PSX breaks 108,000 barrier as investors bet big on major rate cut

Strong liquidity, low inflation, optimism for rate cut drive market to new highs, says analyst

December 05, 2024

- PSX gains 3,134.63 points or 2.98% to close at 108,238.96.

- Analyst says several factors including rate cut driving market.

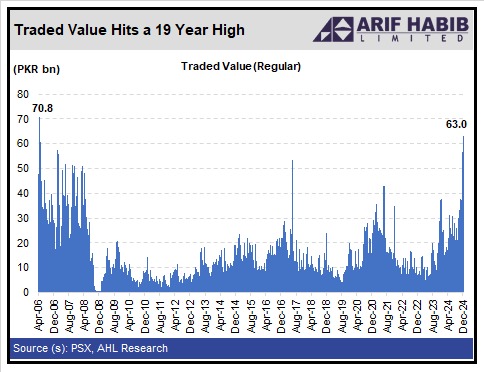

- PSX achieves its highest market activity in nearly 19 years.

The stock market continued its ascent to cross 108,000 points mark on Thursday, driven by a buying spree, growing anticipation of a substantial interest rate cut in the State Bank of Pakistan’s (SBP) upcoming monetary policy meeting on December 16, record-low inflation and strengthening economic indicators.

The Pakistan Stock Exchange's (PSX) benchmark KSE-100 Shares Index climbed 3,134.63 points, or 2.98%, to close at 108,238.96 points, after hitting an intraday high of 108,345.98 points.

“Strong liquidity, stable macro indicators, anticipated rate cut in December’s MPC, and perceived low political risk are all driving the market,” said Muhammad Saad Ali, Director of Research at Intermarket Securities Ltd. “Stock-specific news is also helping the bullish sentiment," he added.

The PSX added another milestone by achieving its highest market activity in nearly 19 years, with a traded value of Rs63 billion ($227 million). This marks the highest activity in the regular market since April 17, 2006, underscoring the strength of investor interest and liquidity.

Finance Minister Mohammad Aurangzeb has also reaffirmed the government’s dedication to economic stabilisation through structural reforms and adherence to the International Monetary Fund (IMF) programme.

Speaking at an event in Islamabad, Aurangzeb highlighted that the current account deficit has narrowed, inflation has dropped to a 70-month low, and the country’s economy is showing signs of recovery.

The Ministry of Finance also reported improved financial stability, attributing it to ongoing reforms.

As inflation continues to plummet expectations are rising for further monetary easing, signalling a brighter economic outlook.

The SBP has already slashed interest rates by 700 basis points (bps) across four consecutive meetings since June, bringing the rate to 15%. Experts widely anticipate another significant reduction, with most analysts predicting a cut of at least 200 bps.

A poll conducted by Topline Securities revealed that 71% of respondents expect a minimum reduction of 200 bps, with 63% forecasting exactly 200 bps, 30% expecting 250 bps, and 7% anticipating a larger cut.

The case for monetary easing is supported by November’s Consumer Price Index (CPI) inflation, which clocked in at 4.9%—its lowest in 78 months and well below the SBP’s target range of 5-7%.

“This reading places inflation significantly below the target, leaving substantial room for further rate cuts,” Topline Securities noted.

The decline in inflation is attributed to faster food disinflation and negative electricity price adjustments. Analysts predict inflation will remain in single digits in the coming months, maintaining a favorable environment for monetary easing.

The trade data released by the Pakistan Bureau of Statistics (PBS) has further bolstered market sentiment. Pakistan’s trade deficit narrowed by 7.39% during the first five months (July-November) of the current fiscal year, standing at $8.651 billion compared to $9.341 billion during the same period last year.

Exports rose by 12.57% to $13.69 billion, while imports increased by 3.90% to $22.342 billion. November’s trade deficit narrowed even further, dropping 18.60% year-on-year to $1.589 billion compared to $1.952 billion in November 2023.

Thursday's rally follows an impressive session on Wednesday, when the KSE-100 Shares Index climbed 545.26 points, or 0.52%, to close at 105,104.33 points after reaching an intra-day high of 105,473.56 points