Explainer: What's in a tariff? A quick guide to the terms driving the trade war

Trump's "Make Tariffs Great Again" crusade sparks a flood of economic jargon, leaving many scratching their heads

April 11, 2025

As Trump-led Washington declared an unprovoked trade war on the world, weaponising the tariffs, global markets turned into a financial Pearl Harbour — if not 9/11.

The deadly chain reaction of losses that wiped billions from the markets has only just begun — you better buckle up because more shocks are in store as the conflict goes full-scale.

All of it followed US President Donald Trump’s 'Make Tariffs Great Again' (MATA) crusade, unleashing a flurry of economic terms that made headlines and left the uninitiated, noneconomic types, scratching their heads in wonder.

Here’s a plain-language guide to what they mean and why they matter.

Tariff

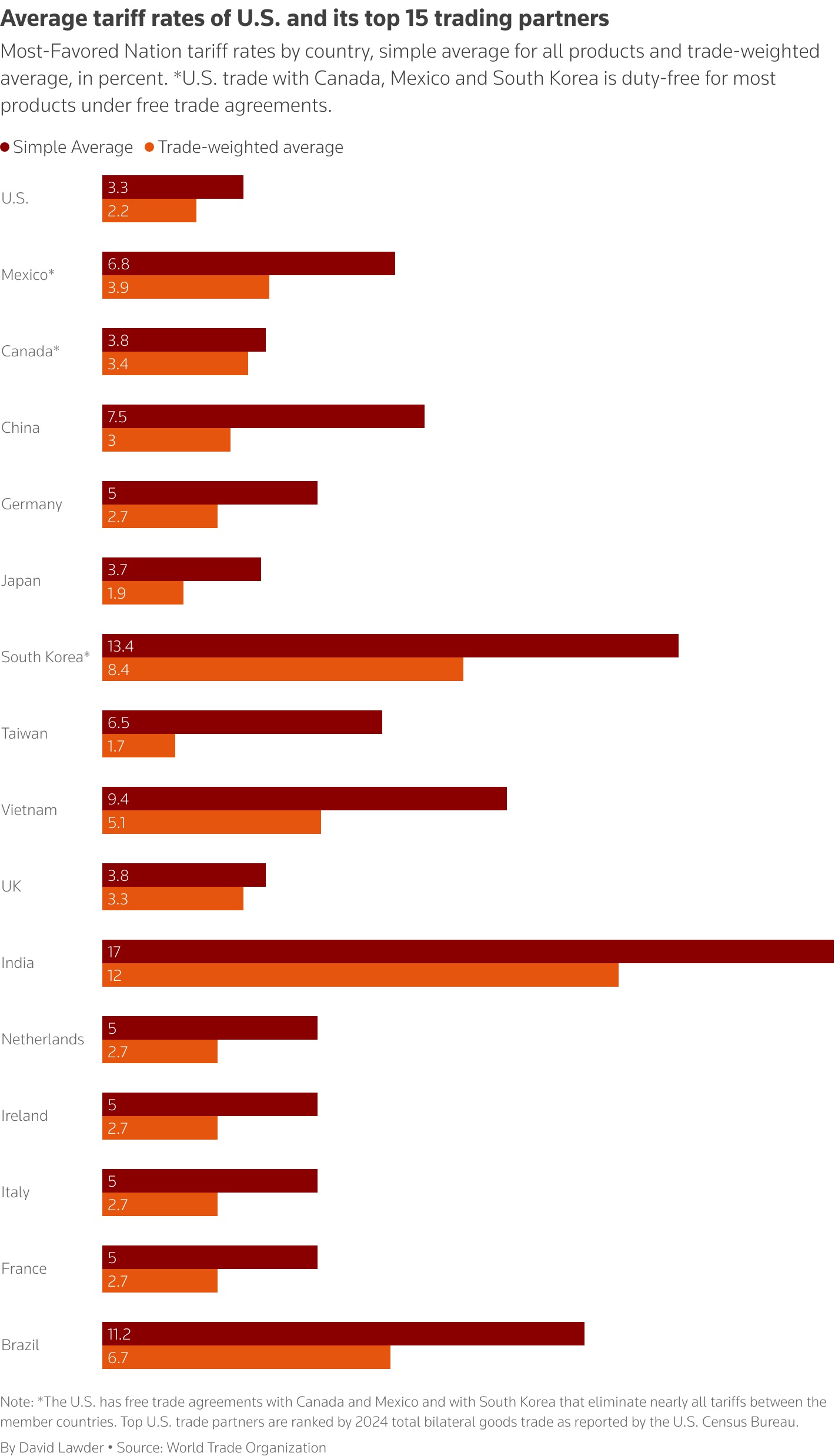

This term is all the rage these days. It’s a regular customer of the global trade and has always been around. By definition, tariffs are border taxes on imports, imposed specifically to protect a country’s uncompetitive local industries.

Under Trump, reciprocal or bluntly put tit-for-tat tariffs meant matching foreign tariffs with identical US ones — essentially “you tax us, we’ll tax you.” Retaliatory tariffs are payback tariffs: if one country imposes tariffs, the other responds in kind.

Trade war

A trade war happens when countries slap tariffs on each other in a tit-for-tat over unfair practices. It’s an economic tug-of-war. The US-China trade war is a key example — since 2018, tariffs have escalated, with some reaching 145%.

