KSE-100 soars 84% in CY24, ends last trading session with drop of 132 points

On last trading session of 2024, stocks closed with slight decline of 132 points amid year-end institutional profit-taking

December 31, 2024

- PSX's KSE-100 index decreased by 0.11% in last session of 2024.

- Analyst sees security unrest, foreign outflows behind bearish trend.

- During CY24, KSE-All saw growth of 61%, concluding at Rs14.6tr.

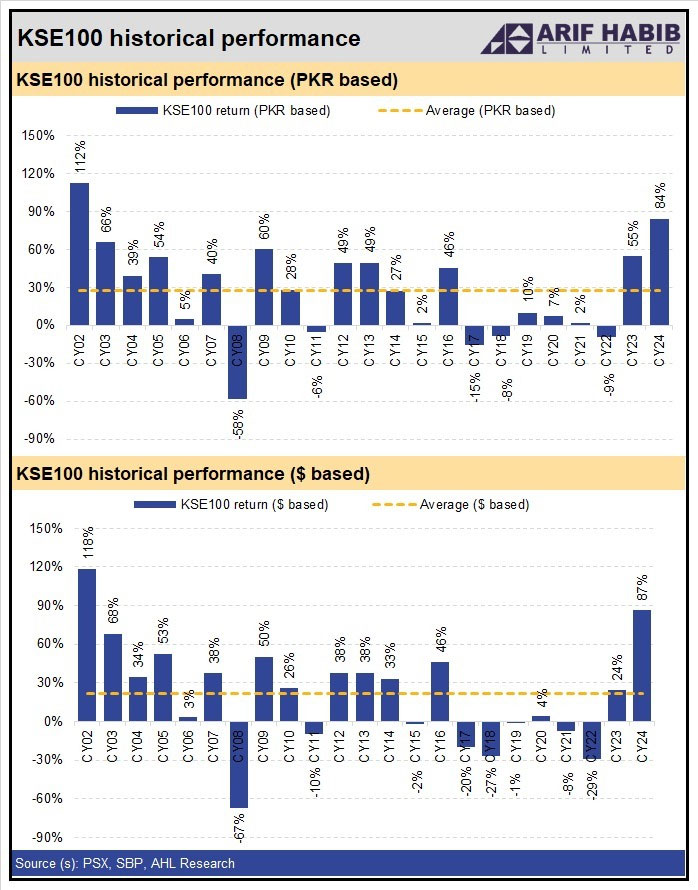

KARACHI: The KSE-100 index surged 84% in CY24, ending the year at 115,127 points. This marks the highest return since CY02 when the index posted a staggering 112% gain.

On the last trading session of 2024, stocks stumbled a little and closed with a slight decline of 132 points amid year-end institutional profit-taking.

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 index decreased by 0.11% to 115,126.9 points against 115,259 points recorded in the last session. The highest index of the day remained at 116,700.02 points, while the lowest level was recorded at 114,804.81 points.

Ahsan Mehanti, an analyst at Arif Habib Corp, said, “Stocks closed under pressure at the year-end close on institutional profit-taking in over-bought scrips.”

He said that a slump in global equities, subdued economic growth at 0.92% for July-September 2024, security unrest in Karachi and foreign outflows played a catalyst role in the bearish activity.

The KSE-30 index decreased by 117.50 points or 0.32% to 36,182.41 points against 36,299.91 points.

According to a report by foreign outlet Bloomberg, the KSE-100’s 84% rise makes the index the second-best performer in local currency terms among the more than 90 tracked globally by Bloomberg.

Country watchers expect the boom to continue next year, bolstered by likely more cuts in borrowing costs and easing inflation, while a loan programme from the International Monetary Fund helps to stabilise the economy. The country’s economy expanded more slowly than expected last quarter, but has broadly recovered from 2023 when it narrowly escaped a default, the report said.

