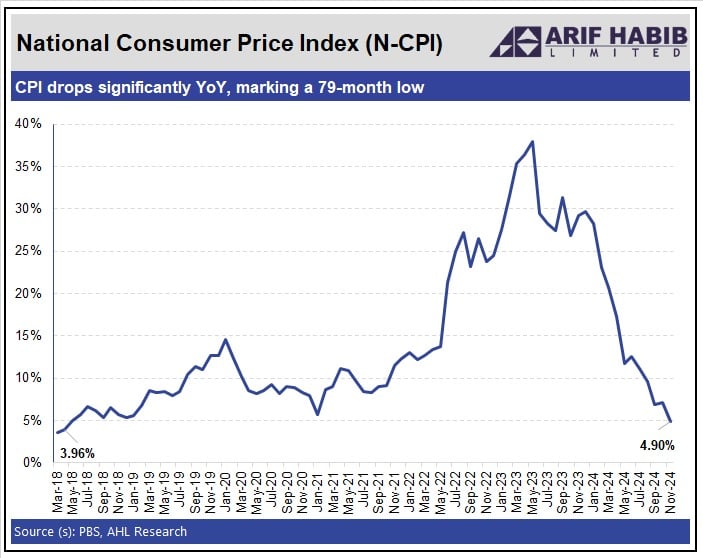

November inflation dips to 6.5-year low of 4.9%, beating official forecast

CPI-based inflation averaged 7.88% in July-Nov FY2025, sharply down from 28.62% last year

December 02, 2024

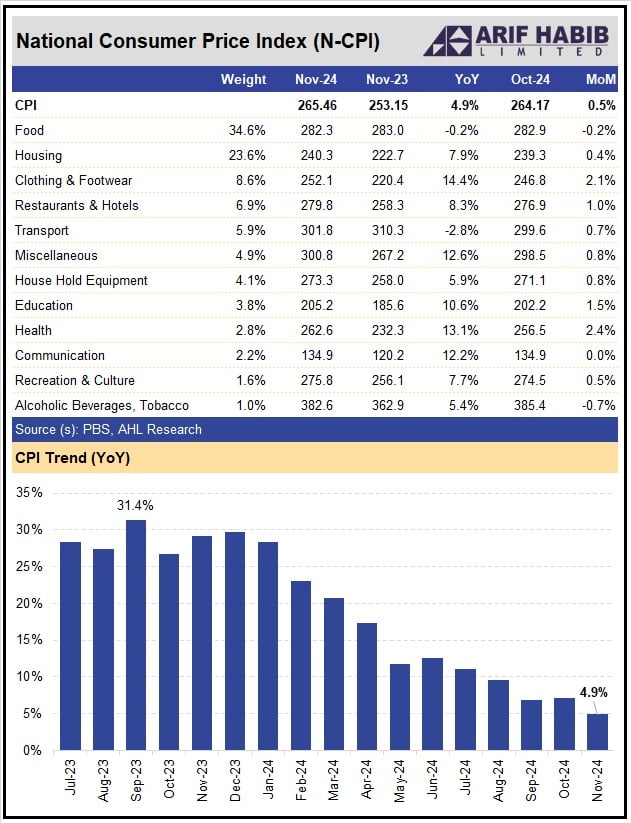

- November CPI-based inflation rose just 0.5% MoM.

- Reading way lower than finance division projection.

- Strengthens case for larger-than-expected cut rate.

Beating official forecasts, Pakistan's inflation slowed to 4.9% year-on-year in November 2024, down from 7.2% in October, marking its lowest level in six-and-a-half years, according to data released by the Pakistan Bureau of Statistics (PBS) on Monday.

On a month-on-month basis, the Consumer Price Index (CPI)-based inflation rose by 0.5% in November, compared to a 1.2% increase in October and a 2.7% rise in November 2023.

The average headline inflation during the first five months of FY2025 stood at 7.88%, sharply lower than 28.62% in the corresponding period of FY2024.

According to a report by Topline Securities, this marks the lowest inflation reading in 78 months — since April 2018.

The November reading also came in well below official forecasts, signalling a significant cooling in price pressures.

Last month, the finance ministry, in its monthly economic report, said inflation is projected to slow to 5.8%-6.8% in November, and then further to 5.6%-6.5% in December.

“Inflation is expected ... [to] further recede to 5.6% - 6.5% by December 2024,” said the Finance Division in its Monthly Economic Update and Outlook.

The State Bank of Pakistan (SBP) reduced interest rates by 250 basis points earlier in November in a bid to revive a sluggish economy amid a big drop in the rate of inflation.

The drop in inflation is expected to enable the central bank to maintain its monetary easing trajectory.

Since June, the SBP has slashed its benchmark interest rate by 700 basis points, bringing it down to 15% last month.

According to a Bloomberg survey, economists anticipate the key rate will decline further to 13.5% by the end of the current fiscal year in June 2025.

Inflation sharply dropped to 7.2% in October from a multi-decade high of nearly 40% in May 2023, while it was slightly higher than 6.9% in September 2024, as per PBS data.

The central bank had said that inflation may lose more steam in next few months owing to subdued demand and better food supplies. On the other hand, the International Monetary Fund has projected consumer price gains to average 9.5% in 2024.