PM Shehbaz credits govt's efforts for drop in inflation rate to 9.6%

"Our work is not done, and lot more needs to be done but we are making real progress," says premier

September 03, 2024

- PM underscores drop in inflation rate to single digit in 3 years.

- Premier reaffirms resolve to bring relief to the common man.

- "Our work is not done, and a lot more needs to be done", he says.

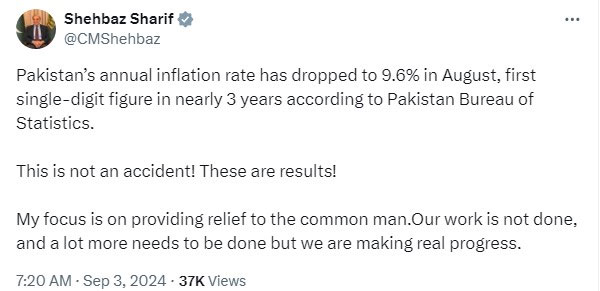

Prime Minister Shehbaz Sharif on Tuesday credited the incumbent government's efforts and policies for a notable reduction in inflation with the country's annual rate dropping to 9.6%.

"Pakistan's annual inflation rate has dropped to 9.6% in August, the first single-digit figure in nearly 3 years according to the Pakistan Bureau of Statistics. This is not an accident! These are results," PM Shehbaz said in a statement issued on his official X account.

The premier's remarks come after data from PBS revealed a significant drop in the inflation rate which has been exceeding the 20% mark since May 2022, peaking at a staggering 38% last May and these skyrocketing inflation rates coincided with the reforms implemented as part of a much-needed International Monetary Fund (IMF) bailout programme.

"CPI general inflation increased to 9.6% on a year-on-year basis in August 2024 as compared to an increase of 11.1% in the previous month and 27.4% in August 2023", the PBS said a day earlier.

Reiterating the government's resolve to provide relief to the masses, the premier added: "My focus is on providing relief to the common man. Our work is not done, and a lot more needs to be done but we are making real progress."

It should be noted that on a month-on-month basis, the Consumer Price Index (CPI) increased to 0.4% in August 2024 as compared to an increase of the previous month’s 2.1% and an increase of 1.7% in August 2023.

According to data, CPI inflation in urban areas increased to 11.7% on a year-on-year basis as compared to an increase of 13.2% in the previous month and 25.0% in August 2023.

On a month-on-month basis, it increased to 0.3% as compared to an increase of 2.0% in the previous month and an increase of 1.6% in August 2023.

Meanwhile, CPI inflation in rural areas increased to 6.7% on a year-on-year (YoY) basis in August 2024 as compared to an increase of 8.1% in the previous month and 30.9% in August 2023.

On a month-on-month (MoM) basis, it increased to 0.6% in August 2024 as compared to an increase of 2.2% in the previous month and an increase of 1.9% in August 2023.

Prices of food items that increased on an MoM basis included onions (22.84%), chicken (13.62%), eggs (12.39%), fresh vegetables (12.25%), besan (4.88%), pulse gram (4.55%), gram whole (3.82%), potatoes (2.90%), pulse moong (2.83%), milk fresh (1.27%), milk products (1.20%) and vegetable ghee (1.10%).

It is to be noted that last month, Moody's Ratings has upgraded Pakistan's local and foreign currency issuer and senior unsecured debt ratings to Caa2 from Caa3 owing to improvement in macroeconomic conditions.

The upgrade to Caa2 reflects Pakistan's improving macroeconomic conditions and moderately better government liquidity and external positions, from very weak levels.

Accordingly, Pakistan's default risk has reduced to a level consistent with a Caa2 rating, as per Moody’s. "There is now greater certainty on Pakistan's sources of external financing, following the sovereign's staff-level agreement with the IMF on 12 July 2024 for a 37-month Extended Fund Facility (EFF) of $7 billion."

Pakistan's foreign exchange reserves have about doubled since June 2023, although they remain below what is required to meet its external financing needs, it said.

According to Moody's, the country remains reliant on timely financing from official partners to fully meet its external debt obligations.

The agency however warned that the "Caa2 rating continues to reflect Pakistan's very weak debt affordability, which drives high debt sustainability risk".