SBP cuts key policy rate by 100bps to 12% on tame inflation

All actions required by IMF have been taken; fund review expected to proceed as planned, says SBP governor

January 27, 2025

- Central bank has been reducing interest rates since June 2024.

- Inflation expected to come down further in Jan before going up.

- Pakistan's economy grew by 0.92% in first quarter of fiscal year.

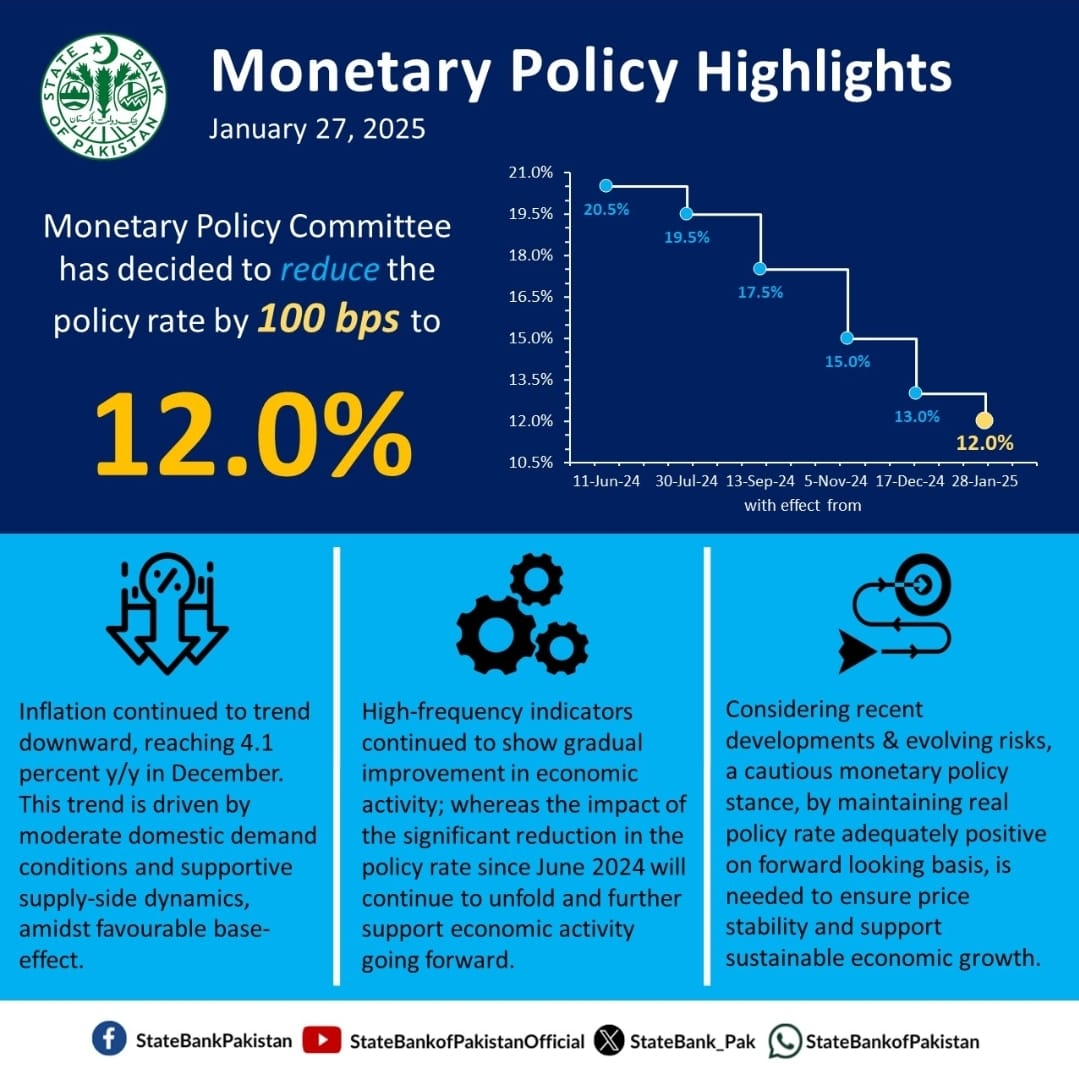

The State Bank of Pakistan (SBP) cut its key policy rate by 100 basis points to 12% on Monday, central bank governor Jameel Ahmed told reporters, for a sixth straight reduction since June as the country attempts to revive business and economic sentiment amid easing inflation.

The bank's governor said at a press conference that the inflation rate would ease further in January but noted core inflation remained elevated, adding that the forecast for full-year inflation in the year to June was an average of 5.5%-7.5%.

"Considering these developments and evolving risks, the committee viewed that a cautious monetary policy stance is needed to ensure price stability, which is essential for sustainable economic growth," the bank's Monetary Policy Committee (MPC) said in a statement accompanying the decision.

"In this regard, the MPC assessed that the real policy rate needs to remain adequately positive on a forward-looking basis to stabilise inflation in the target range of 5–7%," the statement said.

The central bank has been reducing interest rates since June 2024, slashing a total of 1,000 basis points from the record high of 22%.

This marks one of the most aggressive rate-cutting campaigns among emerging markets, surpassing the 625 basis points cut during the COVID-19 pandemic in 2020.

Significant reduction

The committee said the impact of this significant reduction in the rate since June 2024 will continue to unfold and further support economic activity.

The inflation continued to trend downward in line with expectations, reaching 4.1% year-on-year in December, the committee noted.

"This trend is driven by moderate domestic demand conditions and supportive supply-side dynamics, amidst favorable base effect," the SBP said in its statement.

Consumer inflation rate slowed to an over 6-1/2-year low of 4.1% in December, largely due to a high year-ago base.

That was below the government's forecast and significantly lower than a multi-decade high of around 40% in May 2023.

"At the same time, high frequency indicators continued to show gradual improvement in economic activity," it added.

GDP growth forecast

The governor said the bank maintained its forecast of full-year GDP growth at 2.5%-3.5% and said economic growth would pick up in the next six months, which would help boost the country's previously struggling foreign exchange reserves.

"The improved current account outlook, along with the expected realisation of planned financial inflows, is likely to increase the SBP's foreign exchange reserves beyond $13 billion by June 2025," the bank's statement said.

However the SBP also highlighted several risks for inflation, including protectionist policies by "major economies".

United States President Donald Trump has said he is considering imposing tariffs on goods from several countries.

IMF and debt servicing

To a question, the governor said all actions required by the International Monetary Fund (IMF) from the central bank's side have already been taken and they are confident that the Fund's review will go as planned.

SBP governor also mentioned that $7.3 billion in debt repayments had already been rolled over this fiscal year to date and emphasised that any further changes in policy would not have a major impact on the government's debt servicing.

Responding to another query, he also ruled out any concern about the exchange rate for now.

Ahmed stated that once the InvestPak platform is launched, the general public and corporate firms will be able to buy government securities directly.

Pakistan's economy grew by 0.92% in the first quarter of the fiscal year 2024-25 which ends in June, according to data approved by the National Accounts Committee, and released by its Statistics Bureau in December.

The committee noted: "First, real GDP growth in Q1-FY25 turned out slightly lower than the MPC’s earlier expectations. Second, the current account remained in surplus in December 2024, though the SBP’s foreign exchange reserves declined amidst low financial inflows and high debt repayments."

"Third, despite a substantial increase in December, tax revenues remained below target in H1-FY25. Fourth, global oil prices have exhibited heightened volatility over the past few weeks.

"And lastly, the global economic policy environment has become more uncertain, prompting central banks to adopt a cautious approach," the statement said.