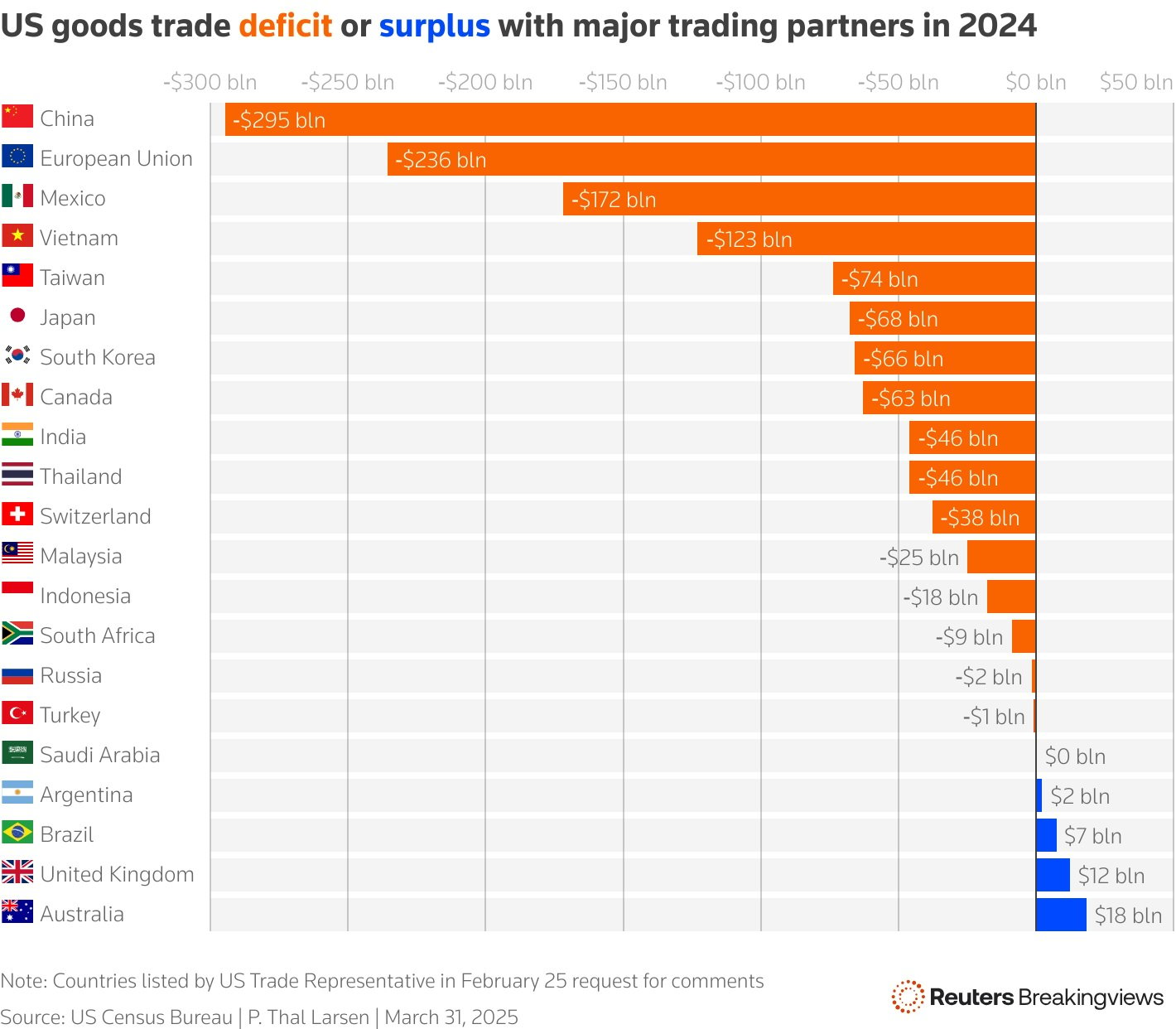

Trade deficit and surplus

A trade deficit means a country imports more than it exports — like the US with China, where it buys more than it sells. A surplus is the opposite: The US sells more to the Netherlands than it imports, creating a trade surplus.

Subsidies

Governments give subsidies to help industries compete. For example, after Trump’s 25% tariff on foreign cars, South Korea boosted electric vehicle subsidies to protect its auto sector.

Stock market

The stock market is where company shares are traded. If you own Amazon stock, its price changes can mean gains or losses.

Key indices:

- S&P 500 (top 500 firms)

- Nasdaq (tech-heavy)

- Dow Jones (30 major firms)

The Fed

The Federal Reserve (the Fed) is the US central bank. It controls the money supply, adjusts interest rates, and keeps the economy steady.

Interest rates

These are the costs of borrowing. Higher rates = more expensive loans. Lower rates = cheaper borrowing. Central banks raise rates to slow inflation or cool the economy.

