SBP flags risks to Pakistan's economic outlook amid global trade volatility

SBP, in its half-year report, projects FY25 GDP growth around 2.5-3.5%, average inflation between 5.5 and 7.5%

April 28, 2025

- SBP projects FY25 current account balance between -0.5%, 0.5% of GDP.

- Strong momentum in workers' remittances, exports expected through FY25.

- External sector performance to improve further in H2 FY25, SBP forecasts.

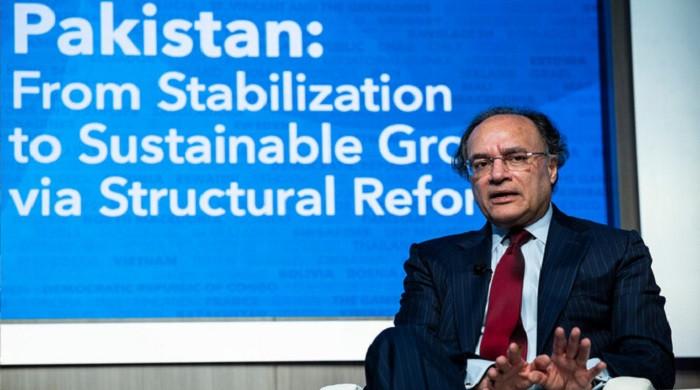

Pakistan's central bank on Monday flagged risks to the country’s medium-term economic outlook, citing uncertainties arising from global trade disruptions and commodity price volatility triggered by the US President Donald Trump's tariffs.

In the State of Pakistan’s Economy, Half Year Report, the State Bank of Pakistan (SBP) pointed out the details of the risks to the medium-term outlook.

It said these risks largely stem from global trade disruptions and related commodity price volatility in light of reciprocal tariffs, the changing geopolitical situation, adjustments in administered energy prices, the response of domestic aggregate demand to various fiscal measures, and the spillover of movements in international currencies on the local currency.

According to the report, Pakistan’s macroeconomic conditions improved further in the first half of the fiscal year 2024-25 (H1-FY25), reflected by steep disinflation, a surplus current account, and a contained fiscal deficit.

The headline inflation fell sharply, the current account balance turned into a surplus, and the fiscal deficit was contained to the lowest level since FY05, the H1-FY25 Report noted, attributing these favourable outcomes to the calibrated monetary policy stance, fiscal consolidation, benign global commodity prices, and the approval of the IMF’s Extended Fund Facility (EFF) programme.

The report projects FY25 annual GDP growth in the range of 2.5 to 3.5%, average inflation between 5.5 to 7.5%, and the current account balance to be in the range of -0.5 to 0.5%, with continued strong momentum in workers’ remittances and exports.

It observed that headline inflation reached a multi-decade low of 0.7% by March 2025 owing to a confluence of factors, including a tight monetary policy stance and fiscal consolidation that kept domestic demand in check, improved supply conditions, respite in energy price adjustments, and subdued international commodity prices.

As a result of cooling inflationary pressures and an improving inflation outlook, the SBP reduced the policy rate by 1000 basis points from June 2024 to February 2025.

The SBP noted that the consequent ease in financial conditions, coupled with a slight uptick in economic activity and ADR-related lending, contributed to substantial growth in private sector credit during H1-FY25.

The SBP, in the report, kept the projection for real GDP growth unchanged in the range of 2.5 to 3.5%, however, downside risks in the form of additional fiscal consolidation and less-than-expected wheat harvests were highlighted.

The central bank termed lower production of important Kharif crops and contraction in industrial activity during H1-FY25 as major causes of the moderation in real GDP growth.

A broad-based decline in Kharif crops was seen to be caused by the falling area under cultivation and lower yields, the report mentioned and pointed to “the key role of agriculture policy uncertainty, last year’s low crop prices, unfavorable weather conditions, and lower use of certified seeds and other inputs” for this lacklustre performance.

Moreover, the report observed that the services sector performed relatively better in H1-FY25 compared to the same period last year.

It also mentioned that the lower contraction in the industry during H1-FY25 compared to the previous year was supported by small-scale manufacturing, utilities, and slaughtering, whereas mining and quarrying, construction, and large-scale manufacturing contributed negatively.

According to the report, a steady increase in exports and workers’ remittances during H1-FY25 outweighed a notable increase in imports, leading to a surplus in the current account balance.

These developments, together with the disbursement of the first tranche under the IMF’s EFF and a slight pick-up in private inflows, were noted to have strengthened SBP’s foreign exchange reserves. The report notes a significant improvement in the outlook for inflation and the external sector.

In view of steeper-than-anticipated disinflation, combined with an adequately tight monetary policy stance, continued fiscal consolidation, and an easing in global commodity prices, the SBP projects average inflation for FY25 to fall in the range of 5.5 to 7.5%.

Similarly, the current account balance is now projected to be in the range of -0.5 to 0.5% of GDP. The report expects the strong momentum in workers’ remittances and exports to continue outpacing the increase in imports. This is expected to cushion against lower financial inflows and help strengthen external buffers.

The report also includes a special chapter titled Pakistan’s Low Competitiveness: A Case for Investing in Productivity, which analysed that weak growth in labour productivity and total factor productivity has adversely impacted the country’s economic competitiveness over time, contributing to the frequent boom-bust cycles.