September remittances surge 29% to $2.85bn YoY banking on rupee stability

On a month-on-month basis, inflows were down 3%, from $2.943 billion in August 2024

October 09, 2024

- Pakistan receives highest-ever quarterly remittances in 1QFY25.

- Saudi Arabia leads Sept remittances, totalling $681.3 million.

- Analysts say surge driven by stability of exchange rate.

Remittances surged 29% year-on-year (YoY) to $2.849 billion in September, compared to $2.208 billion in the same month last year, mostly banking on rupee stability and rising number of overseas workers, the State Bank of Pakistan (SBP) data showed on Wednesday.

On a month-on-month basis, inflows were down 3%, from $2.943 billion in August 2024.

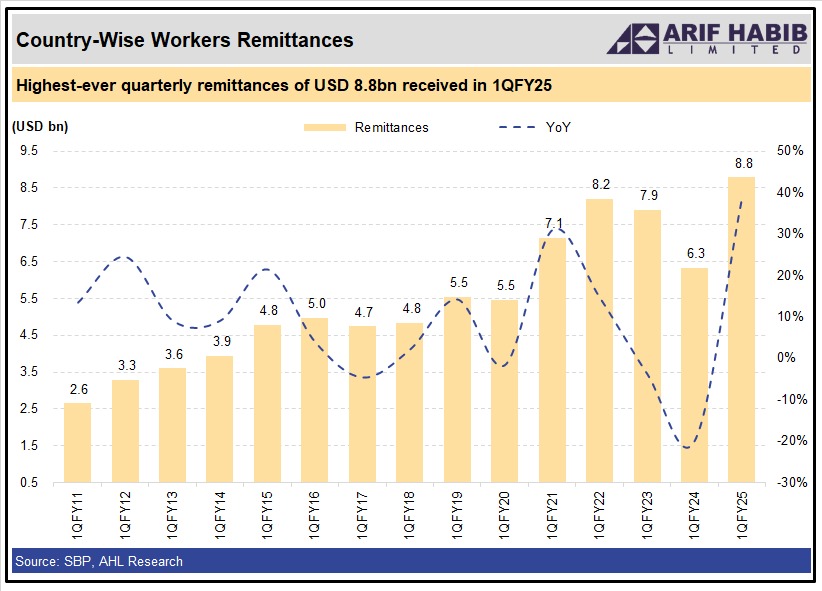

For the first quarter of FY25, remittances totalled $8.8 billion, reflecting a 39% increase compared to $6.3 billion in the same period of the previous fiscal year.

Brokerage Arif Habib Ltd (AHL) reported that Pakistan received the highest-ever quarterly remittances in 1QFY25.

"The surge was driven by the stability of the rupee exchange rate, a narrowing gap between open and interbank market rates, and an increase in the number of workers relocating abroad," the AHL noted.

A breakdown shows Pakistanis in Saudi Arabia sent the highest remittances in September 2024, totalling $681.3 million. While this represented a 4% decline on a monthly basis, it marked a 27% increase from $538.3 million in the same month last year.

Inflows from the United Arab Emirates (UAE) rose 4% month-on-month, reaching $560.3 million, up from $538.4 million in August. Year-on-year, remittances from the UAE surged 40% compared to $399.8 million in September 2023.

Remittances from the United Kingdom stood at $423.6 million, an 11% drop from August’s $474.8 million. However, year-on-year inflows improved by 36%.

In the European Union, remittances fell 3% month-on-month to $365.3 million in September.

Meanwhile, Pakistanis in the United States sent $274.9 million, a 15% decrease on a monthly basis.

Mohammed Sohail, CEO of Topline Securities, a brokerage house, in an X post, said these stronger inflows would help Pakistan maintain rupee stability and contain the current account deficit.