Fitch upgrades Pakistan's credit rating to ‘B-' on firmer fiscal, external metrics

Stable outlook reflects improved policy credibility, IMF progress, says ratings agency

April 15, 2025

- Upgrade follows Islamabad’s bid to sustain momentum post IMF review.

- Fitch sees tight economic policies to continue supporting FX recovery.

- FinMin says move will further strengthen govt economic agenda.

Fitch Ratings on Monday upgraded Pakistan’s long-term foreign-currency issuer default rating to ‘B-’ from ‘CCC+’, citing improved fiscal consolidation, a stabilising external account, and stronger macroeconomic policy management. The outlook is stable.

The rating agency said in a statement on Monday that the move reflected growing confidence in Pakistan’s ability to sustain tighter budget controls and implement reforms under its ongoing International Monetary Fund (IMF) programme.

The upgrade comes as Islamabad looks to maintain momentum following its agreement with the IMF in March to review a $7 billion Extended Fund Facility (EFF) and a new $1.3 billion Resilience and Sustainability Facility (RSF).

“We expect tight economic policies to continue supporting the recovery of international reserves and contain external funding needs,” Fitch said while warning that financing requirements remain high and implementation risks persist.

Finance Minister Senator Muhammad Aurangzeb has expressed satisfaction, Geo reported. “The upgrade is a strong vote of confidence in our economic reforms and policies.”

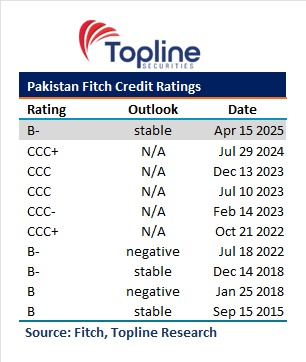

Pakistan was previously in the B- category in July 2022, according to brokerage firm Topline Securities.

The finance minister says that this move “will further strengthen the government’s economic agenda”.

“Following this development, the country is expected to see increased investment, trade, employment opportunities, industrial growth and access to additional financial resources,” he said.

“Going forward, global rating agencies, investors and financial institutions will have greater trust and confidence in Pakistan,” he concluded.

Pakistan’s fiscal outlook has improved, with the budget deficit projected to narrow to 6% of the GDP in FY25 from nearly 7% a year earlier, driven by spending cuts and provincial surpluses. The primary surplus is expected to more than double, exceeding 2% of the GDP.

Fitch noted that public debt levels declined to 67% of GDP in FY24 from 75% in the previous year, with a gradual downward trend expected to continue. However, interest costs remain burdensome, with a forecast interest-to-revenue ratio of 59% in FY25, far above the B median of 13%.

Inflation is projected to ease to 5% in FY25, down from above 20% in the previous two years, before edging back to 8% in FY26. The State Bank of Pakistan (SBP) has kept its policy rate unchanged at 12% after aggressive monetary easing in 2024. Growth is expected to rebound to 3% in FY25.

The country’s external position has stabilised, with a $700 million current account surplus recorded in the first eight months of FY25, boosted by rising remittances and subdued import prices. Gross foreign exchange reserves reached nearly $18 billion in March, up from a low of under $8 billion in early 2023.

Still, Pakistan faces external debt maturities of about $9 billion in FY26, following over $8 billion due this year. The government expects to secure $10 billion in additional funding in the second half of FY25, primarily through multilateral and commercial channels.

On the political front, Prime Minister Shehbaz Sharif’s coalition holds a parliamentary majority but lacks a strong public mandate. Persistent political tensions, institutional fragility, and security concerns in regions bordering Afghanistan remain downside risks, the agency said.

Fitch’s Sovereign Rating Model assigned Pakistan a score equivalent to ‘CCC+'’, but the rating committee applied a one-notch upgrade to reflect improvements in macroeconomic management and inflation control.