Fact-check: Punjab govt rolls out new taxes on agricultural income

Taxes for irrigated areas have remained unchanged in the province, however tax rates for income have been hiked up considerably by amendments to law

A screenshot circulating in WhatsApp groups in Pakistan claims that the Punjab government has rolled out a new set of taxes on agricultural income, with rates ranging from 15% to 45%. This claim has prompted questions regarding its authenticity.

The claim is true, but it must be read with proper context.

Claim

The message circulating in WhatsApp groups reads: “As per new amendments to the law, a 15% tax will be imposed on the annual agricultural income of Rs. 12 lacs in Punjab.”

A similar claim was also shared on Facebook on March 12: “In Punjab, a tax of up to 45% has been imposed on farmers.” The post further claims that farmers earning up to Rs. 600,000 annually will be exempt from taxes, while those earning Rs. 1,200,000 will be taxed at 15% of their total income.

Fact

Official documents from the Punjab Board of Revenue, obtained by Geo Fact Check, confirm that taxes on agricultural income have indeed increased following amendments to the Punjab Agricultural Income Tax Act of 1997 in November 2024.

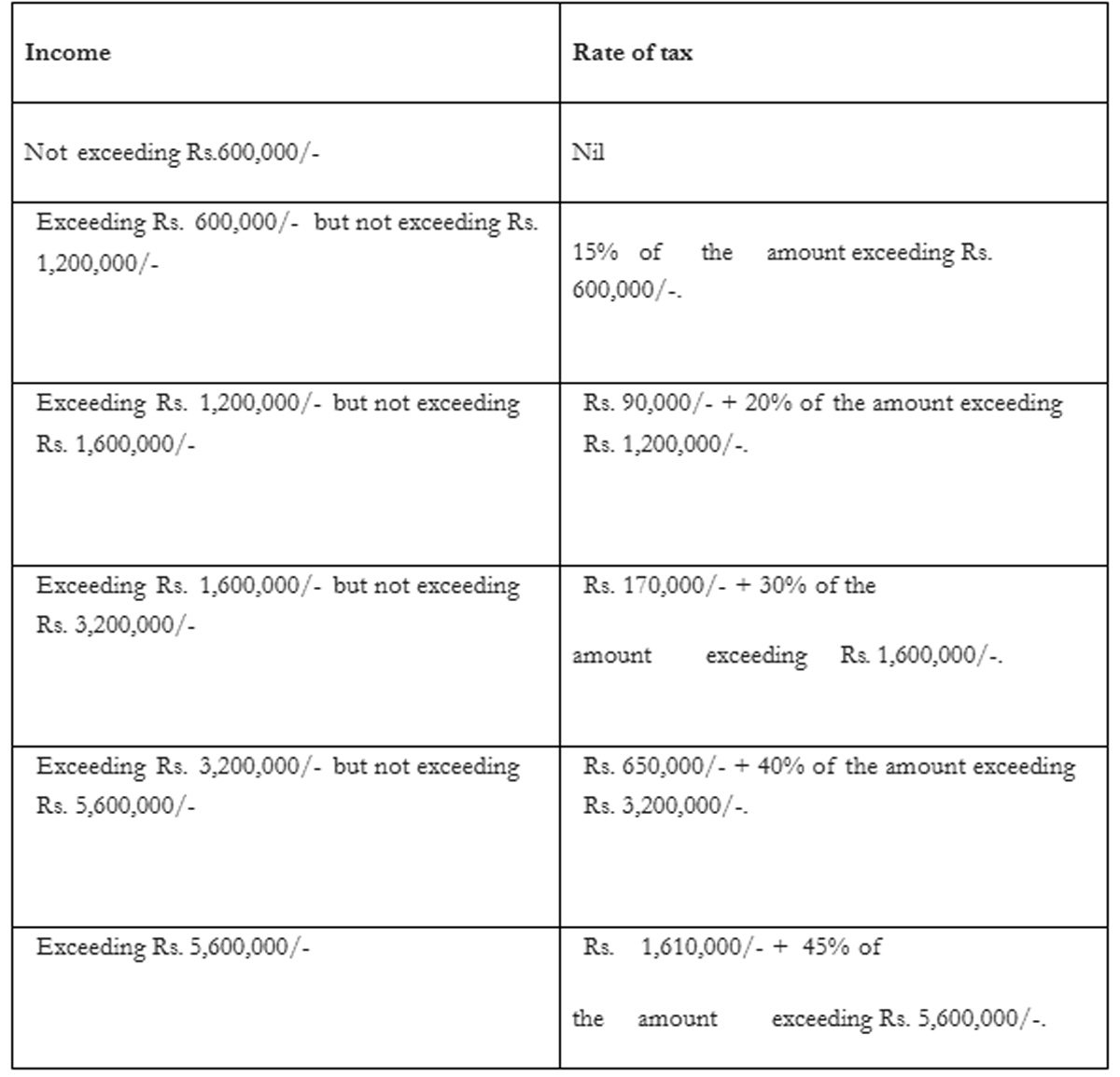

According to Mazhar Hussain, the public relations officer at the Board of Revenue in Lahore, a new tax structure based on cultivated land and farmers' income has been implemented. As per the document, no tax will be imposed on agriculture income of less than Rs600,000 per year. While income between Rs600,000-Rs1,200,000, will have to pay a tax of 15% of the amount exceeding Rs600,000.

