Charting path to export-driven economy

Policies meant to protect domestic industries have stifled innovation, eroded competitiveness

October 19, 2024

Pakistan’s economy remains trapped in a vicious boom-bust cycle, struggling to achieve sustained growth and resilience.

A glaring consequence of this instability is the recurring need for external financial support, such as the recent 24th loan agreement with the IMF. With exports contributing a mere 10.47% of GDP, Pakistan’s weak export base leaves the economy exposed to external shocks, while imports, at 21.85% of GDP, continue to weigh heavily on the trade deficit.

Decades of prioritising import substitution have entrenched deep-rooted structural problems. Policies meant to protect domestic industries have stifled innovation, eroded competitiveness, and fostered an anti-export bias.

In today’s globalised world, where economies thrive through trade, Pakistan's underdeveloped export base is a glaring flaw in its economic strategy. This is a pivotal moment. Transitioning to an export-oriented economy is not merely desirable; it is essential for ensuring the country's long-term stability and prosperity.

Historically, Pakistan's reliance on import substitution — the promotion of domestic production to reduce foreign dependence — may have served an initial purpose in shielding nascent industries. However, this approach has come at a cost. High tariffs, trade barriers, and heavy government intervention have led to inefficiencies, lower-quality products, and an inability to compete internationally. This isolationist model has outlived its utility, stunting the development of industries capable of thriving in global markets.

By contrast, an export-oriented economy promotes integration into international markets by focusing on producing goods and services for export. Countries that have successfully adopted this model, like South Korea and Vietnam, have embraced policies of trade liberalisation, reduced tariffs, and export incentives to attract foreign direct investment (FDI). These economies prioritise competitiveness, technological innovation, and diversification of exports, integrating into global value chains to maximise growth.

For Pakistan, such a shift is critical. The country’s boom-bust cycles — exacerbated by external shocks like volatile oil prices and inconsistent foreign exchange reserves — cannot be mitigated without expanding its export base. Yet, transitioning from an import-substitution model to an export-driven one is no simple task, especially in today’s world of de-globalisation and rising protectionism.

Unfortunately, the global environment is becoming increasingly hostile to new entrants in export markets. Protectionist policies, trade wars, and regionalised supply chains make it difficult for countries like Pakistan to gain a foothold in international trade. For instance, the US-China trade war and rising tariffs in major economies present significant challenges to developing nations. Emerging economies such as Vietnam, Bangladesh, and India have already made substantial strides in establishing their global presence, creating tough competition for Pakistan.

Trade barriers remain one of the most formidable obstacles. As countries impose tariffs, non-tariff barriers and quotas to shield their domestic industries, Pakistani goods find it harder to compete on the global stage. Moreover, the trend toward regionalisation of supply chains — where companies move production closer to key markets — further complicates Pakistan’s efforts to integrate into these supply chains. To counter this, Pakistan needs to strengthen its trade diplomacy, build strategic partnerships, and significantly improve its logistics and infrastructure.

Adding to these challenges is currency volatility. Unstable exchange rates, coupled with rising inflation, push up production costs, making Pakistani exports less price competitive. Without addressing inflationary pressures and stabilising the rupee, Pakistan’s export ambitions will remain compromised.

Despite these challenges, Pakistan has significant opportunities to strengthen its export sector by focusing on sunrise industries — sectors with rapid growth potential that also align with global demand trends and Pakistan's comparative advantages.

One of the most promising sectors is information technology (IT). Global demand for IT services, such as software development, cloud computing, and artificial intelligence, is booming. Pakistan’s young, skilled, and affordable workforce gives it a competitive edge. By investing in IT infrastructure, expanding skill development programmes, creating a payment gateway and offering incentives, Pakistan can significantly enhance its IT exports, especially in business process outsourcing (BPO) and software development.

The textile industry, long a staple of Pakistan’s economy, also presents untapped potential in high-value and niche markets. Consumers worldwide are increasingly seeking sustainable, organic, wrinkle-free, and ethically sourced products. Pakistan’s textile sector can capitalize on this demand by transitioning to premium goods, focusing on key markets in Europe, North America, and East Asia. Investments in sustainable production methods, certifications, and branding will not only boost exports but also enhance Pakistan’s reputation as a supplier of quality textiles.

In agriculture, Pakistan can move beyond raw material exports to focus on value-added products. The global halal food market, valued at over $2 trillion, offers immense growth potential. As a Muslim-majority country, Pakistan is well-positioned to export halal-certified processed foods, dairy, and meat to rapidly growing markets in the Middle East, Southeast Asia, and Europe. Additionally, China’s food imports, which exceed $140 billion annually, offer a significant opportunity for Pakistan to leverage its agricultural strengths, especially through the China-Pakistan Economic Corridor (CPEC)’s second phase.

Pharmaceuticals is another sector ripe for export growth. The global demand for affordable healthcare products, including generic medicines and biopharmaceuticals, continues to rise. By upgrading production standards and focusing on export-oriented manufacturing, Pakistan can tap into this expanding market, particularly in developing countries seeking affordable healthcare solutions.

Finally, the renewable energy sector offers vast potential. As countries around the world are transitioning to green energy, the demand for solar panels, batteries, electrolysis equipment for hydrogen production and wind turbines is on the rise. Pakistan could position itself as a manufacturing hub for these renewable energy components, creating jobs domestically while exporting to energy-hungry regions.

Shifting from an import-substitution model to an export-driven economy is fraught with challenges, especially in today’s protectionist world. However, by focusing on key sunrise industries like IT, modern textiles, agriculture, pharmaceuticals, and renewable energy, Pakistan can navigate these complexities and emerge as a competitive global exporter.

To succeed, Pakistan must invest heavily in infrastructure, imparting skills to youth, promote innovation, and strengthen trade partnerships via trade diplomacy. By learning from the experiences of other export-driven economies and embracing the opportunities in these emerging sectors, the country can break free from its boom-bust cycle, stabilise its economy, and achieve sustainable, long-term growth, ultimately saying goodbye to the IMF forever.

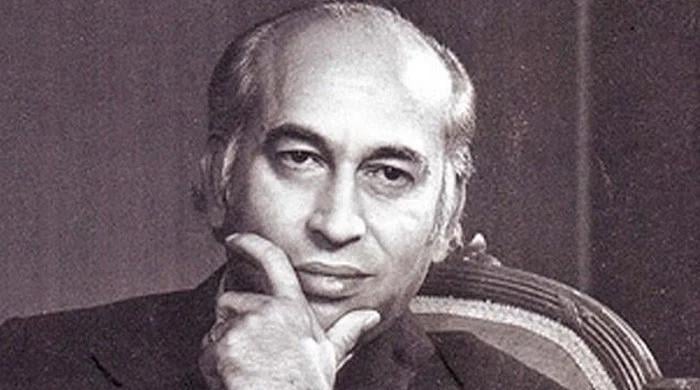

The writer is a professor at the Karachi School of Business & Leadership (KSBL) and former chief economist of Pakistan.

Disclaimer: The viewpoints expressed in this piece are the writer's own and don't necessarily reflect Geo.tv's editorial policy.

Originally published in The News