Hasan Nawaz Sharif's bankruptcy to end on April 29 next year

"There was no probe into any criminality because there was no fraudulent or criminal activity," says source

November 20, 2024

- HMRC refuses to share case details due to "confidentiality laws".

- Hasan asked to pay under £1 million but he refused: source

- Source says Hasan suffered financial losses after Brexit, COVID.

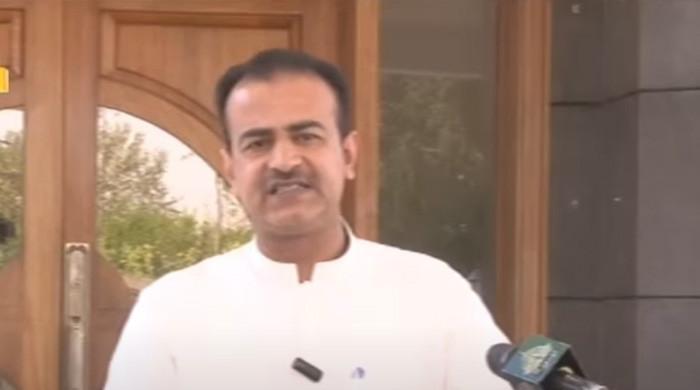

LONDON: Former prime minister Nawaz Sharif's son Hasan Nawaz Sharif’s bankruptcy will end on April 29 in 2025, according to Her Majesty’s Revenue and Customs (HMRC) which originally filed for his bankruptcy.

The automatic discharge will apply on April 29 next year exactly a year after Hasan was declared bankrupt at the Rolls Building in the London High Court’s Insolvency and Companies Court in a case of personal tax liabilities.

An HMRC spokesperson said it cannot share details of the case due to "confidentiality laws" but suggested that it decided to file the bankruptcy petition after exhausting all other options during their negotiations which stretched for over three years.

The spokesperson at the HMRC explained: "We take a supportive approach to dealing with customers who have tax debts and only file winding-up petitions once we’ve exhausted all other options, in order to protect taxpayers’ money."

Geo News has learnt from the sources that Hasan’s tax issue started with the HMRC around 2020. At that time, Pakistan Tehreek-e-Insaf (PTI) was in power in Pakistan.

Although, the PTI govt had nothing to do with the case, a credible source, who was part of the government then, told Geo News that the UK government sources had shared with Pakistan "it was looking into a tax-related matter of Hasan Nawaz".

Both sides engaged in lengthy correspondence over the tax liability issue of one of Hasan’s companies.

The source said the total amount HMRC asked Hasan to pay was under £1 million but he refused, maintaining that he was being asked to pay for the tax liability of a dormant company.

The exact amount involved couldn’t be verified but two sources said it was under £1 million. The same sources said Hasan maintained that he had suffered losses in his business after the Brexit and the COVID lockdown but the HMRC refused to accept the stance and finally the matter reached the court.

The HMRC took the case to the London High Court’s Insolvency Division on August 25, 2023. The bankruptcy petition was first heard by Judge Jones on December 4, 2023 at the Rolls Building. Completely unrelated to this case, the same judge who had made a decision in favour of MQM-Pakistan in Altaf Hussain’s properties case.

The second hearing occurred on February 26, 2024 before Chief Inspector and Companies Court Judge Briggs. The third hearing took place on April 29, 2024 before Judge Mullen — where the judge decided to make Hasan bankruptcy after his lawyers told the court he would file for personal bankruptcy.

Hasan's bankruptcy will end in under half a year but will show on all financial records for around six years and then it goes away.

He continues to be a director of a number of companies in the UK. UK’s Companies House record shows him as a Pakistani national.

Two companies previously run by him — Flagship Developments Limited and Harstone Properties Limited — have been dissolved. Hasan's currently active companies are Quint Paddington Limited, Quint Gloucester Place Limited, Flagship Securities Limited and Que Holdings Limited.

He did not respond to queries but a legal source familiar with the case said: "There was no probe into any criminality because there was no fraudulent or criminal activity and there was no money laundering. This was purely a civil dispute case."