Weekly inflation witnesses marginal decline

Tomato prices dropped by 13.48%, followed by reductions in power charges for Q1 (7.48%) and potatoes by 5.59%

January 03, 2025

KARACHI: Pakistan’s short-term inflation, measured by the Sensitive Price Indicator (SPI), saw a marginal decline of 0.26% for the week ending January 2, 2025, according to data released by the Pakistan Bureau of Statistics (PBS) on Friday.

Year-on-year inflation for the same week recorded a 3.97% increase, reflecting persistent price pressures despite the weekly decline.

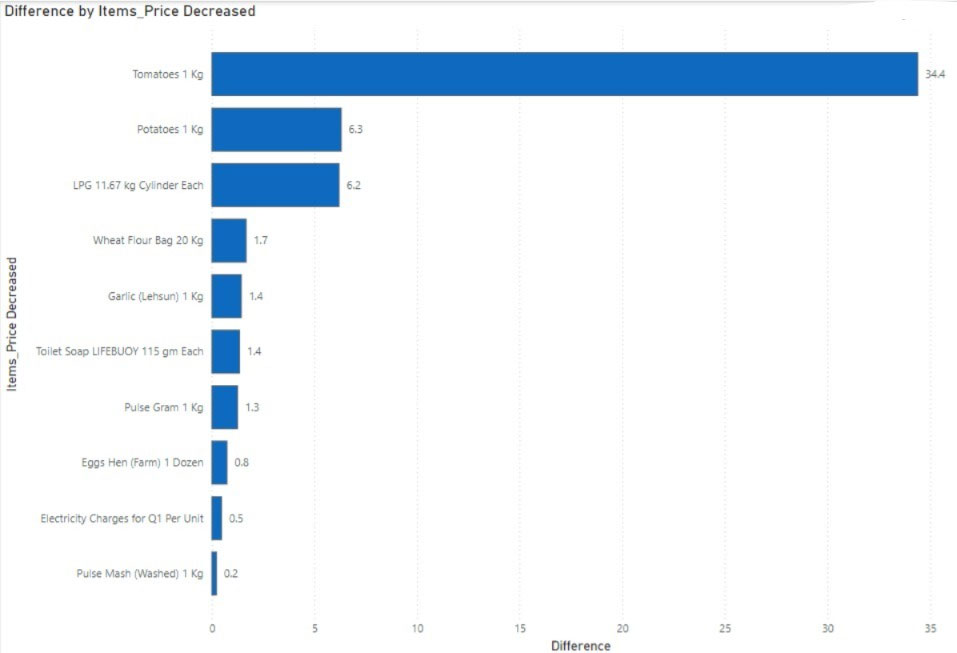

Among food items, tomato prices dropped significantly by 13.48%, followed by reductions in electricity charges for Q1 (7.48%), potatoes (5.59%), and several pulses, including gram (-0.34%) and mash (-0.05%). Marginal declines were also noted in the prices of eggs (-0.23%), garlic (-0.21%), LPG (-0.18%) and wheat flour (-0.09%).

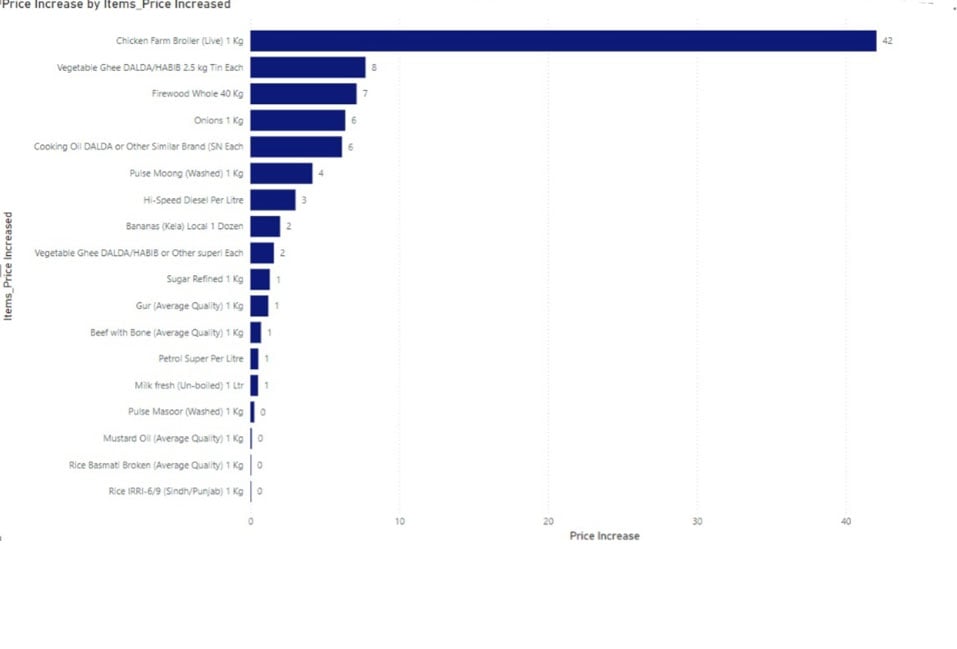

Conversely, chicken prices surged by 10.28%, marking the highest weekly increase, followed by onions (4.93%), bananas (1.68%) and diesel (1.18%). Other notable hikes included sugar (0.95%), pulse moong (1.08%) and vegetable ghee in 2.5kg and 1kg packs (up 0.53%and 0.28%, respectively).

Of the 51 essential items monitored, prices for 18 items (35.29%) increased, 10 items (19.61%) decreased, and 23 items (45.1%) remained stable.

Year-on-year data revealed tomatoes as the largest contributor to inflation, with a 77.84% price increase, followed by significant hikes in potatoes (66.63%), pulse gram (47.53%), and ladies’ sandals (75.09%). However, substantial relief was observed in the prices of wheat flour (-36.12%), onions (-29.95%), and eggs (-15.78%).

The inflationary impact varied across income groups, with the lowest quintile (monthly income up to Rs17,732) experiencing a 0.51% weekly decrease, while the highest income group (monthly income above Rs44,175) recorded a modest 0.10% decline.

The data underscores mixed trends in essential commodity prices, reflecting the interplay of seasonal factors, supply chain dynamics and policy measures aimed at stabilising inflation.

According to data released on Wednesday, Pakistan’s inflation rate cooled down to 4.07% in December 2024 from 4.86% in November and a dramatic drop from 29.66% a year earlier. This marked the lowest inflation rate in nearly seven years and the fifth straight month of single-digit inflation — a milestone last achieved in early 2021.

The first half of FY2024-25 (July-December) saw average inflation plummet to 7.22%, a stark contrast to 28.79% during the same period last year, according to the PBS.

Economists cite stable commodity markets, improved supply chains, and a relatively steady rupee as driving factors, though they also credit a “base effect” from last year’s high inflation rates.