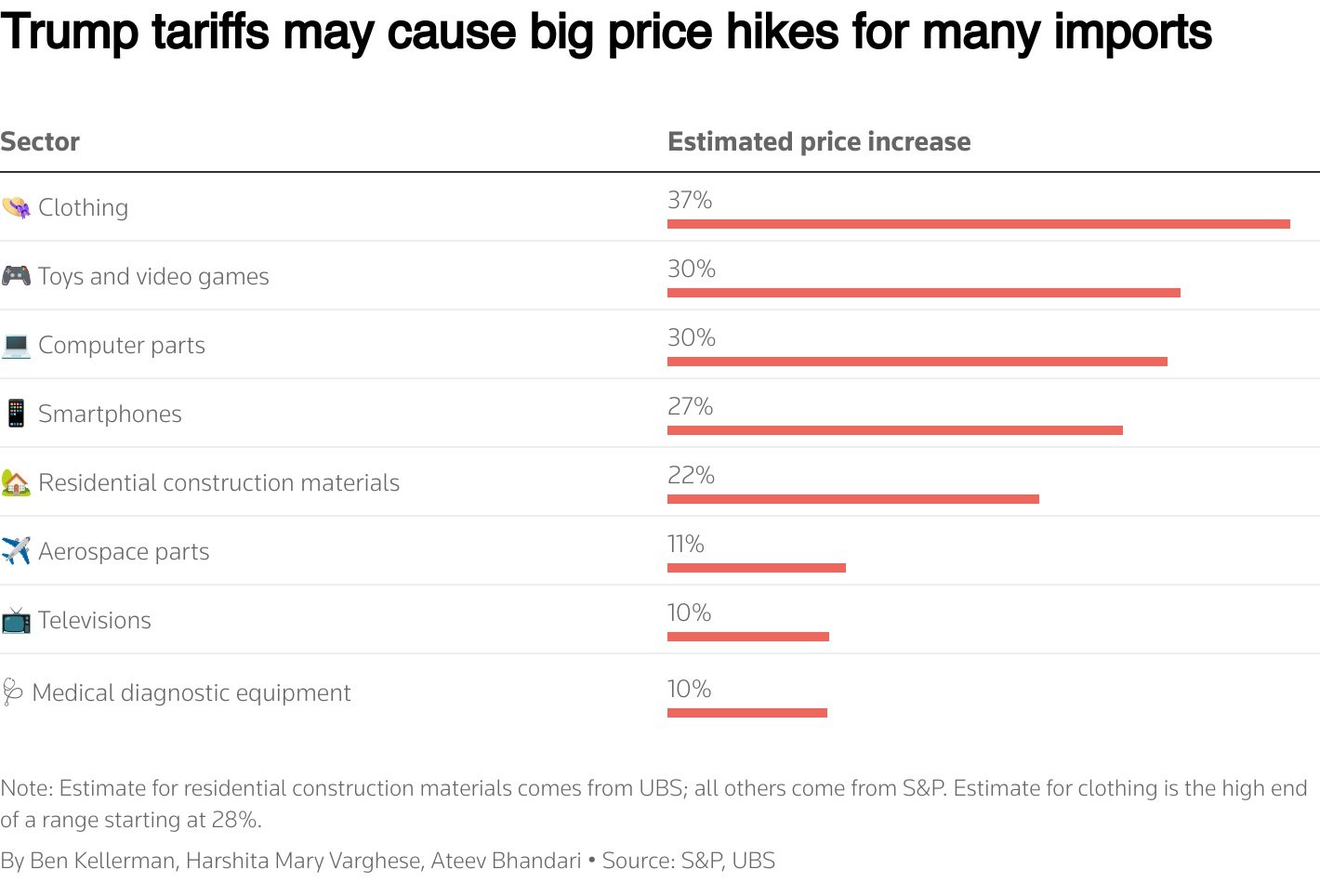

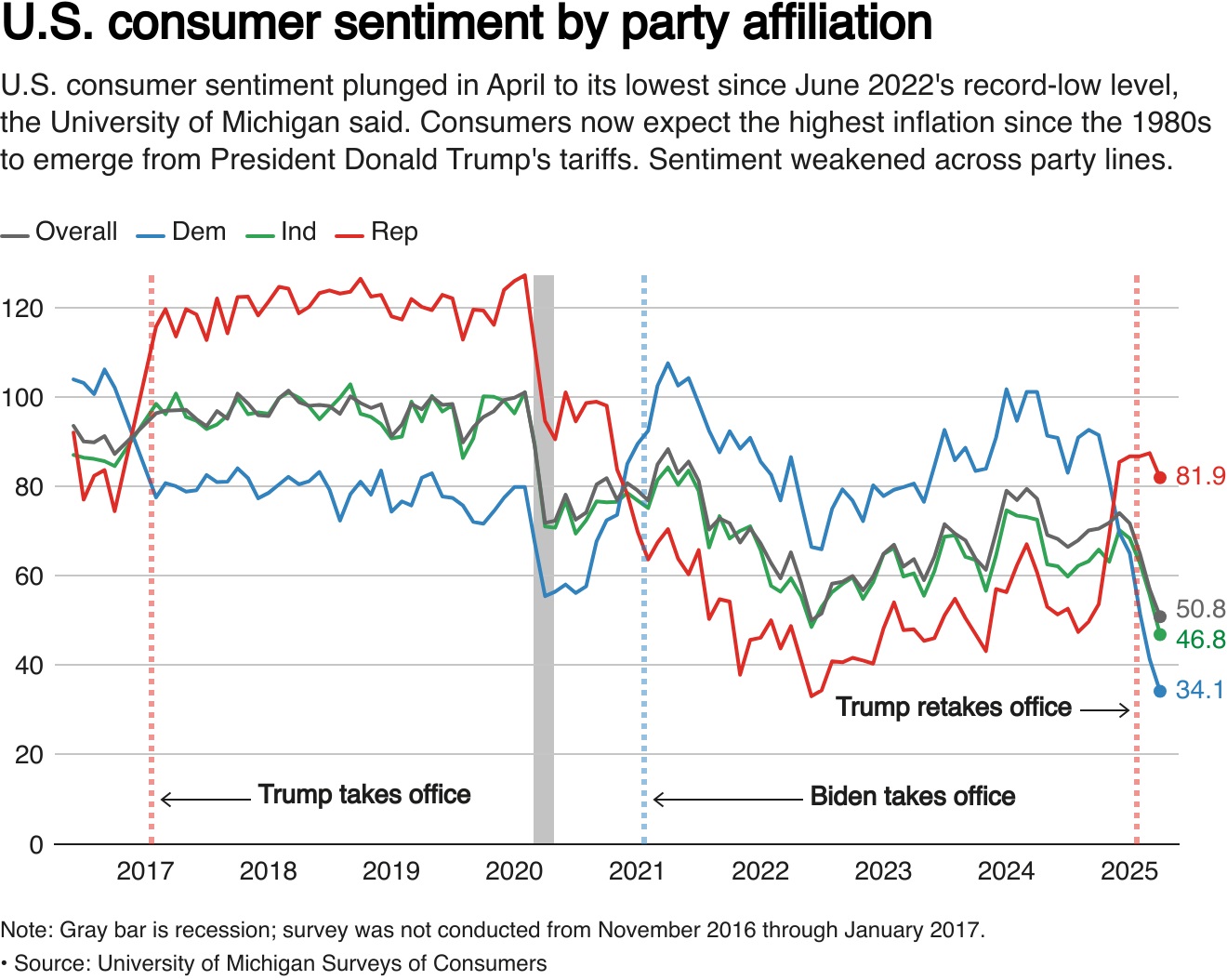

Inflation

Inflation means rising prices over time. If a $2.50 sandwich now costs $3.00, that’s 20% inflation. It can be caused by rising demand, higher production costs, or printing too much money. The Fed uses rate hikes to control it.

Exchange rate

This is how much one currency is worth compared to another. For example, 1 US dollar = 0.90 euros. Strong currencies make imports cheaper, while weak ones boost exports.

Market trends

Market trends show price direction — up, down or stable.

- Bull market: rising prices, investor confidence

- Bear market: falling prices, investor caution

A 20% move in the S&P 500 often signals a trend change.

Debt

Debt is borrowed money a country must repay with interest. The US sells Treasury bonds to countries like China. As of March 2025, US debt stands at $36.56 trillion, raising concerns about future financial stability.

