Inflation to hover between 1-1.5% in March as inflationary pressures ease

Finance Division's report predicts CPI to increase to 2-3% in April; underscore drop in food, energy prices

March 25, 2025

- Finance Division's report link food, energy prices to inflation drop.

- "Fiscal consolidation measures are yielding tangible results," it says.

- Highlights economy's resilience, stability on fiscal, external fronts.

ISLAMABAD: Continuing its steady trend, Pakistan's Consumer Price Index (CPI)-based inflation is anticipated to hover between 1-1.5% in March 2025 courtesy of ease in inflationary pressures.

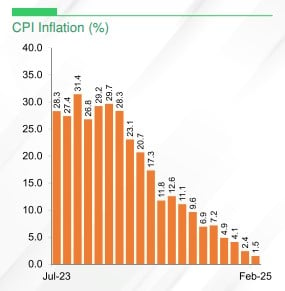

As per the statistics released by Finance Divisions in its "Economic Update and Outlook March 2025" report, the CPI inflation was recorded at 1.5% on YoY basis in February 2025 compared to 2.4% in the previous month and 23.1% in February 2024.

On MoM basis, it decreased by 0.8% as compared to an increase of 0.2% in the previous month. However, the key indicator is likely to witness an increase and is expected to hover around 2-3% in April.

Highlighting that the country's economy was demonstrating resilience and stability on fiscal and external fronts, the report highlighted that inflationary pressures have eased, supported by declining food and energy prices, fostering overall price stability.

"Fiscal consolidation measures are yielding tangible results, leading to a primary surplus and a narrowed fiscal deficit," it said.

Linking the decline in food and energy prices to the drop in inflation, the report said that major drivers contributing to the YoY increase in CPI include health (14.3%), clothing and footwear (13.8%), education (10.9%), restaurants and hotel (7.6%), alcoholic beverage and tobacco (6.7%), furnishing and household equipment maintenance (4.5%), and communication (0.1%).

Meanwhile, a decline was observed in perishable food items (20.3%), non-perishable food items (1.5%), transport (1.1%) and housing, water, electricity, gas and fuels (0.6%).

In its report, brokerage firm Topline Securities estimates that the country's CPI for the ongoing month is expected to decline to a three-decade low, registering between 0.5% and 1% YoY with a monthly increase of 0.9%.

If so, this would bring the average inflation for the first nine months of FY25 to 5.38%, a sharp drop from 27.06% recorded in the same period last year.

The Prime Minister Shehbaz Sharif-led government has said its $350 billion economy has stabilised under a $7 billion International Monetary Fund (IMF) bailout that had helped it prevent a default threat.

Islamabad is awaiting an IMF agreement on the first review of the bailout, which, if approved, will disburse $1 billion ahead of the country's annual budget, usually presented in June.

Inflation in the South Asian country has been declining for several months after it soared to around 40% in May 2023.

An increase in exports and remittances is also lifting Pakistan's external financing requirements, which are already being supported by the IMF bailout and rollovers of bilateral loans from friendly countries, the report said.

Remittances are likely to increase further due to seasonal factors, such as the holy month of Ramadan, and the Eid ul Fitr which follows when Pakistani workers abroad typically send extra money to families back home.

— Additional input from Reuters