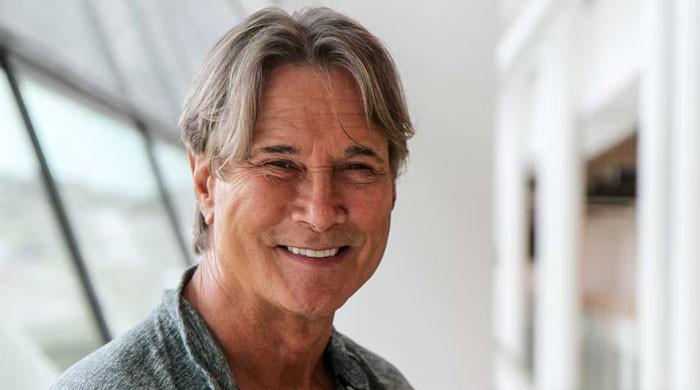

'Harry Potter' star Rupert Grint hit with £1.8m bill in tax ruling

'Harry Potter' star Rupert Grint loses appeal over £4.5 million earnings

November 30, 2024

Harry Potter star Rupert Grint has been ordered to pay £1.8 million in taxes after losing a legal dispute with HM Revenue & Customs (HMRC).

The actor, 36, was originally supposed to make the payment in 2019 when an HMRC investigation disputed one of his tax returns.

Per the HMRC probe, a £4.5 million payment he received in 2011-2012 should be taxed as regular income at a higher rate of 52%.

In response, Grint's legal team appealed, arguing that funds earned through a company managing his business rather qualify for a lower capital gains tax rate of 10%.

A tax tribunal judge, Harriet Morgan, has now ruled against Grint, concluding that the funds were earned from his acting work and counted as income.

Grint–who appeared in all eight Harry Potter films from 2001 until 2011–also faced a second tax-related legal loss in 2019 involving a £1 million tax refund.