For those who have income exceeding Rs5,600,000 will have to pay Rs1,610,000 plus 45% tax on the amount exceeding Rs5,600,000.

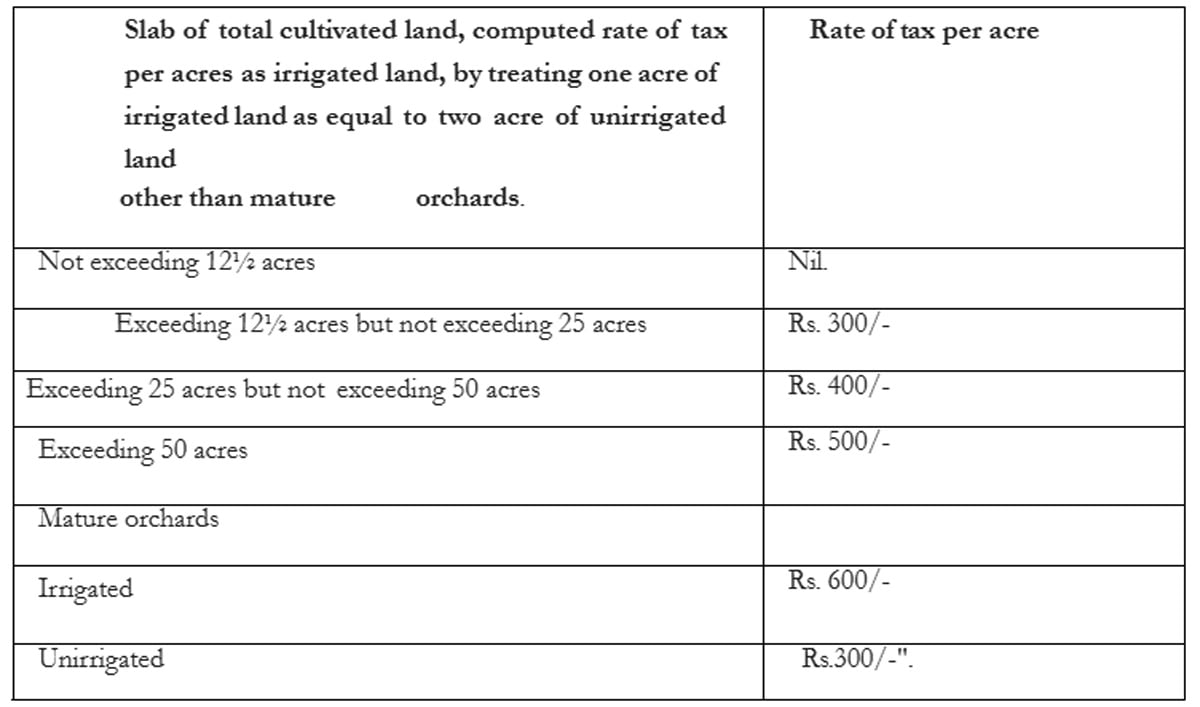

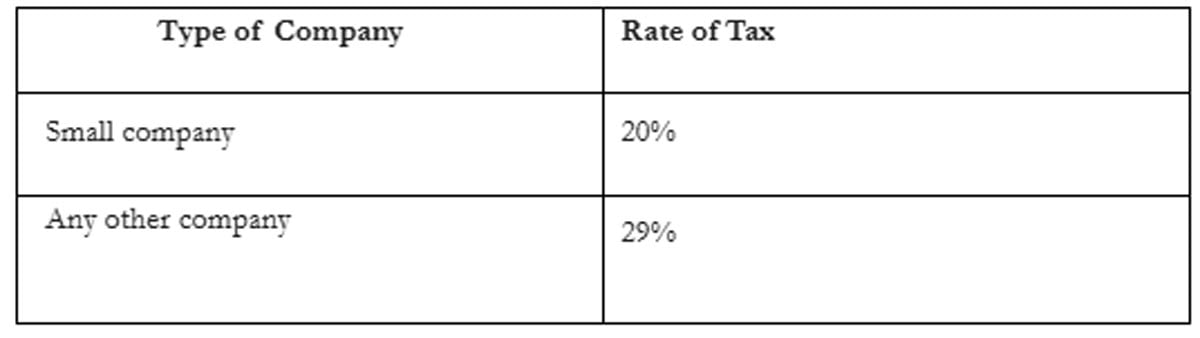

Below is a detailed breakdown of the taxes farmers will now have to pay in the province based on their cultivated land or their income.

Land-based taxes on the sown area.

Tax on agricultural income of farmers

Tax on agricultural income for corporate farming

The taxes for irrigated areas have remained unchanged in the province, however tax rates for income have been hiked up considerably by amendments to the law. The previous tax slabs can be read in this fact check.

Verdict: The claim is true. Taxes on agricultural income have indeed been increased for farmers in Punjab following changes to the law.

Follow us on @GeoFactCheck on X (Twitter) and @geo_factcheck on Instagram. If our readers detect any errors, we encourage them to contact us at [email protected]