Trade agreements

These are deals to ease trade between nations.

- Free trade agreements (FTAs) remove barriers

- Bilateral agreements set mutual trading rules

GDP

Gross Domestic Product (GDP) measures the total value of goods and services produced. It’s a key indicator of a country’s economic health.

Recession

A recession is two quarters of shrinking GDP. It brings job losses, lower spending, and falling stocks. The US has had 11 recessions since 1950.

Types of trade policies

Protectionism limits trade to protect local industries through tariffs, subsidies, or quotas. Free trade promotes open markets, often boosting growth, variety, and consumer choice.

Foreign leaders have puzzled over how to respond to the biggest disruption to the world trade order in decades. Trump's administration has stuck to its guns, touting discussions on several trade deals it says will justify its dramatic upheaval in policy.

The tit-for-tat tariff increases by the US and China stand to make goods trade between the world's two largest economies impossible, analysts say. That commerce was worth more than $650 billion in 2024.

"The president made it very clear: When the United States is punched, he will punch back harder," White House Press Secretary Karoline Leavitt told reporters on Friday.

This week, Trump announced a 90-day tariff pause on dozens of countries while ratcheting up tariffs on Chinese imports effectively to 145%.

China retaliated with new tariffs on Friday. China's finance ministry called Trump's tariffs "completely unilateral bullying and coercion."

Beijing indicated this would be the last time it matched US tariff rises but left the door open for other types of retaliation.