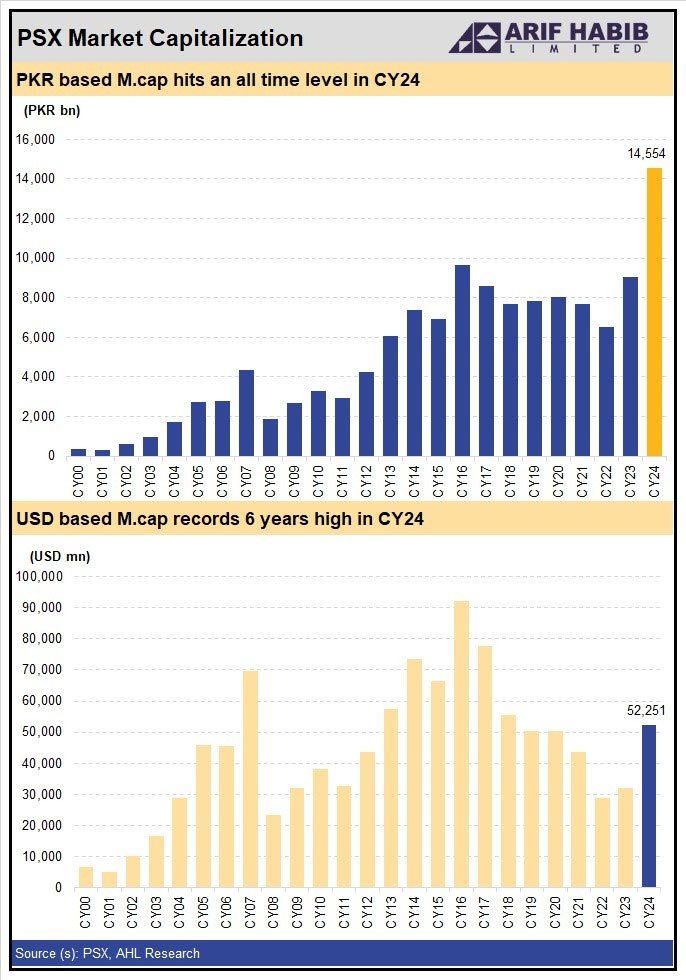

According to brokerage firm Arif Habib Limited, during CY24, the KSEAll market capitalisation experienced a growth of 61%, concluding at Rs14.6 trillion, marking the highest-ever closing on CY basis.

It said, on December 16, market capitalisation peaked at an all-time high of Rs14.8 trillion. In terms of USD, market capitalisation closed at a six-year high of $52.3 billion, reflecting a 63% increase during the year.

