout follows a commitment by the govt to implement reforms, including a major effort to broaden tax base

July 13, 2024

- New IMF package will give much-needed respite to Pakistan.

- Bailout program needs to be validated by fund's Executive Board.

- During FY 2024-25, govt aims to raise nearly $46bn in taxes.

WASHINGTON: In a major development, cash-strapped Pakistan and the International Monetary Fund (IMF) reached a three-year, $7 billion bailout programme, the Washington-based institution said on Friday.

The new program, which needs to be validated by the fund's Executive Board, should enable Pakistan to "cement macroeconomic stability and create conditions for stronger, more inclusive and resilient growth," according to a statement.

This includes steps to strengthen fiscal and monetary policy and reforms to broaden the tax base, improve state owned enterprises’ (SOE) management, strengthen competition, secure a level playing field for investment, enhance human capital, and scale up social protection through increased generosity and coverage in the Benazir Income Support Program (BISP).

“The Pakistani authorities and the IMF team have reached a staff-level agreement on a comprehensive program endorsed by the federal and provincial governments, that could be supported by a 37-month Extended Fund Arrangement (EFF) in the amount equivalent to SDR 5,320 million (or about $7 billion at current exchange rates).”

Faced with chronic mismanagement, Pakistan's economy has found itself on the brink, challenged by the Covid-19 pandemic, the effects of the war in Ukraine and supply difficulties that fuelled inflation, as well as record flooding that affected a third of the country in 2022.

With its foreign currency reserves dwindling, Pakistan found itself in a debt crisis and was forced to turn to the IMF, obtaining its first emergency loan in the summer of 2023.

The latest bailout, coming to Pakistan in the form of loans, follows a commitment by the government to implement reforms, including a major effort to broaden the country's tax base.

In this regard, the authorities plan to increase tax revenues through measures of 1.5% of GDP in FY25 and 3% of GDP over the program.

In particular, the recently approved FY25 budget targets an underlying general government primary surplus of 1% of GDP (2 percent in headline terms).

Revenue collections will be supported by simpler and fairer direct and indirect taxation, including by bringing net income from the retail, export, and agriculture sectors properly into the tax system.

At the same time, the FY25 budget provides additional resources to expand social protection by increasing both the generosity and coverage of BISP, education, and health spending.

In a nation of over 240 million people and where most jobs are in the informal sector, only 5.2 million filed income tax returns in 2022.

During the 2024-25 fiscal year which starts July 1, the Pakistan government aims to raise nearly $46 billion in taxes, a 40% increase from the previous year.

As part of the push, Pakistan's tax authority earlier this month blocked 210,000 SIM cards of users who have not filed tax returns in a bid to widen the revenue bracket.

Pakistan initiated discussions with IMF for the new multi-billion dollar loan agreement - its 24th bailout in more than six decades - to support its economic reform program.

While around 40% of the population already lives below the poverty line, the World Bank said in April it feared that 10 million additional Pakistanis would fall below this threshold.

Islamabad also aims to reduce its fiscal deficit by 1.5% to 5.9% in the coming year, heeding another key IMF demand.

The last loan - a nine-month $3 billion IMF deal - proved a lifeline.

But it came on condition of unpopular austerity measures, including an end to subsidies cushioning consumer costs.

In recent months, the current account balance has recovered slightly, high inflation is just starting to come down, but Pakistan's foreign debt remains very high at $242 billion.

Servicing it will still swallow up half of the government's income in 2024, according to the IMF.

The fund also anticipates 2% growth this year, with inflation still expected to reach nearly 25% year-on-year, before gradually coming down in 2025 and 2026.

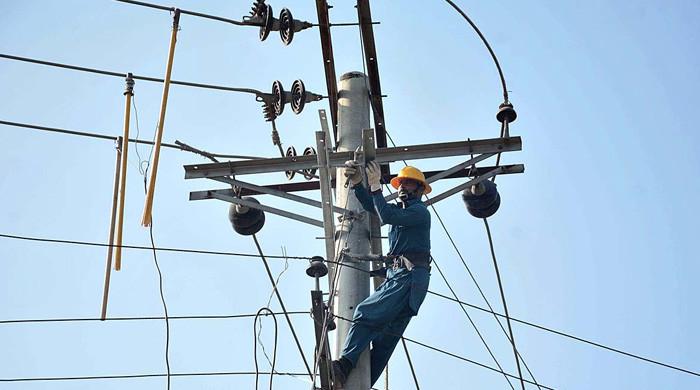

The IMF statement further said that restoring energy sector viability and minimising fiscal risks through the timely adjustment of energy tariffs, decisive cost-reducing reforms, and refraining from further unnecessary expansion of generation capacity.

The authorities remain committed to undertaking targeted subsidy reforms and replace cross-subsidies to households with direct and targeted BISP support.

“Promoting private sector and export dynamism by improving the business environment, creating a level-playing field for all businesses, and removing state distortions,” read the statement.

The authorities were also phasing out incentives to special economic zones, phasing out agricultural support prices and associated subsidies, and refraining from new regulatory or tax-based incentives, or any guaranteed return that could distort the investment landscape, including for projects channeled through the Special Investment Facilitation Council.

They also committed to advance anti-corruption as well as governance and transparency reforms, and gradually liberalise trade policy, it added.