Reforms inevitable for country to get rid of IMF: FinMin Aurangzeb

Ishaq Dar says no need to worry despite $130b of foreign debt as country's economy has a lot of potential

August 01, 2024

- Country will develop only through economic reforms: Aurangzeb.

- Minister underscores role of private sector in country's economy.

- Opposes govt's involvement in businesses related to private sector.

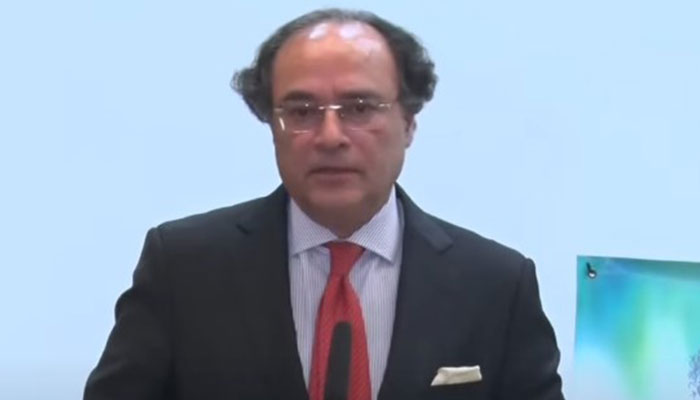

As Prime Minister Shehbaz Sharif-led government eyes International Monetary Fund's (IMF) Executive Board's approval of a fresh bailout package, Finance Minister Muhammad Aurangzeb Thursday said that reforms are inevitable if the country is to get rid of the Washington-based lender.

"Reforms are essential to get rid of IMF [...] the country will develop only through economic reforms," Aurangzeb said while speaking at the groundbreaking ceremony of the head office of the Securities and Exchange Commission of Pakistan (SECP) in Islamabad, adding that the private sector is being encouraged to play a role in the economy.

The finance czar's remarks come as the government, last month, reached a 37-month, $7 billion bailout programme with the IMF which is expected to be approved by the lender's executive board this month.

The board's approval, however, as per the finance minister is linked with with $12 billion debt profiling by friendly countries including $5 billion from Saudi Arabia, $4 billion from China and $3 billion from the United Arab Emirates (UAE) for a three to five-year period.

The cash-strapped country for months has been facing economic woes driven by various factors including but not limited to a weakening local currency coupled with depleting foreign exchange reserves and others.

Although Islamabad has achieved a primary balance of Rs0.952 trillion, equivalent to 0.9% of gross domestic product (GDP), the country faces a rapidly escalating debt trap due to the federal government’s net revenue receipts being insufficient to cover even one major expenditure item during the fiscal year 2023-24

Pakistan needs to repay $24.8 billion in external debt during the current fiscal year, data from the State Bank of Pakistan (SBP) released on Wednesday showed.

Out of the total $24.8 billion amount, $21.2 billion is in principal repayment and $3.6 billion is interest payment.

In terms of gross financing requirements, the governor stated that the total amount of $4 billion is on account of interest, and $22 billion is for principal repayment.

Positive developments

Highlighting the role of the private sector, FinMin Aurangzeb said that it has to come forward and is being encouraged to play their role in the country's economy.

Noting that the government will not be involved in businesses which are carried out by the private sector, the minister said that positive developments have emerged with regard to the economy.

"Fitch has upgraded Pakistan's rating [...] global confidence has improved with the IMF's new loan programme," he said, adding that the central bank has also reduced the policy rate which was a direct manifestation of macroeconomic stability of the country.

His remarks refer to the improvement in Pakistan's rating by Fitch which raised the country's long-term foreign-currency issuer default rating (IDR) to CCC+ from CCC.

Meanwhile, the State Bank of Pakistan, on Monday, also slashed the interest rate by 1% or 100 basis points (bps) from 20.5% to 19.5%, the second cut in a row, citing a slight cooling in the inflation rate.

Highlighting the government's efforts to attract foreign direct investment, Aurangzeb said that their job is to provide the policy framework and underscored the need for reforms in the power sector.

'Not to worry'

Speaking on the occasion, Deputy Prime Minister Ishaq Dar said that PM Shehbaz's government is focused on increasing the country's exports,

"If Pakistan has a foreign debt of $130 billion, don't worry [as] the country's economy has a lot of potential," Dar, who is also the country's foreign minister, said.

Claiming that the country is on the path to development, the deputy PM said that work on development projects is continuing despite limited resources.

On the issue of reforms, Dar echoed the finance minister's remarks and termed them "need of the hour".

"We are facing all kinds of challenges [...] there are opportunities for economic development [and] only obstacles need to be removed [in this regard]," he said.