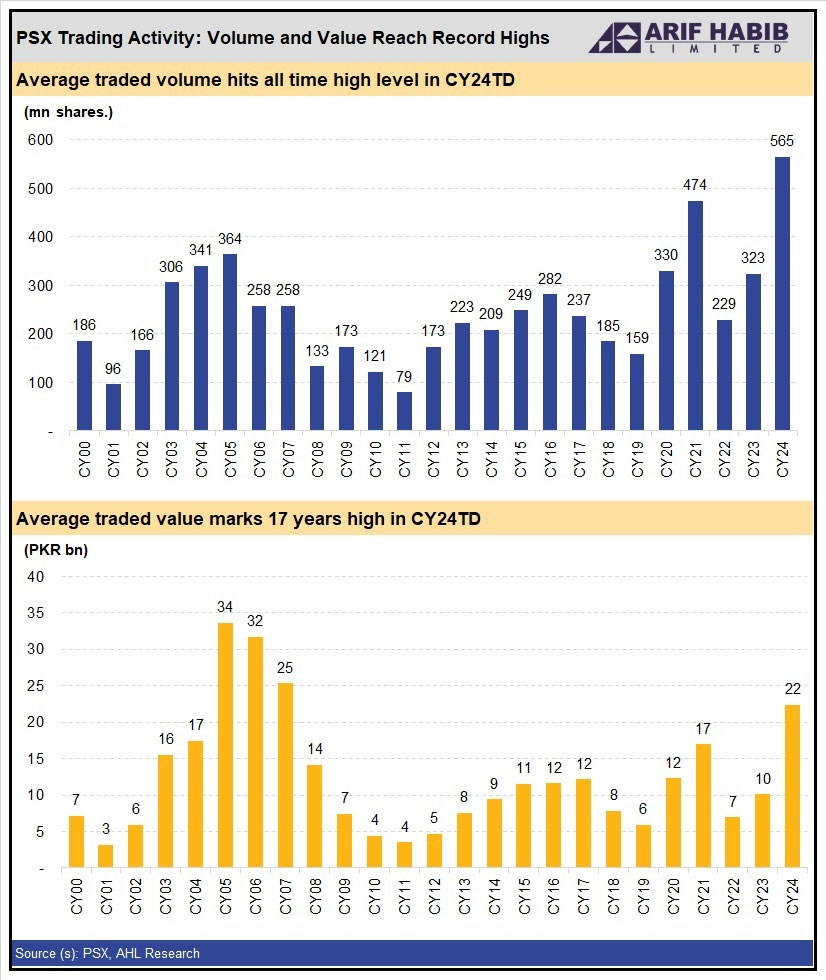

Overall, activity on the PSX remained robust throughout the year, the brokerage firm said, “with the average trading volume reaching an unprecedented level of 565 million shares”.

The average traded value was notably elevated at Rs22 billion, marking the highest average since CY07, when it stood at Rs25 billion, it further added.

On the last trading session, traded shares increased by 177 million shares to 1,236.873 million shares from 1,059.02 million shares. The trading value rose to Rs44.218 billion from Rs40.889 billion. Market capital narrowed to Rs14.495 trillion against Rs14.558 trillion. Of the 465 companies active in the session, 235 closed in green, 188 in red and 42 remained unchanged.

The highest increase was recorded in Bata Pakistan Limited, which rose by Rs104.48 to Rs2,018.85 per share, followed by Unilever Pakistan Foods Limited, which increased by Rs91.16 to Rs21,225.03 per share. A significant decline was noted in Haleon Pakistan Limited, which fell by Rs52.25 to Rs807.67 per share; Shahmurad Sugar Mills Limited followed it, which closed lower by Rs47.31 to Rs425.82 per share.

As the market heads into 2025, historical data indicates a 4% average return in January over the past 10 years. Investors remain optimistic about continued growth, driven by improved macroeconomic indicators, positive corporate earnings, and further foreign inflows.

With an 88% annual gain in USD terms, the PSX cemented its position as one of the world’s best-performing markets in 2024, reflecting resilience despite global economic headwinds and local challenges.

The outlook for the KSE-100 remains positive as the market enters the new year, supported by strong fundamentals, anticipated liquidity flows and government-led reforms.

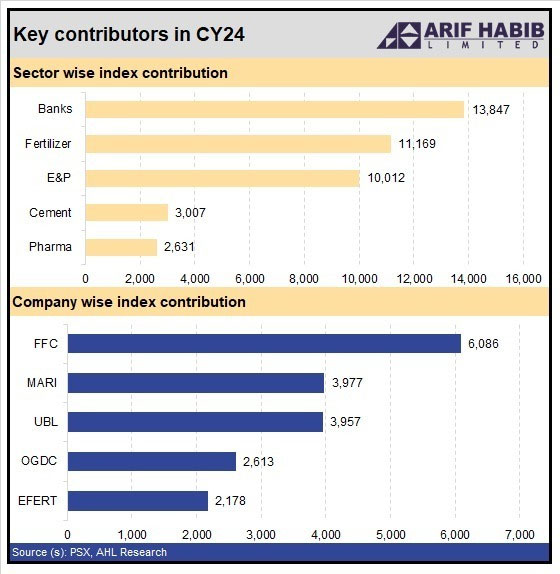

In the final trading session, key contributors to index gains included PPL (+2.3%), UBL (+1.03% ), and HBL (+1.7%). However, FFC (-1.51%), MCB (-2.1%), and BAFL (-2.1%) emerged as the largest drags on the index.

Cnergyico PK remained the volume leader with 213.352 million shares, which closed higher by 41 paisas to Rs7.85 per share. Pace (Pak) Ltd, with 66.219 million shares, followed it, which closed higher by 76 paisas to Rs8.09 per share.

Other significant turnover stocks included WorldCall Telecom, BO Punjab, Fauji Foods Ltd, Pak Refinery, K-Electric Ltd., Telecard Limited, Pak Elektron and Pak Int Bulk.

In the futures market, 298 companies recorded trading, 163 of which increased and 132 decreased and 3 remained unchanged.