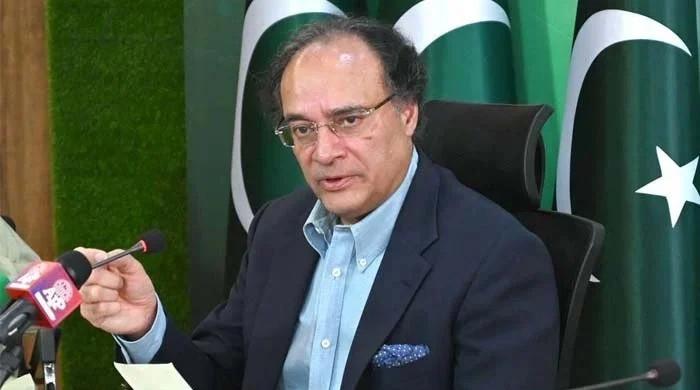

SBP governor predicts inflation to fall in January, fluctuate in coming months

Jameel describes current account situation as positive because it has shown notable improvements

January 10, 2025

- SBP chief expresses hope about economy’s further stability.

- Jameel says SBP dedicated to meeting its inflation goals.

- He stresses on the importance of boosting exports.

KARACHI: Inflation may drop more this month, however, it may fluctuate in the months to follow, State Bank of Pakistan (SBP) Governor Jameel Ahmad said on Thursday.

Speaking at the Federation of Pakistan Chambers of Commerce & Industry (FPCCI), the SBP governor expressed the hope about the economy’s further stability and apprised the forum that the country’s balance of payments and debt level was contained and economic targets were being achieved, The News reported.

He discussed the notable decline in inflation, which fell to 4.1% in December 2024 from an astounding 38% earlier in the year.

Jameel said the central bank is still dedicated to meeting its inflation goals, which should result in sustained economic stability. He did, however, warn that inflationary volatility may present short-term difficulties for consumers and businesses.

The SBP governor described the current account situation as positive because it has shown notable improvements as a result of increased exports and remittances.

While acknowledging the growth in remittances, which are projected to comfortably reach $35 billion by the fiscal year end, he stressed the importance of boosting exports to ensure sustainable economic stability. Without a consistent rise in export volumes, the country might continue to face challenges in managing its current account and balance of payments.

About the foreign debt, the SBP governor revealed that Pakistan’s external debt remained stable, standing at $100.8 billion as of September 2024, with the marginal increase attributed to revaluation adjustments. He noted that the biggest challenge faced by the authorities was the balance of payments; however, he said the country had enough dollars to meet external demands.

He pointed out that the issue of balance of payments rises “when we exceed growth by 4% and we don’t have the foreign exchange component capacity to meet that, then growth becomes unsustainable. “Growth should be sustainable because if it’s not sustainable, we will be back to square one,” he said, highlighting that exports would need to be increased to make growth sustainable.

On the business side, the SBP chief hoped business confidence would improve and foreign direct investment would follow once the economy improved.